Factoring and other forms of financing for businesses

Factoring in its most basic sense is a service for buying back receivables. Learn about the advantages and disadvantages of factoring to decide if it’s the right solution for your business. Let’s start by explaining the essence of how factoring works:

EXAMPLE

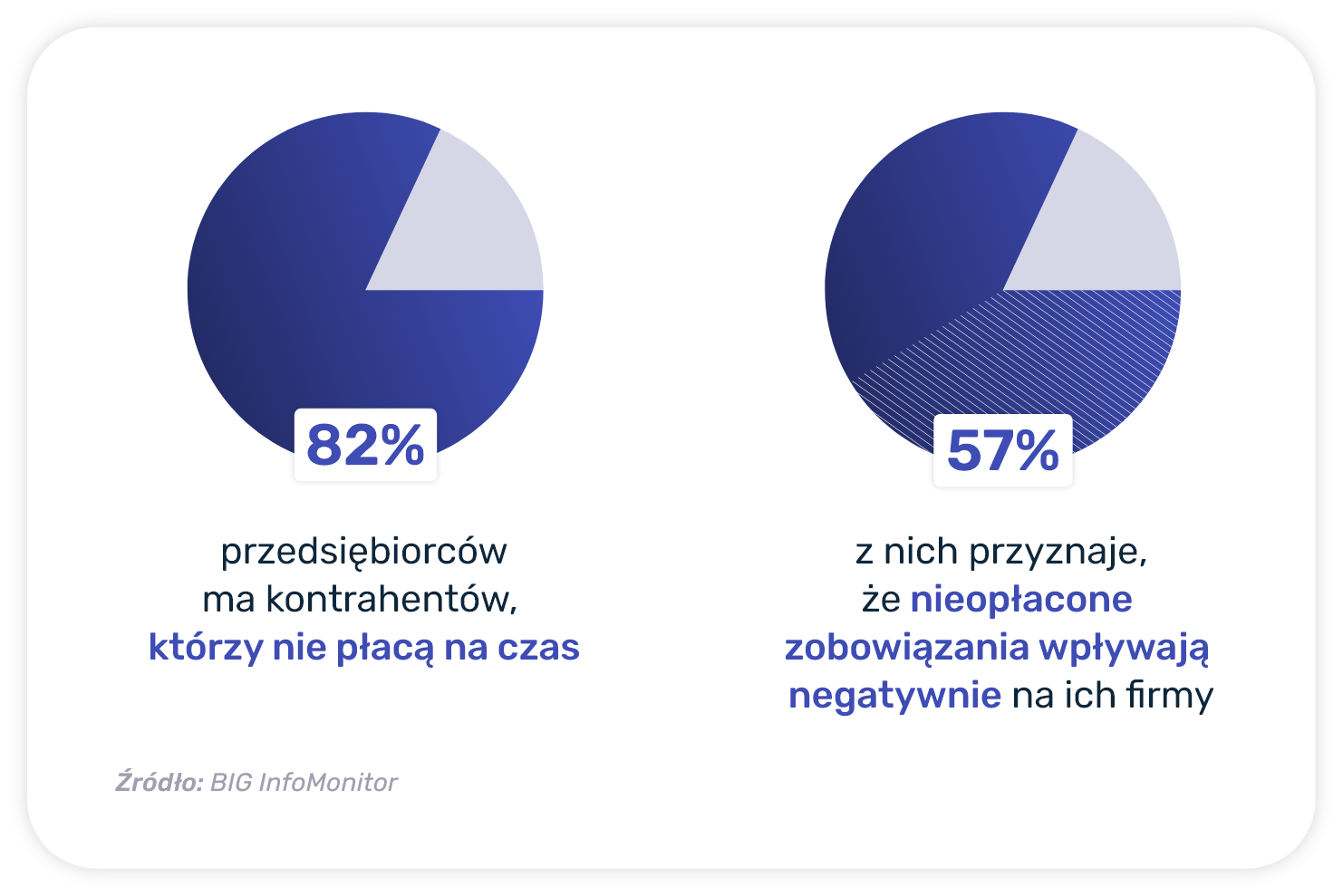

Mr. Stanislaw’s company provides transportation services. Mr. Stanislaw regularly invoices his customers with deferred payment terms of 30 days or more.

