Bill of exchange – definition

What is a promissory note? A bill of exchange is a security containing an obligation of one party to pay a designated amount of money to the opposing party. In a situation where the issuer of the promissory note himself undertakes to pay, we are dealing with a promissory note sola – otherwise known as a promissory note. If, however, the debtor is to be the person designated in the contents of the bill of exchange (i.e., accepting the documents), we are talking about a draft (or drawn) bill of exchange. These two types are the basic names for bills of exchange encountered in business. It is worth noting that there is also a blank promissory note, which combines the features of a promissory note with the concept of a blank promissory note.

Important!

The obligation referred to in the promissory note can only be for a specific sum of money – not for a thing or service.

Who is a trasat and who is a trasant?

In connection with the process of filling a promissory note, we may encounter several terms that the uninitiated may find confusing. So before we get into the more complex issues, let’s clarify the basic concepts.

- Trasant-is another term for the issuer of a bill of exchange or check. If the bill described is a promissory note (sola), the draftsman indicates himself for payment. One of the prerequisites for the creation of a promissory note is the signature of the draftsman.

- Trasat – occurs only in the case of a drawn (scribbled) bill of exchange. This is the person designated by the draftsman as responsible for payment of the sum specified in the promissory note. If the draftsman proves insolvent, the obligation will pass to the draftsman.

- Remitent – a person to whom the draftsman (or, in the aforementioned case of insolvency, also the draftsman) is obligated to pay the amount of the promissory note.

- Guarantor – a person who is unconditionally liable for a promissory note debt.

Important!

The promissory note may indicate several drafters – in such a situation, each drafter is jointly responsible for repayment of the debt.

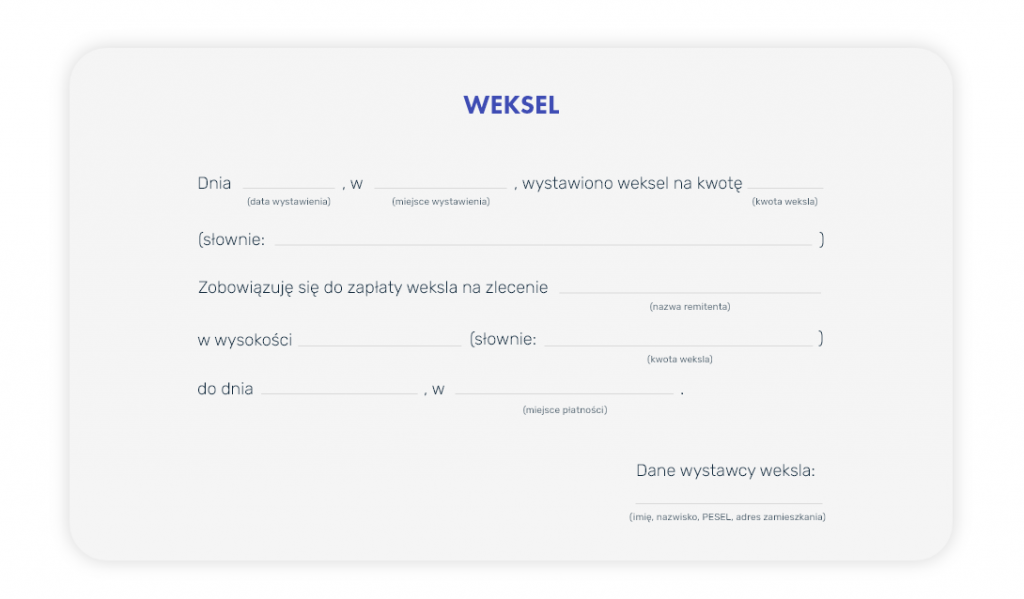

Bill of exchange – what should it contain?

In order for a draft to be treated as valid, it is necessary to include a number of information in the bill of exchange:

- The word “bill of exchange” as part of the title (e.g., at the top of the page) – this word should be written in the same language as the document;

- name of the scribe;

- an order for payment of a specified amount, together with the due date and place of payment (no place of payment means that the bill will be payable upon presentation);

- name of the remitter;

- The date and place where the promissory note was drawn up;

- Signature of the draftsman (issuer of the bill of exchange).

Important!

The draft bill of exchange must contain all of the above. data, except for the specified case of the absence of a place of payment. In such an arrangement, the promissory note should be paid at the place of residence of the draftsman (this place must be indicated in the promissory note).

What is a blank promissory note?

