What is Polish Governance 2.0?

Polish Governance 2.0. is actually a common name for Laws of June 9, 2022. On amending the law on personal income tax and certain other laws. It makes a number of changes to the Polish Order reform, which took effect in early 2022. Thus, this is simply an amendment to this piece of legislation. Its goal is to fix bugs, remove imperfections and resolve problems that have been highlighted since the very beginning of Polish Order 1.0.

The New Polish Order came into force on July 1, 2022, but most of the provisions are effective for the whole of 2022. – That is, as of January 1, 2022. Some of the changes, on the other hand, are not expected to take effect until January 1, 2023.

One can get lost in it, so we have prepared a summary of the most important changes and opportunities that the Polish Order 2.0 introduces. They apply to all forms of taxation: tax scale (general rules), lump sum, flat tax and tax card.

Polish Governance 2.0. Settlement under general rules – changes

These changes apply to all those working on a full-time contract basis, those on a contract of employment, and a sizable portion of entrepreneurs. General taxation is otherwise known as tax scale.

Important!

Polish Deal 1.0. introduced a new tax-free amount of 30,000. He also raised the first tax threshold to PLN 120,000. PLN per year. These rules went into effect on January 1, 2022. and are still in effect.

Change in the PIT rate in the 1st tax bracket

Polish Governance 2.0. Reduces the tax rate in Tax Threshold I: from 17% to 12%. For the 2nd tax bracket (above PLN 120,000) everything remains the same, i.e. the rate is still 32%.

Similarly, the monthly amount reducing income tax is reduced: from PLN 425 to PLN 300 (annually from PLN 5,100 to PLN 3,600).

Important!

The 12% rate applies for the entire year 2022. In practice, this means that once the annual PIT return is filed, the overpayment of tax for the first half of the year will be refunded.

Elimination of relief for the middle class

The first version of the Polish Deal introduced relief for the middle class. The solution was intended to benefit those earning in the range of approx. 6 to 11 thousand. PLN per month. The main goal was to offset the impact of another change (from January 2022) – that is, the non-deductibility of health premiums.

However, the relief has proven to be cumbersome and difficult to apply precisely and correctly, so Polish Order 2.0. completely eliminates it. Importantly, the change is effective for all of 2022.

However, if it turns out that in a particular case the application of middle-class relief would be more favorable than the new rules – it will be exceptionally applied.

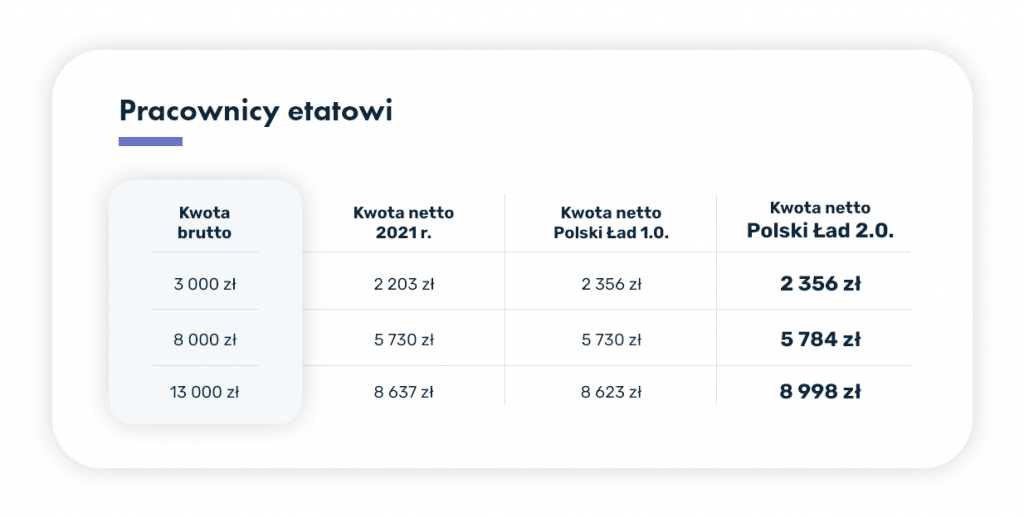

What does all this mean in practice? The reduction of the tax rate and the elimination of the middle class tax credit for the majority of scale taxpayers will bring favorable changes or no change. Below you will find an example of averaged calculations provided by Dr. Michael Wilk (more amounts available at https://marciniwuc.com/polski-lad-zmiany/).

Return of the possibility of accounting as a single parent

Polish Deal 1.0. eliminated the possibility of accounting jointly with a child, instead offering a £1,500 tax deduction. A significant number of people lost out on this solution, which was widely reported and protested.

The new version of the Polish Deal restores the possibility of preferential accounting for single parents who use general taxation. This means that a single parent (after meeting the relevant conditions) can benefit:

- tax-free amount at double the amount (PLN 60,000),

- double the amount of the 1st tax threshold (240 thousand zlotys instead of 120 thousand zlotys).

The possibility to settle in this way applies to the entire year 2022 (so from January 1, 2022).

Parents will not lose the tax preference when the child’s earnings are a maximum of PLN 16,061.28 per year (that’s 12 times the social pension). Previously, it was a maximum of PLN 3,089 per year.