As long as everything worked properly and contractors sent money on time, Mr. Stanislaw saw no reason to change. Over time, however, delays began to appear, and the vast majority of customers, waited with payments until the last minute.

In this situation, Mr. Stanislaw began looking for an alternative. He realizes that he can’t start on the spot issuing invoices with – for example – a seven-day payment term, because he would risk losing customers by doing so. The solution turned out to be factoring.

Waiting dozens of days to pay each invoice is not an option – Mr. Stanislaw has employees, his own obligations and taxes to pay. What options can an entrepreneur use?

- Popular instant loans – generate very high costs, so they are considered a desperate solution,

- Cash or investment loan – a popular choice of entrepreneurs. It is characterized by strict requirements and a fairly long processing time.

- Loan for companies – a short-term solution that does not solve the problem of payment congestion. However, loans can be very helpful in dealing with temporary difficulties of companies.

- Factoring – access to a revolving limit, a solution to bottlenecks and simple handling – a good option for companies that issue invoices with deferred payment terms.

EXAMPLE

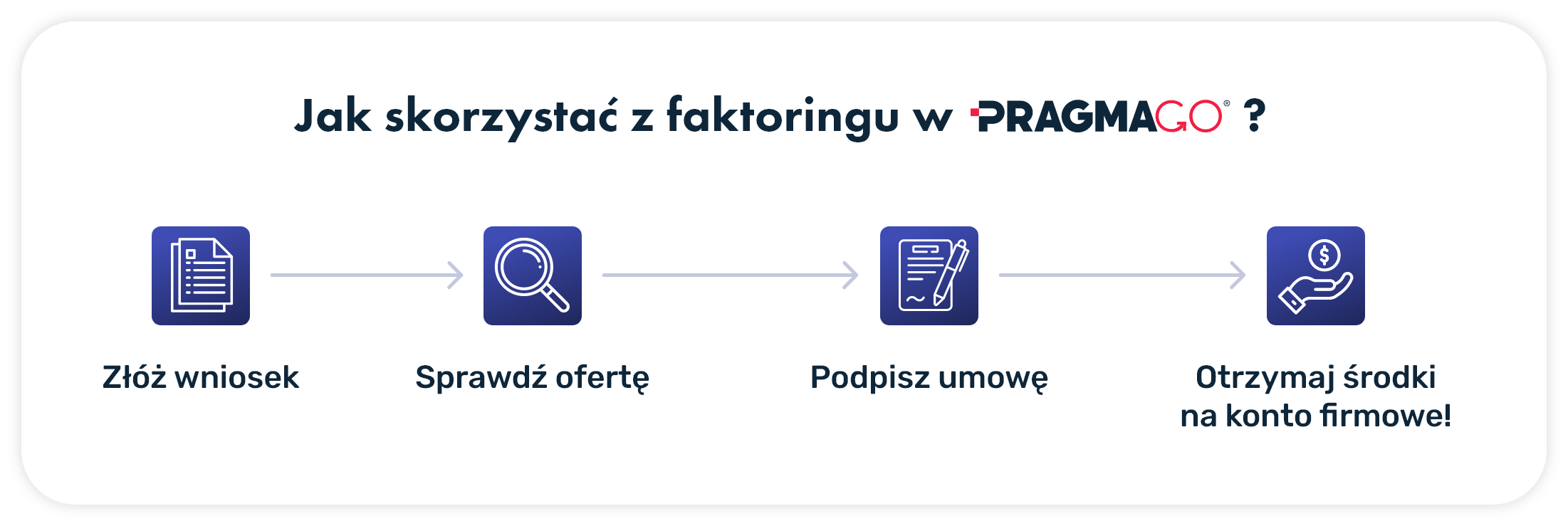

First, Mr. Stanislaw fills out an online application on the factor’s website, where he enters basic information about his company, the details of his customers and the financing limit he is interested in. Mr. Stanislaw receives a detailed offer within 24 hours, along with the terms of the decision. After signing a factoring agreement, he can conveniently submit invoices for financing through the Customer Zone when he needs it.

How exactly factoring works largely depends on the company that provides the service. In some cases, it will be an application available on the website, which you can fill out yourself. In another company, you will be able to apply for financing over the phone – during a conversation with a consultant. Some factoring companies require you to register before completing the application.

