Multi-track development

It is no secret that companies are usually profit-driven. The means to do this are various – companies need to attract customers, ensure the highest quality of products sold or services provided, develop the technologies used and take care of employees.

Underneath all these elements, however, are things that are just as important, albeit less visible – companies must always act in accordance with dynamically changing laws, plan their next moves carefully, and analyze their finances on an ongoing basis.

The primary way to maintain control over a company’s current financial status is to regularly conduct a evaluation of the financial condition of the enterprise . Its important and authoritative segment is ratio analysis, part of which in turn is profitability analysis. However, let’s start at the beginning.

Indicator analysis of the company

In a telegraphic nutshell: ratio analysis allows you to know the actual state of a company’s finances. Entrepreneurs who are new to the adventure of running their own business are often surprised by how many elements affect how much they can actually gain from their work. Already the question of revenue, income and costs incurred by companies – although completely basic – can pose considerable difficulties for new entrepreneurs.

Indicator analysis raises issues that are much more complicated and, most importantly, clarifies them. So as not to create unnecessary confusion, let’s clarify exactly what indicators make up the result of the analysis.

Analysis indicators

The basic ratio analysis considers four aspects of a company’s operations: its liquidity, operating efficiency, debt ratio and profitability.

Liquidity – this indicator primarily describes the company’s ability to pay its obligations on time. This indicator includes several minor ones, such as:

- current ratio;

- quick ratio;

- immediate liquidity ratio.

Each is calculated using a different formula.

Debt – this indicator is used to determine the value of the liabilities a company has incurred in relation to its equity. In this case, too, several indicators stand out:

- total debt ratio;

- debt-to-equity ratio;

- ratio of share of long-term liabilities.

Operational efficiency – this segment of the analysis reports on how the company uses its resources. The performance analysis is contained in two indicators:

- turnover ratio (ratio of sales to capital held);

- the turnover cycle ratio (including: inventory, accounts receivable and accounts payable cycle).

The last group of financial analysis indicators are the profitability indicators, which are the focus of this guide. We will devote a little more space to them.

Analysis of the company’s profitability

Profitability analysis, although listed last today, is often the most important part of a company’s financial analysis. Profitability is the factor that indicates the continued sense of doing business (or lack thereof).

What is profitability?

Strongly simplifying, one might be tempted to say that profitability is simply the profitability of the activities carried out by a company. However, wanting to delve a little deeper into the subject, we need to consider profitability as the sum of the efficiency of the capital held and the efficiency of the company’s asset management.

Important!

The result of the profitability analysis can be positive (we then say profit) or negative – such a situation is called a deficit.

Profitability indicators

In order to properly determine the level of profitability of the company, it will be necessary to prepare an analysis that takes into account as many as three profitability indicators:

- ROS indicator;

- ROE;

- ROA.

In order to properly determine the level of profitability of the company, it will be necessary to prepare an analysis that takes into account as many as three profitability indicators:

- ROS indicator;

- ROE;

- ROA.

ROS indicator

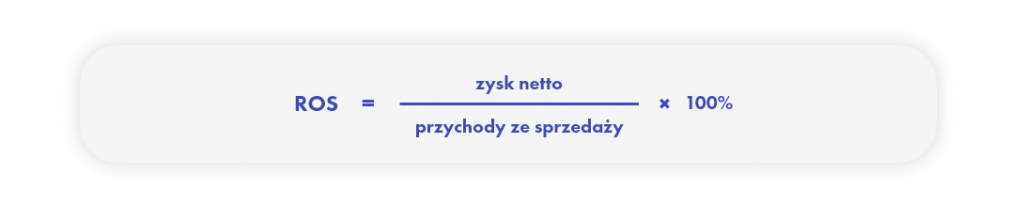

The abbreviation ROS is deciphered as Return of sale, which means return on sales. To get the result of this indicator for our company, it is enough to perform a simple calculation expressed by the formula:

The variables in this formula are net profit, which is the amount the company has earned in total, and the sum of revenues derived from the sale of products or services less the value of taxes and all costs incurred by the company.

