Basics

The APR is often confused with the interest rate, although it is actually an indicator that takes into account many more component costs of credit. The definition of the term is found in the Consumer Credit Act. Art. 5 Section 12 of the act states that it is the total cost of credit to the consumer, expressed as a percentage of the total amount of credit on an annual basis. The explanation of the term, while brief, contains three key pieces of information:

- We calculate the RRP based on the total cost of the loan, which consists of:

- interest,

- commissions,

- charges,

- Insurance,

- other costs.

- We recognize costs as a percentage of the total loan amount.

We recognize both the costs and the amount of credit provided on an annual basis.

Important!

Although the statutory definition states that it is the total cost of credit borne by the consumer, there is nothing to prevent the APR from also being used in the context of business loans.

The reason why this is not often done is mundane: lenders are not required to specify this parameter for a business loan. We will return to this later in the article.

How to read and interpret the RRSO?

The annual percentage rate is most often used to compare the prices of loans and credits. However, it is not enough to glance at the value of the rate and on this basis determine which loan is cheaper and which is more expensive. Strictly speaking, this can only be done if the two loans (or loans) being compared are for the same term.

Let’s return for a moment to the definition in the Consumer Credit Act. According to its wording, the RRSO is the total cost of credit […] on an annual basis. This means that any fees charged on financing are taken into account as many times as necessary to make the period taken into account a total of one year.

Here are some examples:

- a loan with a term of 1 month will have an unusually high APR because all the fees accompanying it will be multiplied 12 times,

- the fees associated with a 6-month loan should be multiplied 2 times to get the result,

- A 10-year loan means that all fees are divided by 10.

Conclusion: the longer the term of the loan, the smaller the impact of fees on the RRSO.

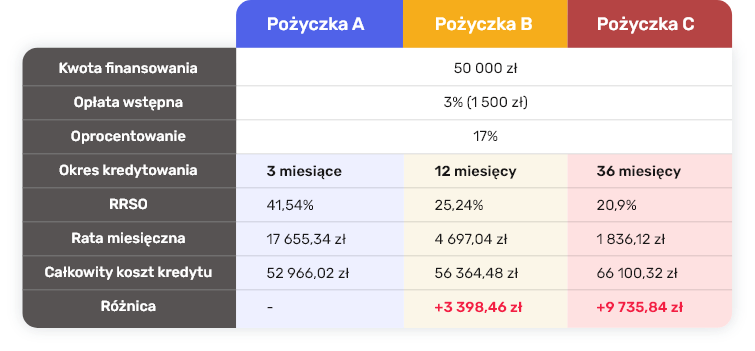

Let’s check it on specific calculations:

The example given above illustrates how the loan term affects the RRSO. Several important pieces of information emerge from this:

- The annual percentage rate of interest can only be compared against loans or credits of the same duration.

- A high APR does not always equal a high cost of credit.

- Even a loan with a high interest rate can be beneficial to the recipient.

What is the 0% APR?

The 0% APR means that you will repay the same amount you get in financing. So if you borrow PLN 20,000, the total amount to be repaid will be PLN 20,000. This is a popular solution in the context of financing consumer purchases, rather unheard of in business.

What should be kept in mind when interpreting the indicator?

In order to effectively interpret this parameter, one should always keep in mind several important aspects.

Credit costs

If the APR is much higher than the loan interest rate itself (after taking into account the annualized inclusion), it means that the real cost of the loan has been hidden in various fees (commission, upfront fee, preparation fee, etc.).

Same credit period

The APR is a great and simple tool for comparing the cost of loans – if it is given, a customer (both individual and business) can compare loan offers of the same loan term at a glance.

Identical APR, different amounts to be repaid

RRSO does not tell you the absolute amount of the cost of the loan. It happens that two loan offers for the same amount and provided for the same period of time have identical RRSO, but different total costs. The differences lie in the amount of fees. In order to compare exactly such offers, it is necessary to contact the entities offering them and obtain detailed financing terms.

RRR vs. current liabilities

RRSO takes into account all costs, including one-time fees. Because of this, RRSO always compares less favorably with short-term loans and credits than with long-term ones. Short-term loans generally have a very high RRSO compared to those taken out for a period of several months, which does not necessarily mean that they are unfavorable.

Annual snapshot

RRSO tells you the average annual cost of financing a given loan. So if we have an indicator for a loan taken out for a quarter, the RRSO will answer the question “how much will I pay if I take out four such loans?”.

RRSO in business – what is its role?

