Revenue higher

by 95% – case study

Products: invoice financing, fixed factoring

Long payment terms, high risk, lack of funds

Before opting for factoring, our client had to face problems typical of the TSL industry, but occurring in unprecedented intensity. Payment terms reached 60 days. Despite this, the company was trying to expand its operations abroad and attracted new customers. With their number, however, the risk of its operations grew.

Once again, when the invoice payment came due more than two months after the deal was struck, an important decision had to be made – to seek external financing

Initially, the entrepreneur was interested in an overdraft or working capital loan. For banks, however, the aforementioned risks proved to be an obstacle. So the client decided to finance one VAT invoice on a trial basis with the help of our partner. A good first impression resulted in direct contact and the establishment of long-term cooperation.

How is our cooperation going?

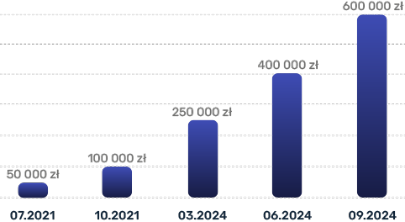

We offered the client fixed factoring financing with a limit of PLN 50,000 and the possibility to increase in the future. We proceeded immediately, and the fundraising process was evaluated very well. Since the client has an account at the same bank, he receives transfers from PragmaGO in real time. As a result, he can dispose of the funds due in just a few moments after submitting invoices for financing in the Client Zone.

Bigger needs are not a problem

The limit we offer is renewable. What does this mean? Each time our client receives funds for an invoice submitted for financing, the amount of the available limit will decrease, but when the invoice recipient settles the payment, the limit will return to its previous state. In this way, the company obtains 100% liquidity and does not have to watch payment terms, because it still has funds available within the factoring limit.

Instant payments, revenue growth, new fleet

Today, after three years of cooperation, we can proudly observe the results. The client, using factoring, has purchased new vehicles, which has contributed to a significant expansion of the ability to accept new, lucrative orders from foreign customers.

Here are the results of the cooperation:

The company’s turnover in two years increased from 7.5 million zlotys to 13 million zlotys

The average waiting time for funds has decreased from 58 to 10 days

The company’s revenue during this period increased up to 95%

A summary of the company’s financial results showed that our client’s business has grown by 25% in two years – and all indications are that we have not yet said the last word.