What is the EBITDA ratio? How does it affect the valuation of a company?

EBITDA, or a company’s operating profit before deductions, is one way to determine a company’s value, profitability and potential. Calculating EBITDA shows exactly how much profit a company makes before deducting all due taxes, interest and depreciation expenses on fixed assets, intangible assets.

The EBITDA ratio is nothing new. It appeared as early as the 1980s, successively trying to supplant the then most popular (and still used today) EPS ratio – Earnings Per Share. Its critics point out that the idea of deliberately ignoring depreciation and the cost of capital makes the EBITDA parameter meaningless. Enthusiasts, on the other hand, point out that EBITDA helps to estimate a company’s potential and profitability, and that the omission of the aforementioned factors is intentional, as it allows to assess how much profit a company generates from its operations alone.

EBIT, or EBITDA, but with depreciation and deprecation

Often you can also meet with EBIT (Earnings Before Interests and Taxes). This is a variant that takes into account the operating profit of the company, as well as the value of depreciation and amortization. Still, the cost of capital and public charges (taxes) are not taken into account.

How to calculate EBITDA?

In order to properly calculate this parameter, one must first understand what it consists of. The list – in addition to the operating profit itself – includes:

- Interest – all interest costs on company liabilities, i.e. loans, credits, bonds, etc.,

- Taxes – income tax burden (PIT or CIT), excluding PIT paid for employees and VAT.

- Depreciation – costs associated with the operation of fixed assets, including cars, real estate, computers, machinery, as well as the cost of consumption of intangible assets.

Important!

When calculating profit with depreciation, it is necessary to take the carrying value, not the tax value of depreciation. This is important because depreciation rates can vary.

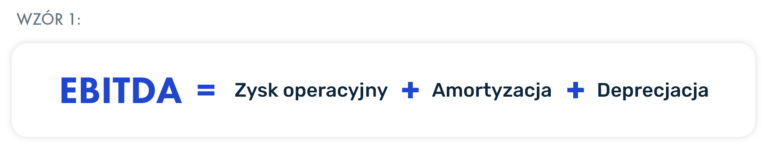

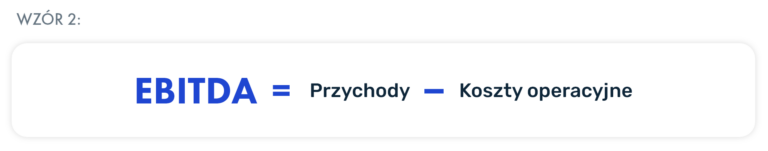

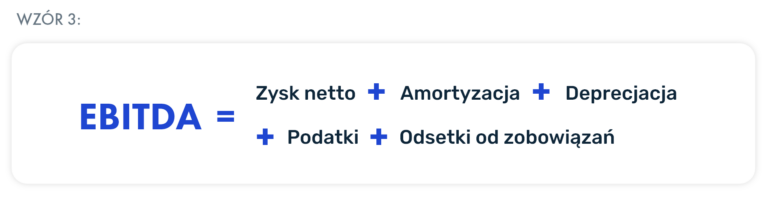

EBITDA – calculation formulas

We present the three most popular methods of calculating EBITDA.

Example:

Ms. Victoria’s enterprise generated sales revenues of PLN 600,000. The company’s own costs, which include the cost of materials, goods and services, amounted to PLN 150,000. In this case, the EBITDA measure is PLN 450,000. Subtracting depreciation and amortization expenses of PLN 40,000 will give Ms. Victoria’s company a result of PLN 410,000 – this is the EBIT measure.

Example:

Mr. Rafal’s company generates a net profit of PLN 180,000. Depreciation and amortization costs amount to about PLN 40,000, interest on liabilities is an amount of about PLN 35,000, and taxes paid amount to PLN 50,000. When all these components are added, EBITDA is 180,000 + 40,000 + 35,000 + 50,000 = PLN 305,000.

When is financial EBITDA used?