EXAMPLE 1

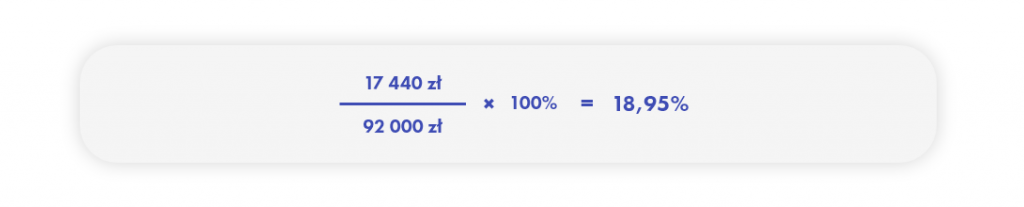

Mr. Jacek runs a one-man business – he photographs and films wedding ceremonies and receptions. In the first half of 2020, its sales revenue reached 92,000 zlotys. The costs he incurred, including applicable taxes, amounted to PLN 74,560. In his case, the ROS rate will be 18.95%, according to the calculation:

In order to fully assess Mr. Jack’s company’s ROS, it is appropriate to compare its performance with other one-man companies operating in the industry.

Important!

The result of the ROS ratio analysis is the net profit margin – the amount the company gained per zloty of sales revenue. In the above example, 1 zloty of sales generated less than 19 cents in profit.

In order to get the full picture and draw the right conclusions from the analysis, proper interpretation of the ROS is necessary. Of course, the higher the score our company achieves in the equation given above, the better the company’s profitability. Regularly analyzing the return of sale ratio makes it possible to determine whether the company is increasing sales efficiency. A declining ROS value should be a warning sign for an entrepreneur – it usually means that the company is incurring too many costs.

ROE

ROE stands for Return on Equity, or return on capital. The result of the ROE analysis determines how much profitability the company has generated in relation to the equity capital employed, and therefore how efficient it is in terms of using equity capital. ROE is calculated by the formula:

EXAMPLE 2

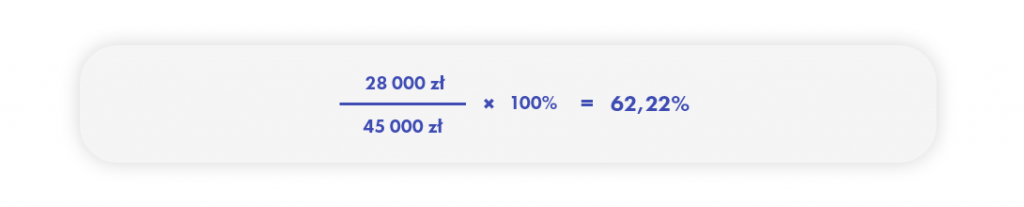

Ms. Hanna opened her own office of legal counsel. The capital she put into opening the company amounted to PLN 45,000. In the first year after opening, the law firm earned a net profit of PLN 28,000, which resulted in a return on equity of 62.22%.

The interpretation of ROE looks similar to that of ROS – here, too, it is desirable to achieve the highest possible value. The result of an ROE analysis determines how well a company is doing in terms of the use of equity capital – this can be important if the company has shareholders or (if registered on the stock exchange) stockholders. A full analysis should include information on the ROE of competing companies operating in the same industry.

ROA

The abbreviation ROA – return on assets – stands for return on assets. The described indicator helps determine the ability of a company’s total capital to generate profit. Again, as in previous cases, a simple calculation is used:

The result of applying the above formula indicates how much profit the company has earned for each zloty invested.

EXAMPLE 3

The software company, which until now operated in Krakow, opened a branch in Warsaw in mid-2018 and hired 35 people there. Costs incurred in this connection amounted to PLN 1,280,000. In the first year, the profit generated by the newly opened branch amounted to PLN 750,000, which means that the ROA for the Warsaw branch was 58.6% – however, the company’s authorities have grounds to expect an increase in this ratio in subsequent years.

ROA and its interpretation work similarly to the previous two – it is worth comparing results not only with those recorded in earlier reporting periods, but also with those of competitors and industry averages.