The indicator, which works well and is widely used by consumers, serves a slightly different function in a business context. First of all: as we have already mentioned, lenders do not have to provide RRSO for financial products aimed at business. In fact, the vast majority of business loan offers are devoid of this indicator. This is interesting because for business customers, RRSO can be extremely important – but for slightly different reasons than for consumers.

The indicator, which works well and is widely used by consumers, serves a slightly different function in a business context. First of all: as we have already mentioned, lenders do not have to provide RRSO for financial products aimed at business. In fact, the vast majority of business loan offers are devoid of this indicator. This is interesting because for business customers, RRSO can be extremely important – but for slightly different reasons than for consumers.

Interest rate for companies at a glance

The RRSO value answers the question: how much does each zloty borrowed cost my company annually? This is important information, especially when compared with the company’s internal financial analysis and investment plans.

What does this actually mean? Let’s assume that the cost of a borrowed zloty is lower than the amount you can – potentially – earn on it in a year. In this case, if you have a choice between two loans with the same interest rate, the commitment with the higher total cost is often the better choice. Why? We explain!

Some examples

Consider a situation in which your company borrows:

- PLN 100,000,

- for a period of 12 months,

- At an interest rate of 18% per year.

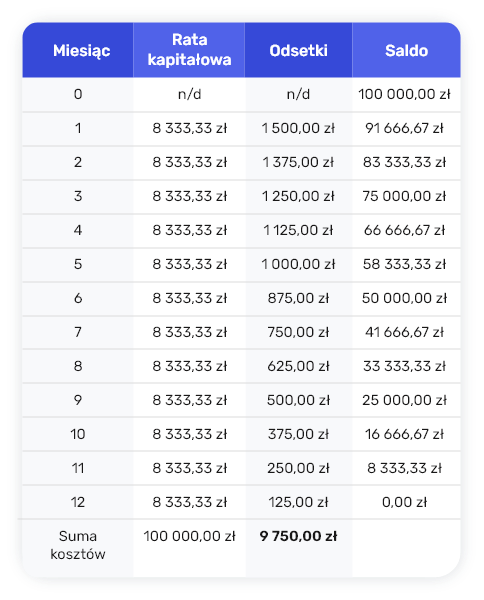

Variant one: repayment of 12 equal principal installments (in the amount of PLN 8,333.33) plus interest.

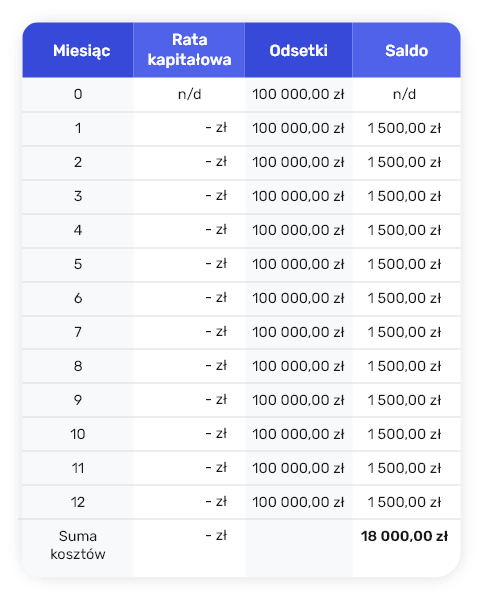

Option two: repayment of the entire principal after 12 months. Only the interest portion is payable in installments.

Option one – repayment of capital installments throughout the year

The total amount to be paid in this variant is: PLN 109,750.

Second option – repayment of the entire obligation at the end of the loan period

The total amount payable under this option is PLN 118,000.

Higher APR = greater benefit?

If the two examples above were about credit for the consumer, the latter would more than likely choose the first option. First, because it involves lower costs, and second, because it allows you to spread payments over a convenient 12 installments, rather than requiring you to accumulate the entire amount at the end of the loan term.

The difference between the cost of credit for a consumer and for a company is that many companies, given a choice between the above options, will choose the more expensive one. The option in which the borrower has to give back PLN 118,000 (i.e., the cost of the loan almost doubles) is more favorable for one simple reason. The second option gives the company the opportunity to manage the amount of PLN 100,000 for the entire loan period. This is money that can be used wisely – for example, invested – and earn a high rate of return.

However, the described action involves risks. It is nothing more than leverage.

RRSO vs. form of taxation

When thinking about the annual percentage rate of charge in a business context, one should not forget how the form of taxation affects its use. The cost of financing with a business loan or credit is a tax-deductible expense, which is also important information for the decision-making process regarding the choice of the right financing offer.

