Financial statements – a glimpse

Financial statements are one way to assess a company’s liquidity, but not only – with its help, the company’s ability to pay its debts and its effectiveness in collecting debts are also checked.

The financial statements consist of three elements:

- Balance sheet – an inventory of the components that constitute the assets of the enterprise (assets), as well as the sources of its financing (liabilities);

- Profit and loss account – a list of income and expenses of the enterprise;

- Cash flow – a statement of cash flow.

Cash flow – what is it?

A cash flow statement is a summary of all cash flows pertaining to the company that produces it. From the income statement and balance sheet, cash flow differs primarily in that it contains information that better reflects the actual state of affairs.

Important!

The cash flow statement – unlike the other elements of the financial statements – does not contain estimates, but only a record of cash flows that actually occurred. It is this element that makes cash flow a more reliable and useful source of financial information.

Cash flow analysis

In order to achieve maximum transparency, the information contained in the cash flow is divided into three groups – it is all about cash flow from:

- From operations;

- From investment activities;

- From financial activities.

Cash flow from operating activities

This data segment contains information on the company’s core business. What kind of entries can we find there?

- sales proceeds;

- expenses (delivery of goods, services);

- salaries for employees;

- taxes paid;

- insurance premiums;

- administrative fees;

- company accounts;

- other income and expenses from operations.

Important!

In this segment of the data, we do not find mention of unusual events for the company, such as investments or obtaining subsidies.

Cash flow from investing activities

It is in this section that all data on investments made by the company should be included, as well as proceeds from the disposal of investments and tangible and intangible fixed and financial assets.

Cash flow from financing activities

In this segment, we will find information about the sources of financing obtained and repaid, thus:

- proceeds from the issuance of debt securities;

- funds obtained from loans and/or borrowings;

- proceeds from the issuance of shares in the company;

- distributions to shareholders;

- repayment of loans, borrowings and other liabilities;

- expenses related to the redemption of securities;

- Banking, credit costs, etc.

Important!

The characteristics and structure of cash flow are described in detail in the Accounting Act.

How to create a cash flow statement?

Before scouring the internet for a cash flow formula, it is important to know the two methods of preparing a cash flow statement – direct and indirect.

Cash flow – direct method

This method focuses on breaking down and detailing financial flows into concerning specific groups of inflows and outflows. The creation of such a division makes it easier to find information about events that have occurred that affect the company’s finances.

In this method, the following are taken into account:

- Proceeds from sales and other operating activities;

- Expenses for supplies, services, salaries, benefits and insurance, taxes and other operating expenses.

Cash flow – indirect method

This method focuses on the final value of the net profit (or net loss) and any adjustments to expenses, which are non-monetary, that is, those that did not actually generate expenses.

In this method, activity adjustments are taken into account:

- operating activities, such as depreciation, dividends, profits from investment activities or from exchange rate differences;

- current, such as the change in reserves, inventories, receivables, payables or settlements.

Cash flow variants

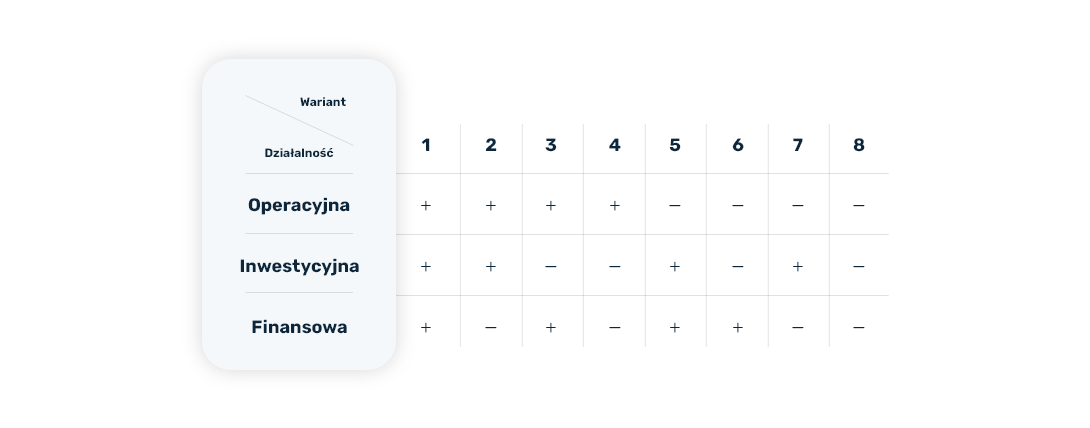

The result of the created cash flow analysis is one of eight possible variants including the results (positive or negative) of cash flows from operating, investing and financing activities:

How to interpret the variants?

Option 1 – Often refers to the accumulation of funds and that the company gains from operations while selling assets and incurring liabilities.

Option 2 – The operating balance is still positive, but the company sells assets. Increased investment flow may mean cutting costs (e.g., through layoffs).

Option 3 – The positive operating stream is less than the company’s investment costs – so the company assists itself with external sources of financing.

Option 4 – Sizable funds from operating activities, negative result in investing and financing activities – this means that the company can afford to make investments and that it is paying its liabilities on time. Such a situation is a good signal for the company.

Option 5 – The operating stream is negative, but other indicators suggest the temporariness of the problem – the resulting shortfall in funds is quickly filled by external financing.

Option 6 – Although the company is recording losses from operations, it continues to invest, which translates into an increase in asset value.

Option 7 – Both financial and operating activities present a negative result, this means that sales are not going well and lenders have a bad view of the company’s situation. In such an arrangement, it remains to sell assets to plug the budget hole.

Option 8 – All three negative elements usually mean financial trouble for the company. If the company has raised capital beforehand, it can cover its needs, pay off its debts and devote some of the funds to investment, but if there is no financial cushion, getting this result may mean having to make major changes to avoid bankruptcy.

What’s next for the cash flow statement?

Cash flow can be successfully used, for example, in the process of assessing a company’s liquidity, for the reason that it contains only cash entries and the actual state of the company’s finances.

EXAMPLE

The company closed a transaction with the customer for a net amount of PLN 30,000. Payment from the counterparty is delayed, but income has already been recorded – a company without a prepared cash flow statement will be treated as if it has these funds, but their absence will actually negatively affect the company’s liquidity rating.

The preparation of a cash flow statement eliminates the problem in question, for the reason that the data contained therein represent the actual state of affairs, and not that resulting from accounting documents (invoices, etc.).

When can cash flow be useful?

- In assessing the company’s liquidity;

- In the process of granting bank and non-bank loans and credits;

- In risk assessment for trade credit;

- In analyzing the company’s solvency.

It is worth remembering that a properly prepared cash flow is a mine of important information that will help budding entrepreneurs distinguish between the solvency of the company and the profits generated.