Online factoring

with guaranteed payment

Sign the contract and get an advance payment right away. We will take care of the assignment formalities later!

Fill out a free application

Get permanent access to cash at terms convenient to you.

How does factoring work?

You issue deferred payment invoices, and we pay you in advance. Your contractor then gives the amount due on the invoice due date directly to us.

We sign a cooperation agreement and you get access to the Client Zone, where you submit invoices for financing – quickly and conveniently.

We grant a limit from PLN 50,000 to PLN 15,000,000 – also possible in EUR, USD, GBP or CHF.

You spend the funds you receive on any corporate purpose.

Interested in factoring for a higher amount? We also have this option – inform your customer advisor of your request.

What makes our factoring offer different?

Individual support from a customer advisor

You are sure that our factoring meets your individual needs – you can easily adjust the amount of the limit, the range of additional services, and even the way of signing the contract.

Also available for start-ups

We finance companies from day one of their operations. If there is no credit history, we carry out an assessment of the invoice recipient’s payment reliability.

Guaranteed payout to start

Right after signing the contract, you will receive a portion of the funds from us so that you can use them as soon as possible. No waiting for the contractor to sign the assignment! We will deal with the formalities of the assignment later.

Monitoring of receivables

You don’t waste time controlling invoice repayment dates – we do it for you. We also advise on how to secure your transactions through the use of appropriate sales documents.

Online calculator factory

Select the currency for factoring

Estimated net cost

Which billing method will work for me – subscription or rate?

How to choose the optimal limit?

Can I change the limit during the contract?

Can I include factoring expenses as a business expense?

The presented calculation does not constitute a commercial offer within the meaning of Art. 66 par. 1 KC. The total cost was calculated for an entrepreneur who settles flat tax (19%) and VAT. For invoices with a denomination of pow. 250 thousand. PLN 75 thousand or 75 thousand. EUR we are preparing a special price offer.

A factoring service is for you if:

You offer deferred payment invoices to your contractors, and you need cash faster.

You regularly issue invoices to regular contractors.

You run a sole proprietorship or are looking for financing for a company in the SME sector.

You need permanent financing of more than PLN 50,000 (or equivalently in EUR, USD, GBP and CHF).

Not sure if online factoring is the solution for you?

Maybe you need access to cash from time to time, or maybe you’re interested in fast financing?

Check out our single invoice financing offer and take care of your company’s liquidity.

Questions and answers

What does the guaranteed payout consist of?

Do my counterparties (customers) have to agree to factoring?

Will my creditworthiness be verified during the application process?

How to sign a contract with a qualified electronic signature?

What invoices can be submitted for funding under this service?

What is the factoring process?

How long do you have to wait for a decision?

Is it possible to finance invoices in foreign currency?

What industries can benefit from factoring?

Can I add/delete previously designated recipients/contractors?

Didn’t find the answer to your question?

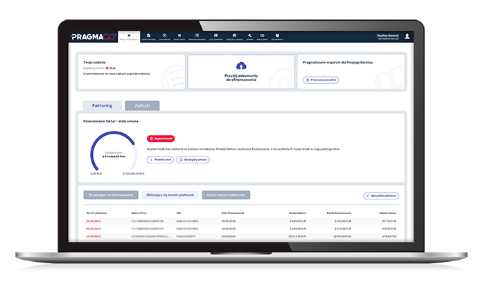

Customer Zone

Customer Zone is a platform that you have free access to 24/7 – whenever you need it. Here you can, among other things. convert invoices to cash even faster and add/remove counterparties, as well as request a change in the factoring limit.

In the Customer Zone you benefit from financing on an ongoing basis – without additional paperwork.