30% increase in sales – case study

Product: subscription factoring with advance payment

What problems plagued our client?

Our long-standing client is a family company that has been on the market since the 1980s. A dozen years ago, the company was transformed, which was directly related to a significant expansion of its operations. Despite this, it still had to struggle with the problems that afflict the entire furniture industry, which are mainly due to seasonality.

The furniture industry experiences a real siege during the summer months, while in autumn and winter it has to watch the market closely, fight for customers and manage its budget carefully. This, combined with long payment terms on invoices, means that outside the summer season, doing business in this industry can be significantly hampered.

The client came to us thanks to the recommendation of an intermediary. This one, knowing the difficulties faced by the company and the capabilities of PragmaGO, suggested financing using factoring and put the entrepreneur in touch with an advisor.

What solution have we come up with?

Wanting to enable the entrepreneur to quickly unlock funds and accept more orders without looking at payment terms, we offered subscription factoring with advance payment. Thanks to this solution, our client doesn’t have to wait for recipients to pay up – instead, he submits the invoice for financing, only to receive a transfer to his company account a few hours later. The automatic advance present in this option is an additional convenience, whereby the bulk of the retained deposit goes into the customer’s account long before the recipient pays the invoice.

Effects of cooperation

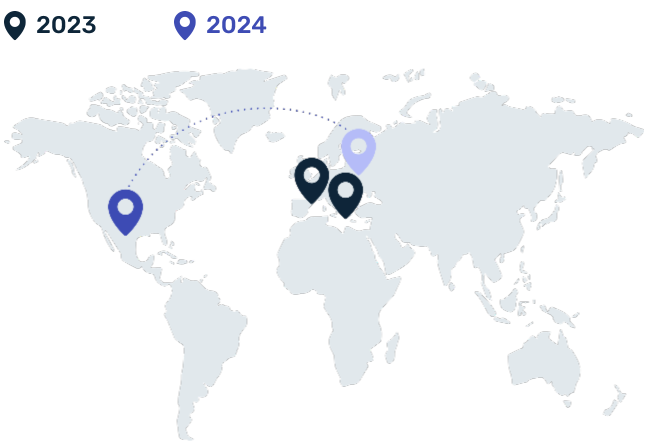

Thanks to factoring, our client can develop the company without restraint – the waiting time for repayment has been reduced by as much as 30 days, allowing much better planning of expenses and investments, and finally expanding the business on a regular basis. Today the company offers its services in the European Union countries and the United States.

In two years of cooperation with PragmaGO, our client’s company has grown by 30%, while increasing sales and investments.

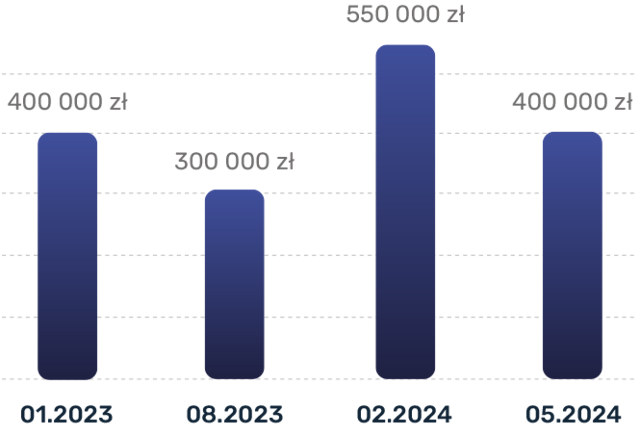

Flexible financing

In a situation where the client takes on many orders, and thus needs more capital on hand, we have increased the available limit, allowing us to finance invoices for a much higher amount.

In months of stagnation, on the other hand, the customer could use the option to lower the limit for a specific period of time – without changing the other terms of the contract and without additional fees!