The beginnings of factoring in Poland

1990s. is first and foremost the huge political changes in Poland, which opened our country to the free market economy. Thousands of new companies were created, and some entrepreneurs tried to transplant solutions already known abroad to the Polish market.

In 1994, the first factoring company was established in Poland, and other companies joined in the following years. The first steps consisted mainly of education – the Polish entrepreneur was previously unfamiliar with factoring, so he approached the news with reserve. Polish factoring companies decided to form the Confederation of Factoring Institutions precisely in order to integrate the industry, introduce new forms and expand the scale of education about factoring services. The activities of the KIF have been continued since 2006 by the Polish Factors Association – the main tasks of the association still include cooperation of entities involved in factoring, popularization of this type of financing instrument and education (also through cooperation with economic universities).

Factoring in Poland in recent years

Factoring services n g factoring is a sector that has been growing steadily for many years. Data on the factoring activities of financial companies is collected by the Central Statistical Office, so every year we can read a report analyzing the current state of the industry.

There have been reports available on the CSO’s website since 2006, but in this article we will focus only on the most recent information, concerning the last few years (2015-2021) – last year’s analysis also included an assessment of the impact of the coronavirus pandemic on the factoring industry in Poland, today we will see how factoring is doing in the face of the economic crisis and rising inflation.

The scale of factoring is measured by a number of ratios, but just two of them allow us to outline the overall picture. These are the value of redeemed receivables and the number of customers.

Control group

Before we go into a detailed discussion of the CSO reports, it is worth knowing that the annual surveys since 2015 have included the fewest 50 factoring service providers (in 2017) and the most 57 (in 2018). In the last year analyzed (2021), 52 entities were considered.

The group of companies surveyed was diverse – for example, in 2020, among the 52 entities surveyed, as many as 54% constituted companies for which factoring is the only type of activity, 6% companies that provide other services as well, but factoring remains the most important one, a 40% Those companies for which factoring is only a side business (for example, banks). In 2021, the ratio was maintained. Forty-three non-bank factoring companies and nine banks providing factoring services were surveyed.

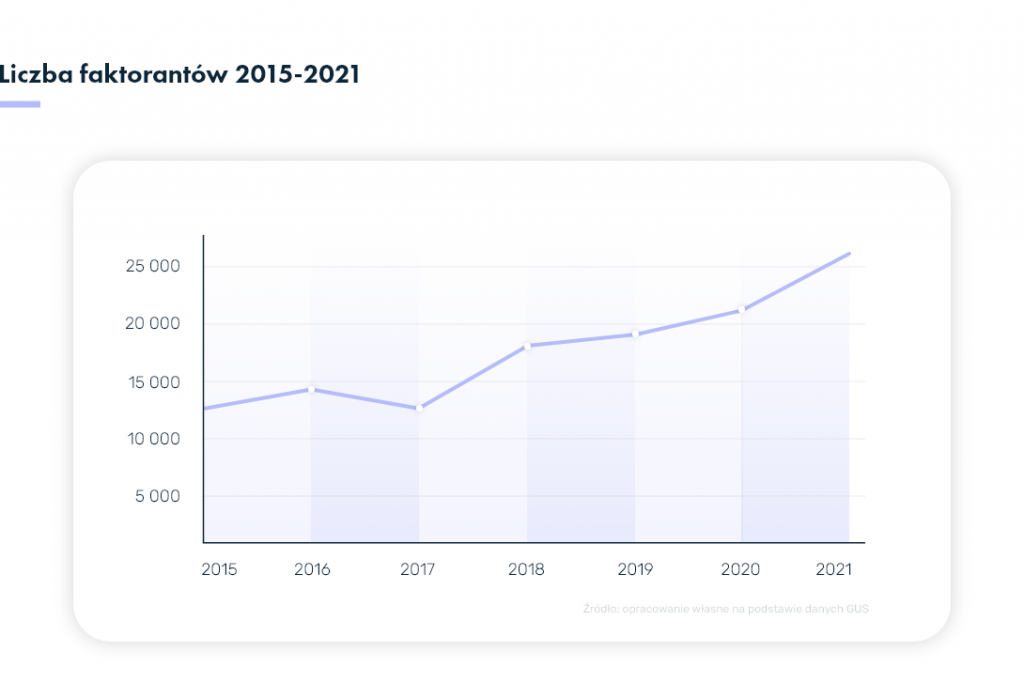

Number of factoring companies

The popularity of factoring in Poland is constantly growing, which can be clearly seen in the number of entities using this type of service. Although the growth observed over the past few years presents different dynamics, it is in vain to look for a halt in the upward trend, but on the contrary. In 2021, we saw a particularly large increase – the difference in the number of factoring clients in Poland exceeded 5,000 entities (21,153 in 2020 compared to 26,371 in 2021). This can be seen well in the chart below:

Based on the number of customers alone, it is difficult to draw far-reaching conclusions, but we see an upward trend in 2021. accelerated significantly. The results of the analysis covering the current year, 2022, may be particularly interesting – we will then have a full picture of how rising inflation and difficulties in borrowing have affected factoring in Poland

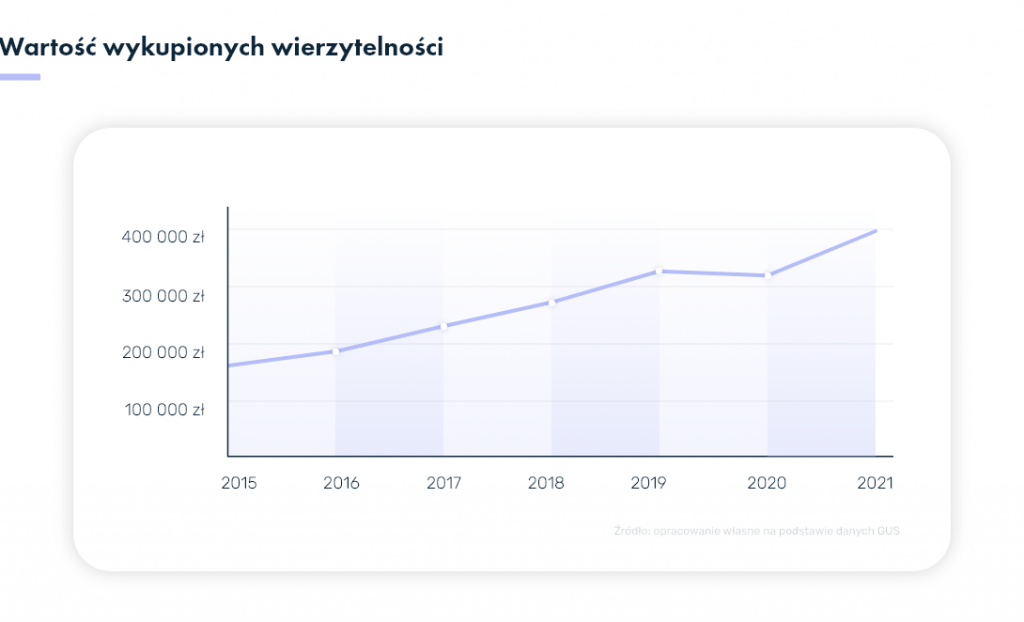

Value of redeemed invoices

The effectiveness of the factoring market is determined not only by the number of companies using these services, but also, and perhaps most importantly, by the value of the invoices bought back (that is, the de facto total amount of receivables financed by factors).

Poles are eager to finance expenses and invoices of increasing value through factoring. The difference is clear, and the growth rate is impressive. Although we could see a slight slowdown in 2020 – the total value of the of financed invoices decreased by approx. 6 million year-on-year – in 2021 factoring in Poland broke a record, and in a big way! Thanks to factoring, invoices with a total value of PLN 399,822 million were financed!

Interestingly: the share of international factoring in the Polish factoring market increased slightly. In 2020, it was 15.8%, while the latest figures show a result of 16.4%. Overall, the value of purchased receivables increased by 28.6% in domestic factoring and by 33.5% in foreign factoring.