Blank promissory note what is it? This is a specific type of promissory note, which differs from the standard bill of exchange in that part of the data is not completed at the time of issuance. However, this does not mean that any information can be missing – even a blank promissory note should contain the signatures of the issuer, the draftsman and any guarantors.

It is worth remembering that the drafting of a promissory note does not require the participation of a notary – even a blank from the tax office is unnecessary, although, of course, in order to properly draft a blank promissory note, a template can be very useful.

How to fill out a blank promissory note?

The process of filling a blank promissory note is crucial to its validity. Filling the promissory note must be done in accordance with the terms set forth in the promissory note declaration. The creditor has the right to fill the promissory note when the circumstances specified in the promissory note agreement arise, for example, when the debtor fails to pay the obligation on time.

Important!

All guidelines for the issuance and replenishment of bills of exchange are governed by the Law on Bills of Exchange, dated April 28, 1936. Among other things, we will learn from the regulations that a promissory note must be signed by hand to be valid.

We often encounter the question: when is a blank promissory note invalid or what makes it voidable? It is worth knowing that a blank promissory note, as a rule, is not a security, because it is not filled in correctly – some of the information (usually the bill amount) is missing.

The difference between a blank promissory note (permitted by the Law on Bills of Exchange) and an invalid promissory note stems from the intention to leave some fields blank. Therefore, for a blank promissory note to have the force of law, it is necessary to draw up an additional document, usually called a promissory note declaration or agreement.

Bill of exchange declaration

Given the vulnerability of a blank promissory note to irregularities and even the risk of fraud, a popular practice is to draw up a promissory note agreement, which de facto constitutes a contract between the parties named in the note. In the promissory note declaration, the persons involved jointly stipulate the terms and conditions under which the promissory note can be executed.

What should a promissory note declaration contain?

- the date of the agreement (the same as the date of the bill of exchange);

- The names, forenames and addresses of the parties to the agreement;

- A statement by the debtor in which he declares to give the promissory note to the creditor;

- The creditor’s obligation to give the promissory note to the debtor immediately upon payment of the obligation;

- signatures of the parties.

Important!

The promissory note declaration is a separate document: it cannot be part of the promissory note or the contract from which the note is derived. If the parties decide to secure a contract (e.g., a loan) with a blank promissory note, a total of three documents are drawn up: the aforementioned contract, the blank promissory note, along with a promissory note declaration, resulting from the need to fill in the blanks of the note.

Surety on a promissory note

Sometimes the promissory note declaration implies the need to find a promissory note guarantor who will accept possible liability in the event of insolvency or evasion of payment by the draftsman. In order for a suretyship to be considered valid, the guarantor must sign the promissory note (or extension of the note), preferably preceded by the word “I vouch.”

To make the information about the suretyship precise, it is also worthwhile to include a note for whom the suretyship is given – the absence of such information indicates a suretyship for the issuer of the promissory note.

Enforcement of a promissory note and a payment order

In the event of non-payment of a promissory note obligation, the creditor can enforce his rights through the courts. Enforcement of a promissory note often begins with the filing of an application for an order for payment under the preliminary injunction procedure. The court, after examining the formal correctness of the promissory note, may issue an order for payment, which, if not challenged, becomes an enforceable title.

Defense against a promissory note

The promissory note debtor has the right to defend against claims under the promissory note. He can do so by filing objections in injunctive proceedings or through an anti-enforcement action. It is important that the debtor carefully read the contents of the promissory note and the promissory note declaration before signing them to avoid later problems.

In conclusion, the blank promissory note is a powerful tool in business dealings, but it requires caution and accuracy from both creditor and debtor. The proper filling, completion and eventual transfer of rights under the promissory note are crucial to its legal effectiveness.

Statute of limitations on a promissory note

According to the letter of Polish law, almost any property claim can be time-barred – this is explicitly stated in Art. 117 of the Civil Code. Bills of exchange are no exception to this rule, but the issue of the statute of limitations on bills of exchange is clarified by the provisions contained in Art. 71, 72 and 76 of the Law on Bills of Exchange.

The most important information regarding the statute of limitations on promissory notes is that if a claim secured by a promissory note is barred by the statute of limitations, the obligation formulated in the contents of the note is also extinguished. The creditor cannot then claim payment from the promissory note relationship.

However, the law has also taken into account the interests of creditors and provides for the possibility of claiming payment from the basic relationship (the contract between the creditor and the debtor) or due to the unjust enrichment of the debtor (in the latter case, the statute of limitations is extended to 10 years).