Online factoring

with guaranteed payment

Sign the contract and receive an advance payment immediately. We will take care of the assignment formalities later!

Complete the free application

Gain constant access to cash on terms that are convenient for you.

How does factoring work?

You issue deferred payment invoices, and we pay you in advance. Your contractor then pays the amount due directly to us on the invoice due date.

With factoring, you sign a cooperation agreement and gain access to the Client Zone. Here you can quickly and conveniently submit invoices for financing without having to send another application.

The standard limit amount is from PLN 50,000 to PLN 15,000,000 or from EUR 11,000 to EUR 3,330,000, depending on the needs of your company. Once granted, you can use the limit without any further formalities, and the funds received from the sale of invoices can be used for any purpose.

Interested in factoring for a higher amount? We have this option too – just let your account manager know.

What makes our factoring offer different?

Personal attention from a dedicated account manager

You can be sure that our factoring is tailored to your individual needs – you can easily adjust the amount of the limit, the range of additional services, and even the way the contract is signed.

Free transaction insurance

You don’t have to worry about your counterparty becoming insolvent and unable to meet its obligations. When you use online factoring, you get credit insurance as part of the package.

Guaranteed advance payment

As soon as the contract is signed, you receive a welcome advance from us so you can start using the funds as soon as possible. No need to wait for the contractor to sign the contract! We will deal with the formalities of the assignment later.

Receivables monitoring

You don’t have to waste time monitoring invoice payment dates – we do it for you. We can also advise you on how to secure your transactions through the use of appropriate sales documentation.

Online factoring calculator

Choose a currency for factoring

Estimated net cost

Which billing method will work for me – subscription or rate?

How to choose the optimum limit?

Can I change the limit during the contract?

Can I include factoring expenses as a business expense?

A factoring service is for you if:

You offer deferred payment invoices to your contractors, and you need cash faster.

You regularly issue invoices to regular contractors.

You run a sole proprietorship or are looking for financing for a company in the SME sector.

You need permanent financing of more than PLN 50,000 or EUR 11,000.

Not sure if online factoring is the solution for you?

Maybe you need access to cash from time to time, or maybe you’re interested in fast financing?

Learn about single invoice financing and take care of your company’s liquidity.

Questions and answers

What is a guaranteed advance?

Do my counterparties (customers) have to agree to factoring?

Will my creditworthiness be verified during the application process?

How to sign a contract with a qualified electronic signature?

What invoices can be submitted for funding under this service?

What does the factoring process involve?

How long do you have to wait for a decision?

Is it possible to finance invoices in a foreign currency, e.g. EUR?

Which industries can benefit from factoring?

Do factoring services require insurance?

Can I add/delete pre-designated recipients/contractors?

Didn’t find the answer to your question?

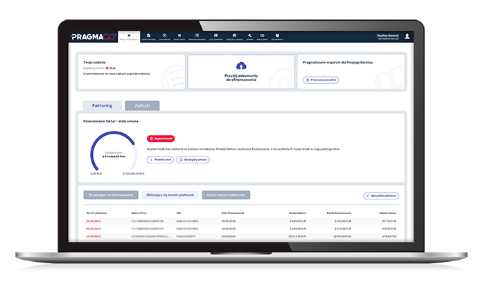

Customer Zone

Customer Zone is a platform that you have free access to 24/7 – whenever you need it. Here you can, among other things. convert invoices to cash even faster and add/remove counterparties, as well as request a change in the factoring limit.

In the Customer Zone you benefit from financing on an ongoing basis – without additional paperwork.