IP Box relief – what is it?

The IP Box relief also functions under two other names: the Innovation Box and the Patent Box, and has been in effect in Polish tax law since January 2019. It is designed for taxpayers engaged in R&D, or research and development.

Under the IP Box relief, taxpayers can enjoy preferential taxation of income derived from intellectual property rights. However, these rights must be protected by law (e.g., by copyright).

Here’s how to describe IP Box relief in one sentence:

Thanks to the IB Box relief, companies that produce their own intellectual property (IP – Intelectual Property) are entitled to account for the profits derived from it at a preferential rate of 5%.

Who can benefit from IP Box relief?

Although I initially mentioned R&D taxpayers, the IP Box relief is not reserved only for these types of companies. Of great importance here are individual interpretations issued by the Director of National Tax Information – especially those confirming the legitimacy of accounting for the company with the allowance.

So what are the main requirements for eligibility for IP Box relief?

Five conditions for IP Box relief

First: a taxpayer benefiting from the preferential 5% rate should conduct research and development activities – we will return to this condition later.

Second: the entrepreneur must produce qualified intellectual property, and with it qualified intellectual property rights, as part of its research and development activities.

Third: It is the responsibility of a company wishing to take advantage of IP Box relief to keep detailed records of business events. These records should include all financial operations that are in any way related to income, derived by the company from qualified intellectual property.

You can find detailed information on this topic:

- In the CIT Law – art. 24e para. 1(1) et seq;

- In the PIT Law – Art. 30cb para. 1(1) et seq.

Fourth: income from qualified IP that a company earns must be taxable in Poland.

Fifth: the taxpayer should incur qualified costs in connection with the creation and expansion of qualified intellectual property.

These five points raise many doubts for entrepreneurs who are interested in accounting for income using the IP Box relief. To meet them, the Ministry of Finance has issued a document entitled: Tax Explanation of July 15, 2019 on preferential taxation of income produced by intellectual property rights – IP Box. The problem is that the publication fits on 86 pages and is written in language… statutory.

Research and development activities

As I have written before, one of the conditions that must be met in order to take advantage of the IP box relief is to conduct research and development activities. What does this slogan actually mean? The answer is provided by the previously mentioned CIT Law and PIT Law:

Research and development activities are those activities that involve scientific research, development, or both, perform them systematically, with the aim of increasing knowledge resources and using knowledge resources to create new applications.

Qualified intellectual property law

The answer to the question “what is qualified IP?” is also hidden in the PIT Law (Article 30ca) and the CIT Law (Article 24d). They are:

- patent,

- utility model protection right,

- The right of registration of an industrial design,

- The right from registration of integrated circuit topography,

- supplementary protection right for a patent on a medicinal or plant protection product,

- The right from the registration of a medicinal product and a veterinary medicinal product authorized for marketing,

- The exclusive right referred to in the Law of June 26, 2003. On legal protection of plant varieties (Journal of Laws of 2018, item 432)

- copyright in a computer program

IP Box for developers – is it possible?

It is the last point in the above list that makes IP Box relief usable for developers, but not all. A popular form of cooperation in the software industry – B2B – means that many software developers are also entrepreneurs.

Given that the programmer produces software (computer programs), can he take advantage of the IP Box relief? Here, too, certain conditions apply.

The right to use qualified intellectual property

If a developer wants to use the IP Box, he or she must be a co-owner or user with rights to use the IP under a license agreement. The important thing is that the developer must have made a creative contribution to the creation, development or improvement of the qualified IP. Thus, it does not have to own the rights to intellectual property, but it must participate in its creation.

Cost and revenue records

The IP Box allowance for programmers can only be used while simultaneously keeping records of costs and revenues related to qualified intellectual property rights.

Moreover, if a programmer is involved in the creation of more than one intellectual property, he or she should keep records in such a way that it is possible to identify each revenue, deductible expense, earned income and loss, and link them to the relevant intellectual property whose creation was affected by the business event.

Costs related to R&D activities

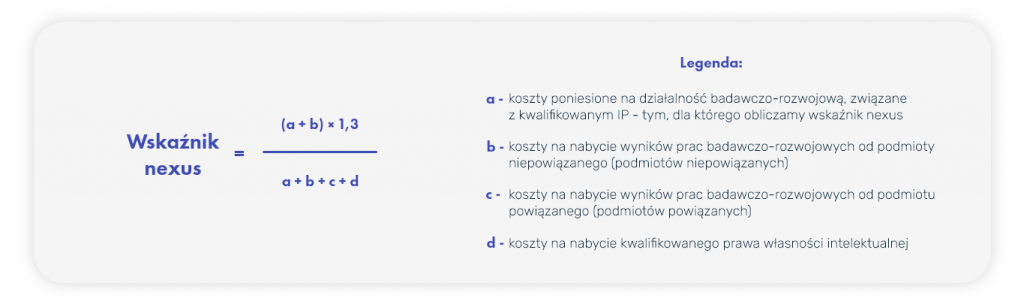

A programmer cannot take advantage of the IP Box relief if he or she does not incur any costs for research and development activities. To accurately calculate how much revenue is associated with qualified IP, use the nexus indicator.

Attention!

The nexus index should be calculated for each qualified intellectual property separately.

When calculating the nexus index, it is worth remembering that its value cannot exceed 1. It is also worth using the nexus index calculators available on the web, which will make its calculation a little easier.

What’s next for the nexus indicator? Having already had its value, multiply it by the income from qualified intellectual property earned in the year. The result of such an action is the tax base at the 5% rate.

Unfortunately, the regulations on the IP Box relief, as well as the list of conditions and activities that must be performed to check whether an activity qualifies for the relief, are lengthy and, for many entrepreneurs, overly complicated.

It is for this reason that many developers who could theoretically benefit from the IP Box do not do so, fearing negative tax consequences in the future.

However, there is a way to make 100% sure that the taxpayer’s activities are within the limits set by the IP Box relief – these are individual interpretations.

In order to submit an application to the Director of the National Tax Information, download a sample ORD-IN document – available at this link – and fill it out and send it to the address of the National Tax Information – ul. Teodora Sixta 17, 43-300 Bielsko-Biala.

You can also apply electronically – just go here and click the “File” button, then log in with your Trusted Profile or e-ID.

Interpretations already issued by the Director of National Tax Information regarding IP Box relief are available online. One of them is the interpretation with the reference 0115-KDIT3.4011.757.2020.3.JG dated April 6, 2021. You can also find other tax interpretations using the Eureka System, a search engine provided by the Ministry of Finance.

How to account for IP box relief?

Both the R&D tax credit and the IP Box credit are only taken into account in the annual return as an attachment to the tax return. Only then is any overpayment of PIT or CIT shown – those who take advantage of the IP Box relief can therefore count on a sizable tax refund.

If you would like to add a PIT/IP or CIT/IP attachment to your annual return, click on the links below to download a form to fill out:

- PIT/IP form – for PIT taxpayers;

- CIT/IP form – for CIT taxpayers.

IP Box relief and the Polish Deal

Why do we also mention the R&D relief? As of January 1, 2022, the provisions of the new Polish Order introduced the possibility of simultaneous use of IP Box relief and R&D relief. Previously, it was possible to use one or the other relief, without combining them.

This means potentially even more benefits for entrepreneurs working in the R&D segment!