To use online factoring at PragmaGO, all you need to do is fill out a short online application on the website. As part of the process, you should:

After analyzing the application, your company will receive a personalized offer, which you can accept or decline. The mere sending of the application is non-committal – only after receiving the personalized offer you make a decision on establishing cooperation.

If you decide to do so, we will grant your company a revolving factoring limit. This is the amount you can use to finance your invoices.

EXAMPLE

Mr. Stanislaw took advantage of factoring and received a limit of PLN 250,000. This means that he can dispose of the invoices he issued to the previously notified recipients for a total amount of PLN 250,000.

Financing of invoices is done on the basis of assignment of receivables. So if you want to “sell” an invoice, it is necessary to obtain the consent of the counterparty to the assignment.

What does it mean that the limit is renewable?

Renewability of the limit means that each time a contractor pays an invoice, the repaid amount goes back into the pool for the entrepreneur to use.

Example:

Mr. Stanislaw financed four invoices for a total of PLN 118,000. Since he had a limit of PLN 250,000, this means that he had PLN 132,000 left to use. After some time, one of the recipients settled the payment in the amount of PLN 40,000. Thus, the available limit amount increased by the repaid amount – to the level of PLN 172,000.

Mr. Stanislaw financed four invoices for a total of PLN 118,000. Since he had a limit of PLN 250,000, this means that he had PLN 132,000 left to use. After some time, one of the recipients settled the payment in the amount of PLN 40,000. Thus, the available limit amount increased by the repaid amount – to the level of PLN 172,000.

Who provides the factoring service?

Factoring services in Poland are provided by factoring companies, such as PragmaGO, and some banks (find out what the difference is).

The entity providing factoring is called a factor.

Who can benefit from factoring?

Wanting to know the advantages and disadvantages of factoring, entrepreneurs often start by seeing if they can use this service at all. We have good news, because factoring can be used by any registered entrepreneur, no matter what industry he is in or how long he has been in business. The condition is that the invoice the entrepreneur wants to finance is not due – it must be submitted for factoring financing before the due date.

An entrepreneur using factoring is called a factor.

