Postpone the tax payment date – spread it in installments

Do you need funds to pay your current income tax, VAT or Social Security contributions? Specify the amount you need – you will receive the money on the indicated account, and we will spread the repayment over the number of installments you choose.

What is tax financing

and Social Security?

This is a service with which you will finance and defer the current payment of PIT, CIT, VAT or Social Security contributions.

The entire process of applying for funds is done online, without the need to sign a contract. We transfer the indicated amount directly to your account.

You can use tax financing both as a company owner and as a sole proprietor.

You can pay us back the borrowed amount in 3, 6, 9, or even 12 monthly installments – so you can avoid the consequences of missing payments on time.

Tax Financing – Check Out a Sample Calculation

Installment amount

What does the final cost of the service depend on?

What is the funding limit?

The presented calculation does not constitute a commercial offer within the meaning of Art. 66 par. 1 KC.

What are the distinctions between tax and Social Security financing?

Receive money to the designated company account

You will pay your obligations to the US or Social Security on your own – we do not interfere with your payments.

Defer online payment

You don’t need to go to the office or bank, the whole process of applying for financing is done online, saving you a lot of time.

Gain access to cash for your next business expenses

We provide you with a financing limit – a pool of funds to use to finance any further business expenses.

Choose the number of installments yourself

You can spread each payment for up to a year.

Tax and Social Security financing is for you if:

You need to pay income tax, VAT or Social Security contributions, and you don’t have the funds.

You want to avoid penalties or interest for not paying taxes and Social Security on time.

You want to avoid bailiff seizure of your account and blocking of your funds.

You value flexibility and the ability to obtain financing at any time.

Questions and answers

Can I spread my employees’ Social Security contributions in installments?

Does the service allow me to pay my debt to the US or Social Security?

Does the service affect my creditworthiness?

What is the waiting time for a funding decision?

Who can use the tax financing service?

Didn’t find the answer to your question?

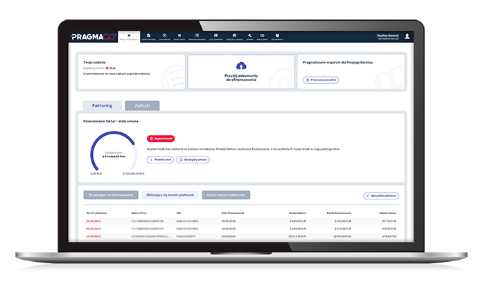

Customer Zone – take advantage of online financing

Client Zone is a platform you can access 24/7 – whenever you need it.

Here you can request financing for further taxes and Social Security contributions, as well as other business costs.

In the Customer Zone you can also learn about sales invoice financing.