For this reason, the situation must be approached differently by an entrepreneur accounting for lump sums on registered income – his company will generally pay more, as he cannot include the financing costs in his settlement. On the other hand, companies and entrepreneurs using full accounting will be able to deduct the costs incurred, which will ultimately make the loan more favorable to them.

How to calculate the annual percentage rate of interest?

Now that we’ve established that RRSO is just as (or maybe even more) important for companies as it is for consumers, it’s useful to know how to calculate the rate yourself. It is also important to remember that it takes into account all fees associated with the loan, so:

- interest rate,

- Insurance,

- preparation fees,

- entry fees,

- commissions.

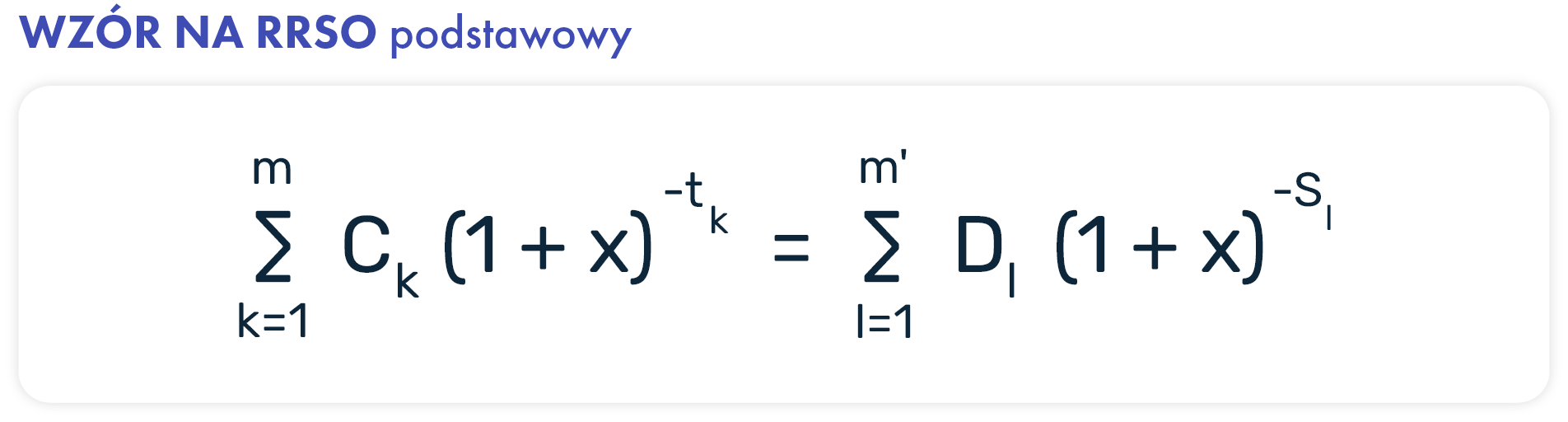

The formula is not one of the easiest, although, fortunately, there are two variants. The second one is a bit simpler to apply.

Explanations:

- x – the actual annual interest rate,

- m – sequence number of the last loan installment payment,

- k – sequential number of payment / 1 k m,

- Ck – payment amount k,

- tk – the period between the date of the first payment and the date of each subsequent payment (in years) / t1=0,

- m’ – the sequence number of the last repayment or fees paid,

- l – sequence number of repayment or fees paid,

- Dl – the amount of repayment or fees paid,

- Sl – the period between the date of the first withdrawal and the date of each repayment or payment of fees (in years).