Important!

A parent who raises a minimum of 1 child with the other parent or legal guardian – including in an alternate care situation – cannot benefit from accounting together with the child.

Polish Governance 2.0. Settlement on a lump sum basis – changes

As the Polish Deal came into effect, many entrepreneurs decided to change their form of taxation to a flat rate on registered income, which was often more favorable at the time.

After the new changes, it is still not for everyone. The tax changes were introduced in the middle of the year – so it is exceptionally possible to change the form of taxation during 2022.

Possibility to change the form of taxation to general principles

If you settle on the basis of a lump sum, but want to change the form of taxation because of the Polish Deal 2.0. – You can do it, but the change is only possible to the general rules. There are two possibilities:

- change in taxation from July 2022 (first half of the year on a flat rate, the second half of the year on a general basis) – submit a notice to the tax office by 22.08.2022, you will need to file 2 PIT returns later,

- change in taxation for the entire year 2022 – submit a notice to the tax office by 02.05.2023, that is, by the deadline for filing the return for 2022 (filing PIT).

Important!

The choice of the PIT tax form applies only to 2022 in this case. If you want in 2023. continue to account on a general basis (or return to a lump sum if the change affected the entire year) – it will be necessary to file under the current rules. Such an application shall be submitted by the 20th. day of the month following the month in which the first income was received (usually by February 20).

Unification of PIT filing deadline

Polish Governance 2.0. also introduces the unification of the PIT filing deadline. From the 2022 return. Entrepreneurs using flat-rate taxation will submit them by April 30 following the year to which the return relates. This provides more time to file PIT-28.

The deadline for paying the tax for the fourth quarter of the year, or December, is also changed to January 20 of the following year. This change takes effect on January 1, 2023, meaning it does not yet apply to 2022.

Polish Governance 2.0. Settlement on the basis of the flat tax – changes

As in the case of the lump sum – taxpayers settling under the flat tax can also change to the general form during 2022. However, the change applies to the entire year (you can’t account for half in one way and the other half in another).

To do so, all you need to do is submit the correct PIT to the tax office by the due date of the return, which is May 2, 2023.

Important!

If you are changing from flat tax to general tax for 2022. – the change applies only to this year. If you also want in 2023. use the tax scale, it is necessary to file under the existing rules. Such an application shall be submitted by the 20th. day of the month following the month in which the first income was received (usually by February 20).

Polish Governance 2.0. Health premium deduction – changes

One of the main tenets of Polish Governance 1.0. was to make it impossible to deduct health premiums – regardless of the method of taxation. Because of this, the tax to be paid has increased.

In this case, the new version of the law introduces partial changes for taxpayers using: tax card, lump sum, flat tax. However, this is not a return to what was used back in 2021.

Health contribution – flat tax

Taxpayers who settle their accounts this way can either deduct health insurance premiums from income or include them in expenses. Maximum relief in 2022. is PLN 8,700 (the amount is to be indexed annually).

In practice, this means that the maximum financial benefit will be PLN 1,653 (deduction realized from income, not from tax).

It is more advantageous to include health insurance premiums as an expense – reducing both income tax and Social Security.

Health contribution – lump sum

If you are settling in a lump sum, you can deduct 50% of the health insurance premiums paid from your income. The amount of the contribution depends on the annual income (up to PLN 60 thousand – PLN 335.94, up to PLN 300 thousand – PLN 559.89, above PLN 300 thousand – PLN 1,007.81).

In practice, however, the real savings are relatively small – from a few tens to approx. PLN 1,000 per year (depending on the amount of the premium and the flat rate).

Health contribution – tax card

Taxpayers on the tax card can deduct 19% of the health insurance premium paid from their taxes. If you settle this way, you have a fixed health contribution of PLN 270.90 per month. The real maximum savings from the corresponding deduction is PLN 51.47 per month.

EXAMPLE

Think through and count every tax change. The health contribution will also be adjusted, which in some cases may involve a surcharge – under the general rules, the health contribution is always 9% on income.

Health contribution – cooperating person

Polish Governance 2.0. also introduces changes in the amount of the health contribution for a cooperating person – that is, one who remains in a joint household and assists in running the business (e.g., spouse, children, parents).

The premium after the changes is 75% of the amount of the average monthly salary in the enterprise sector in the fourth quarter of the previous year – instead of the previous 100%. In practice, in 2022. This represents a reduction from PLN 559.89 to PLN 419.92.

Polish Governance 2.0. 1.5% instead of 1%

Polish Governance 2.0. also introduced a change regarding the donation of 1% of tax to charity – that is, to Public Benefit Organizations. The new law includes the possibility of donating 1.5% of the tax. This is in response to appeals by foundations and other organizations to the rising cost of living and inflation.

Changes from July 1, 2022. are an attempt to correct mistakes and solve problems that arose after the Polish Order came into effect. Due to their introduction in the middle of the year, they have caused anxiety among accountants, entrepreneurs and salaried employees alike. However, many of the solutions are relatively favorable (vis-à-vis the Polish Order 1.0., not necessarily the earlier options) for a large portion of taxpayers.