Since EBITDA shows the value, potential and profitability of a company, it is a valuable tool for investors looking for companies worth entrusting their funds to with an eye toward long-term profit. The indicator is also used by financial analysts preparing various statements, comparisons or financial audits.

Among other things, EBITDA can be used to measure a company’s operating capacity and profitability. The idea is to see how efficient a company is in terms of generating profits. The tax burden is deliberately omitted, so that it is possible to compare companies operating under different tax conditions (e.g., operating in different countries).

The indicator in question is also a readily used tool in the context of valuing companies and assessing their creditworthiness.

Important!

EBITDA is a specific indicator that includes – in addition to standard operating activities – various types of economic events, including one-time events. EBITDA is therefore also an important indicator for comparing a company’s performance year-on-year. In one year, a company may be doing great, but its EBITDA will be lower by one or two unfortunate events. The following year, the company may generally perform worse, but the lack of spectacular failures may make the overall ratio higher.

Discussions on whether EBITDA is the right indicator for assessing the value of a company will not cease for a long time, but it is certainly an important parameter that shows the real situation of a company in a given year.

A major advantage of the indicator is the ability to make instant calculations. When an in-depth and time-consuming analysis is not possible, EBITDA can be an ideal way to get a quick and fairly reliable insight into the finances of a given company. It should be noted, however, that EBITDA is rarely the only indicator in an assessment. It’s a good starting point, but one that often needs to be refined with other tools – ones that are more detailed or that take into account data relevant to that particular situation in which they are used.

EBITDA shows how much revenue a company generates from its core business, and therefore how efficiently it is managed excluding its tax situation and liabilities. Although it doesn’t say much in theory, financial analysts may consider this information important because it shows the efficiency of management, and liability and tax issues can be optimized over time.

EBITDA disadvantages

The most serious criticism directed at EBITDA is that it does not take into account the cost of capital, which, depending on the size of the company and the industry in which it operates, can be high and significantly affect the company’s actual financial position.

One of the most vocal critics of EBITDA is Warren Buffet, according to many, the world’s most famous (and successful) stock market investor. Buffet has a portfolio of statements unfavorable to EBITDA, one of the most popular being:

We won’t buy companies where anyone talks about EBITDA. If you look at companies that use EBITDA as a performance measure and those that don’t, I suspect you’ll find a lot more fraud in the former group. Look at companies like Wal-Mart, GE or Microsoft – none of them ever use EBITDA in their annual report

Source: corporatefinanceinstitute.com/resources/valuation/warren-buffett-ebitda/

Buffet’s words have some support – for EBITDA does not take into account the cost of investments in fixed assets or expenses for their maintenance. The more depreciable fixed assets a company has, the more important it is to include them in the calculation as well. This can be particularly important, for example, in transportation companies with a fleet of hundreds of vehicles, each of which loses value over time and must be depreciated.

Failure to take tax charges into account can also be a problem. When a large portion of revenue is consumed by liabilities to the state, the actual value of the company may be much lower than that implied by EBITDA.

It’s also worth remembering that operating expenses themselves can vary, which EBITDA does not count against. They are treated as a single parameter, while in some industries there may be operating expenses not included in EBITDA.

Important!

Despite criticism from some investors (including the aforementioned Buffet), EBITDA – itself an alternative, unadjusted measure – when combined with adjustments can produce high-quality results, especially in terms of predicting a company’s future situation.

EBITDA optimization

Like many other parameters, the EBITDA reading can also be optimized using several methods. Among the most effective are:

Raise the unit price of products or services – the more expensive the products, the higher the profit, and thus also the EBITDA,

Optimization of company costs – especially indirect (salaries, rental costs, depreciation costs) and overhead,

Margin expansion.

Summary

EBITDA is by no means a solution without flaws and problems. However, its popularity is due to its undeniable advantages – including its simplicity and the speed at which results can be obtained. The most important thing, however, is that the EBITDA parameter is extremely rarely used on its own, in isolation from other, more insightful analyses, and that it is subject to various adjustments. Only after these are applied can one speak of a reliable and authoritative use of EBITDA.