What is the factoring process?

Before we go on to distinguish the aforementioned two types of factoring and learn about their definitions, let’s remind ourselves of exactly how the steps leading to financing work:

- It starts with an invoice for goods or services. Company A, which issues the document, also sets a deadline for payment of the amount due – for example, 30 days.

- It turns out that the amount that Company B has agreed to pay is needed by Company A immediately – for various reasons, waiting as long as 30 days for repayment is not an option. So Company A turns to a factoring company and signs a factoring agreement – with or without recourse.

- The factor (the company providing factoring services) advances the agreed amount (usually about 80-90%) immediately, so that Company A can pay its obligations and continue its business unhindered.

- There follows a day of payment by Company B. However, this one drags its feet on payment. It is at this point that the choice in point 2 will be relevant. form of factoring.

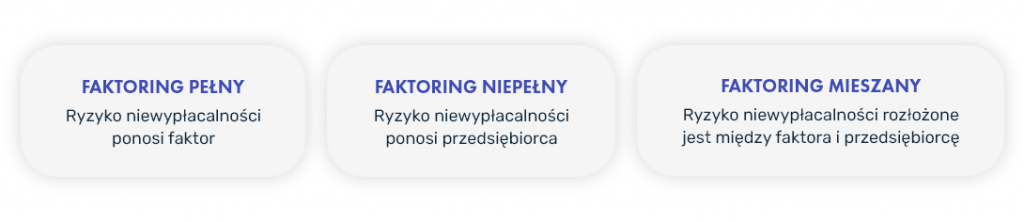

We have already reminded you what factoring is in general and how it works. Now it’s time to learn the key differences between the types of factoring discussed – full factoring, partial factoring and its mixed version. In what situations is it worth choosing factoring with recourse and in what situations without?

Factoring with recourse / incomplete

This form of financing is otherwise known as incomplete factoring. The cost of obtaining it is lower, but in the above-described case, the risk of the debtor’s insolvency still rests with Company A.

So when is it a good idea to use this form of factoring? When we are confident in the solvency of the counterparty, we work with them on a long-term contract basis, and we are anxious to receive the receivables as soon as possible. An important note is that even if you will have to return the amount received from the factor and take care of getting a refund from the counterparty yourself, it is worth considering this option for several reasons.

First: thanks to the advance from the factor, you will immediately regain liquidity, and the payments that will flow from other customers in the meantime will stabilize the financial situation of your company.

Second: even when the repayment deadline for Company B to return the money has passed, and your company has to give back the advance and seek collection of the receivables on its own, you will be given additional time to repay the advance received from the factor. By managing your finances wisely, such a situation will help you maintain high cash flow rates for your business.

Non-recourse / full factoring

You will pay more to a factoring company for full fact oring, primarily because it assumes the risk of the counterparty’s insolvency (either in full or up to a certain amount, depending on the provisions in the contract). With this development, the first four points of the process described above will look identical, while the next step will be for the factoring company to collect the receivables on its own.

Thanks to such an arrangement, a company that opts for non-recourse financing can, as soon as it receives the down payment (which is about 90% of the amount), plan further moves with peace of mind and conduct business without worrying about the debtor’s possible financial troubles. The remaining amount will be received when the factor recovers the receivable.

When is it a good idea to use non-recourse factoring? First of all, in the case where your company is growing at a high rate, so that it is establishing cooperation with many new entities and you do not know their financial situation. Full factoring can also prove helpful if you want to improve your company’s balance sheet by getting rid of receivables, thus positively affecting your company’s financial rating.

Mixed factoring

Mixed factoring is a type of factoring that combines elements of full factoring and partial factoring. In this case, the risk of insolvency is shared by both the factor and the factoring party – the terms and amount of liability for each party are established in the contract.

Factoring at PragmaGO

Both recourse and non-recourse financing are services available from PragmaGO. If you’re not sure which form of online factoring will work best for your situation, schedule a phone call. Choose a convenient date and we will contact you to help you make the right decision.