No more waiting for payments – case study

Products: online factoring with advance payment

The eternal problem – payment terms

Our client’s story begins in standard fashion – with trouble paying his obligations regularly. This was due to the short payment terms imposed by his suppliers. On top of all this, there were repeated difficulties for the company’s customers to pay their debts on time.

Such a situation quickly created problems for the company, which could not afford to be late to its suppliers, while at the same time lacking the tools to combat prolonged payments from contractors.

First attempt to solve the problem

The solution was to be factoring offered by the bank. The entrepreneur chose the bank’s offer because of the cost and the fact that the institution has been on the market for years – all of which was supposed to guarantee stable cooperation and satisfaction for both parties.

However, this did not happen. At the time we contacted our prospective client, there was a dispute between him and the bank. The root of the conflict turned out to be the lack of flexibility in financing and the lack of support from the bank’s customer service department. In this situation, it turned out to be a priority for the entrepreneur to find another factoring solution as soon as possible. One that would enable operation without loss of liquidity even for a day.

PragmaGO – solution for troubles

All five of the above points proved to be met by our offer. By working together with a broker, we initiated contact with a supplement manufacturer and quickly established long-term cooperation.

First, a supervisor guided the client through all the key processes. Then we provided support in obtaining the necessary documentation from the recipients. The first funds were credited to our Client’s account after just a few days, and we acquired subsequent assignments on an ongoing basis, acting in consultation with the Client. Importantly – the client can benefit from the support of the custodian throughout the duration of the contract, not only at the beginning of the cooperation.

Above all, flexibility

The needs of our client have changed many times during our cooperation, but thanks to direct contact with the guardian, the response to dynamically changing conditions is always quick and decisive.

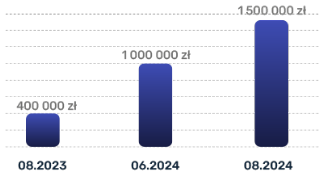

We have changed the limit available to the client several times, starting from the amount of PLN 400,000. Today, our client benefits from a global factoring limit, which we recently raised from PLN 1,000,000 to PLN 1,500,000.

Stable growth and clear conditions

The cooperation between PragmaGO and our client has resulted primarily in stable financing for the company and a significant reduction in the waiting time for payment from its counterparties.

Previously, the entrepreneur was forced to wait up to 60 days for repayment – today he receives the money after a few days at the furthest. As a result, he can carry out strategic activities and develop his brand without hindrance and without looking at payment terms – also by investing.

Add to this a small but noticeable increase in the number of orders and turnover. Thanks to factoring, the company – despite the turmoil on the market and growing competition – gained the stability so necessary in the realities of doing business in Poland and created conditions for further development.