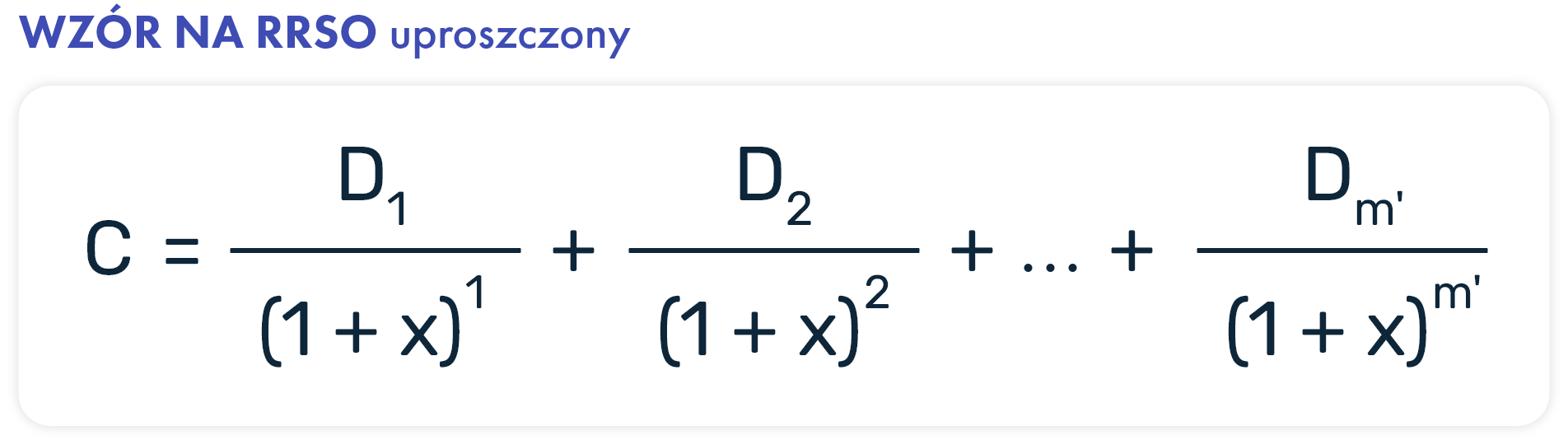

If the financing provided to the company will be paid in a single tranche, we can use a simpler formula:

Explanations:

- C – loan amount,

- x – RRSO,

D1, D2, D3… – subsequent loan installments

How to calculate the approximate RRSO in memory?

In some cases, it is possible to calculate a pointer in memory. However, this applies only to very clear situations.

If the interest rate is the only cost of the loan:

If the loan is short-term (granted for no more than a few years), you can try to calculate the RRSO approximately using the following formula:

Explanations:

- O – interest rate on the loan

- soj – sum of one-time charges

- lmk – number of months of credit

- su – insurance rate added to the current installment

Example

Company A took out a loan of PLN 60,000, for a period of 8 months. The terms of the loan proposed by the bank are:

- 11% interest rate,

- 1% commission (PLN 600),

- Insurance 0.1% of the amount of credit used per month.

In this case, using the mentioned formula, you can calculate the approximate RRSO:

RRSO ≈ 11% + ((1% * 12) / 8) + 0.1% * 12

RRSO ≈ 11% + 1.5% + 1.2%

RRS ≈ 13.7%

Remember, however, that the above formula gives only an approximate result. You will get a confident result by using the IRR (Internal Rate of Return) function, available in the spreadsheet.

Popular mistakes in understanding RRSO

The annual percentage rate can be questionable, especially when the loan parameters are complex or unusual. Check out this list of common mistakes to avoid them in the future!

Higher APR does not mean higher loan costs

What at first seems like correct reasoning loses its meaning when you consider loans granted for short periods. The APR takes into account the cost of a loan on an annual basis, regardless of the term of the loan you are currently analyzing.

This is not the same as the interest rate

In fact, the interest rate is only the amount of interest that the bank or other lender adds to each installment paid. In addition, there are other so-called non-interest loan costs in loans and credits. These include commissions, service fees, up-front fees, insurance, etc. The APR takes into account all the costs listed, along with the interest rate.

APR is not always the best indicator for comparing loan offers

The annual percentage rate of charge is worth checking only when comparing loans granted for the same period and with the same repayment model. For example, a loan given for 12 months with the same interest rate, but with repayment in equal installments every month, will have a different APR than a loan with similar parameters, but taking into account repayment of the entire amount at the end of the contract). We have illustrated this with examples above.

Loans outside banks don’t always have higher APRs

In such cases, the term of the loan is always key – non-bank lenders often offer loans for shorter periods, with the resulting differences in parameter values….

The absence of an indicator in the offer does not mean that the lender has something to hide

It is still important to keep in mind the existing division between consumer and business loans. In the case of consumer loans, the lender must include the RRSO in the offer – this is its legal obligation. However, if you are taking a loan for a business, you will notice that banks and non-bank lenders do not disclose the RRSO. This is because they are not obliged to do so. However, you can calculate the RRSO yourself.

RRSO in business – summary

The annual percentage rate of interest is an indicator that can be crucial for entrepreneurs. It is not easy to reach, but in many situations it is worth the trouble to calculate it. This will give you an idea of the correct interest rate on a loan and how much each zloty borrowed in a loan costs. It’s up to you to estimate whether your company can generate more profit before the borrowed amount has to be paid back.