Advantages and disadvantages of factoring

Advantages of factoring

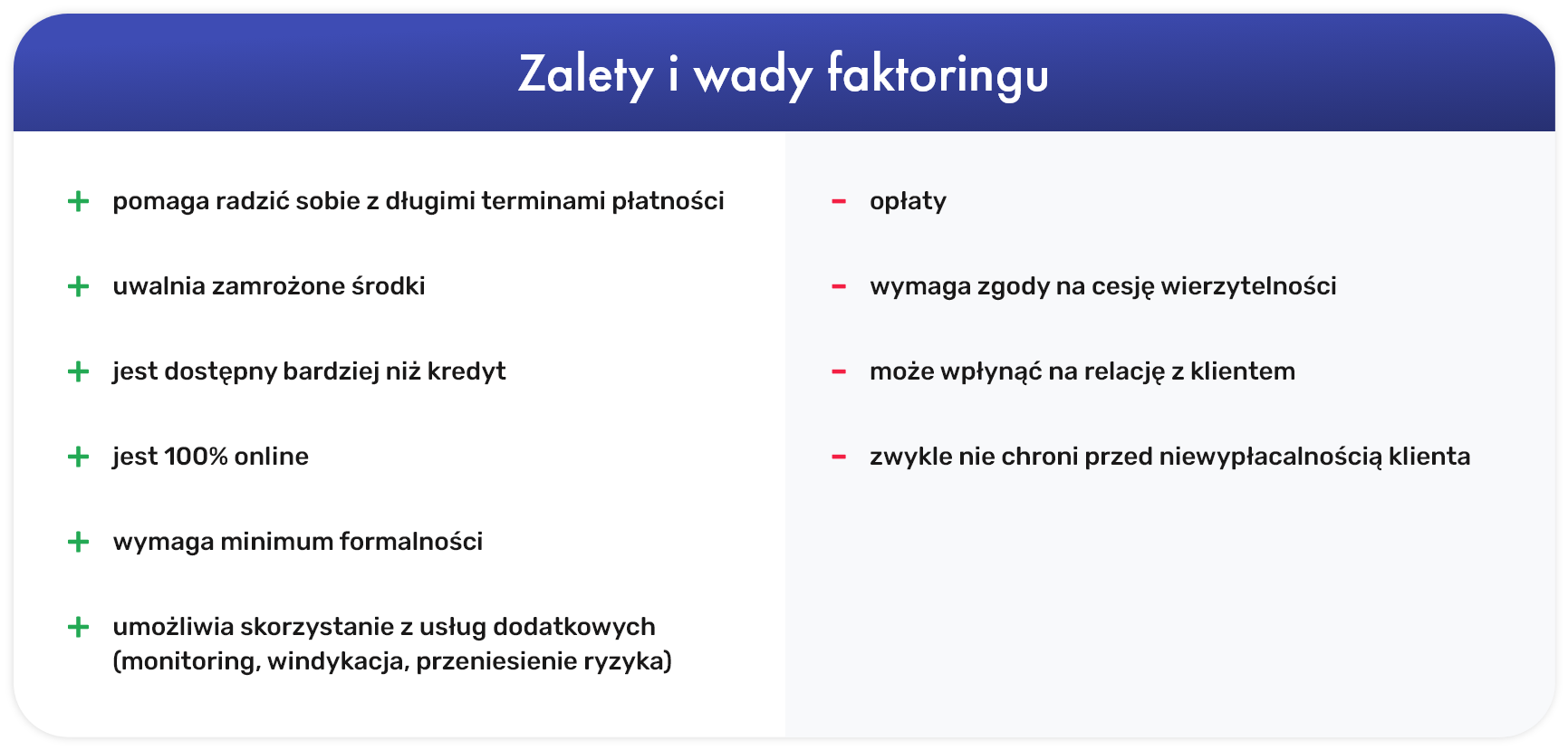

Among the biggest advantages of factoring is certainly the speed of action – if you apply for factoring online on a business day, you can receive a decision up to 24 hours! Once the agreement with the factor is concluded and the assignment is established, the funds from the invoices submitted for financing are credited to the customer’s account immediately.

Factoring is also a reliable way to instantly improve a company’s liquidity ratio – this is of considerable importance if the company plans to make investments or take out a loan in the future.

Another benefit of factoring is its accessibility – unlike a bank loan, a factor does not have to run a business for a minimum of one year, and even the smallest business can benefit from factoring. The factoring service is available even without creditworthiness.

Another advantage of factoring is the simplicity of operation. Forget about the complicated procedures, crooks and a dozen pages of addenda, here the matter is extremely simple: choosing PragmaGO, you fill out the application online. You also submit invoices for factoring financing online. What’s more, you can do it anytime through the Customer Zone available 24/7.

One form of factoring also allows you to transfer the risk of the debtor’s insolvency to the factor – using such a solution increases the cost of factoring, but allows you to practically forget about the unpaid receivable the moment you receive the funds in your account.

What distinguishes factoring from other financial services is also a wide range of additional services, such as insurance, monitoring of receivables or comprehensive handling of them.

Downsides of factoring

Like any solution, factoring also has its drawbacks. Among the most obvious ones is the need to pay a commission – but it’s worth mentioning that this is not an amount you need to physically own at the time you enter into a factoring agreement. This is because the set amount will be deducted from the value of the invoice sold, which makes the fundraising process even easier.

Another potential disadvantage of factoring is the risk of deterioration of the relationship with the counterparty – an important feature of open factoring is the need to inform the company to which the invoice is being sold of the establishment of a relationship with the factor and to obtain approval for the assignment of receivables.

On the one hand, taking such decisive steps should result in increased motivation on the part of the counterparty to make timely payments in the future. On the other hand, however, the debtor may take it as a sign of mistrust on the part of the entrepreneur who decided to use factoring.

When using a basic form of factoring, keep in mind that the risk of counterparty insolvency does not automatically transfer to the factor. The popular (and cheaper) factoring with recourse is a service under which you receive payment for an invoice immediately. However, when the due date (usually several days longer than the original one on the invoice) passes and your counterparty fails to pay, you must return the funds received. For this reason, you should carefully select the recipients whose invoices you want to submit for financing.

Summary

Factoring is a versatile financial solution that is most readily used by small and medium-sized companies. It works exceptionally well in industries such as transportation or construction, but also in others where invoices are usually issued with a distant due date.

The advantages and disadvantages of factoring allow us to conclude that factoring can be a very beneficial solution for a company. Nevertheless, it is worth being vigilant and considering all the relevant aspects of the service before deciding on financing.