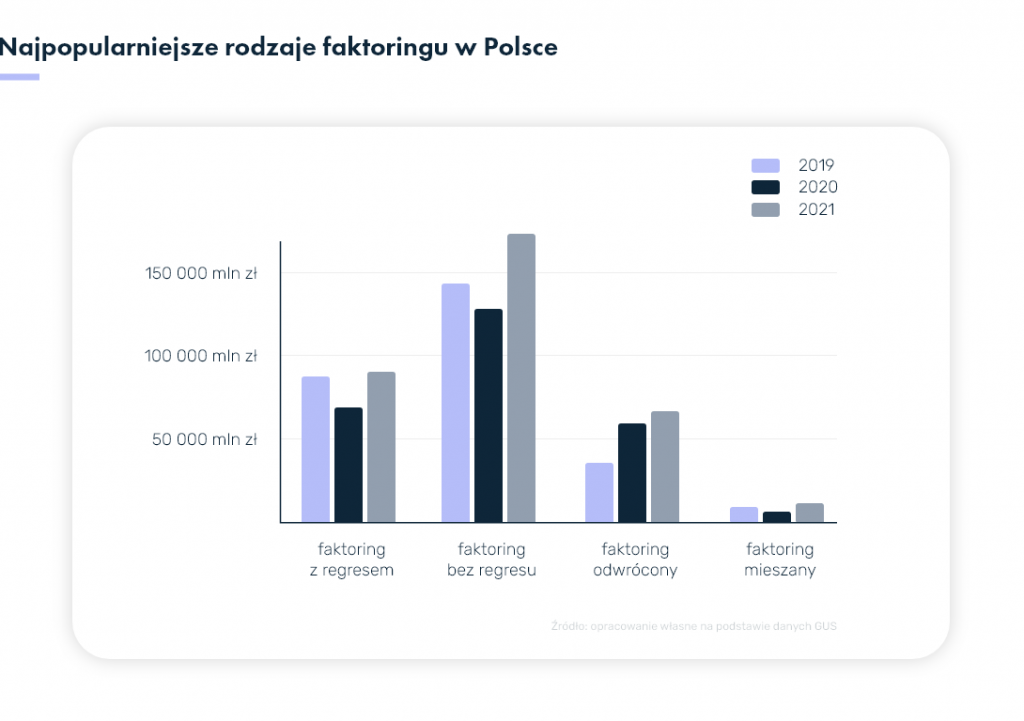

The most popular types of factoring in Poland

There are several different types of factoring available on the factoring market in Poland – among the most popular (taking into account the total value of financed invoices) are:

- factoring without recourse (51.7%)

- factoring with recourse (24.7%)

- reverse factoring (20.2%)

- mixed factoring (3.4%)

This situation is perfectly illustrated in the chart below:

Just a first glance at the above data leads us to believe that the last year was characterized by increases in every category, but non-recourse factoring gained particular importance – the value of financed invoices grew by almost PLN 50 million year-on-year!

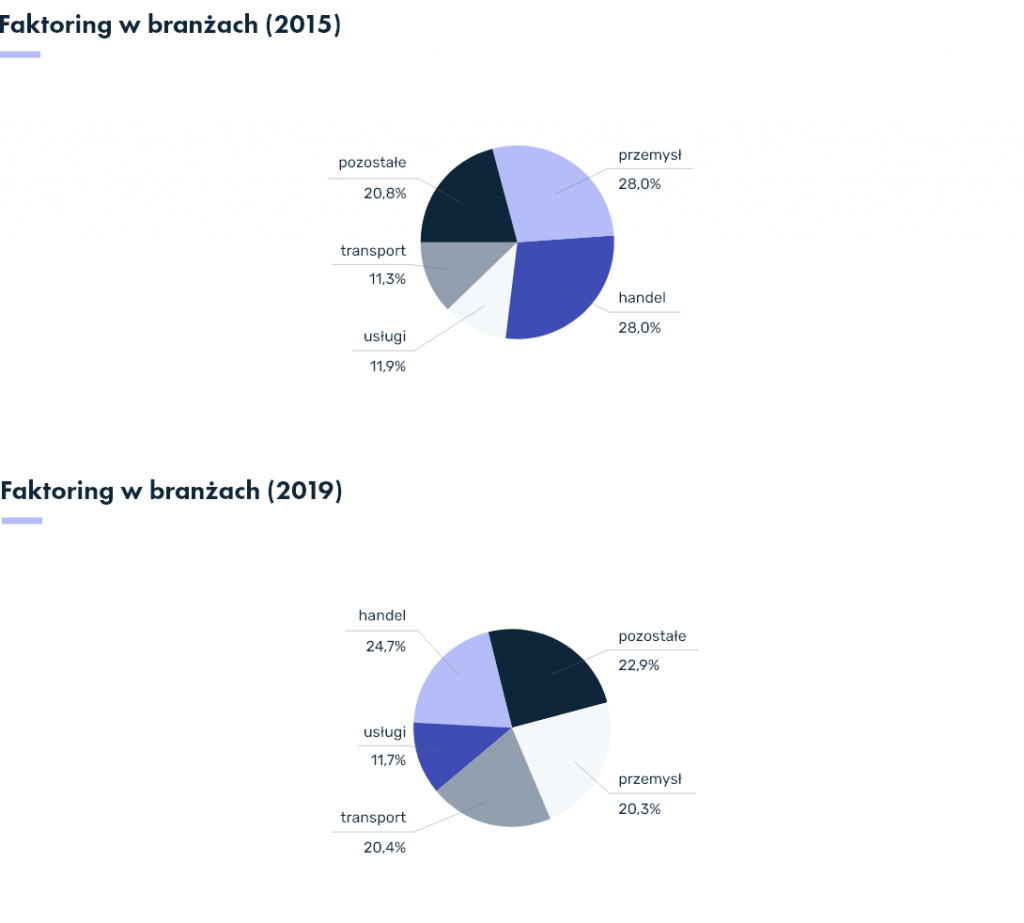

Interest in factoring in selected industries

It is no secret that factoring is used more frequently in some industries. There are many reasons for this: one of them may be the long payment terms of invoices, usually the result of a well-known and long-standing practice in the industry.

Another factor that may influence some areas of the market to turn more readily to factoring is the more frequent need to raise funds to perform a service that a company commits to by winning a tender – a pattern that construction companies, for example, are very familiar with.

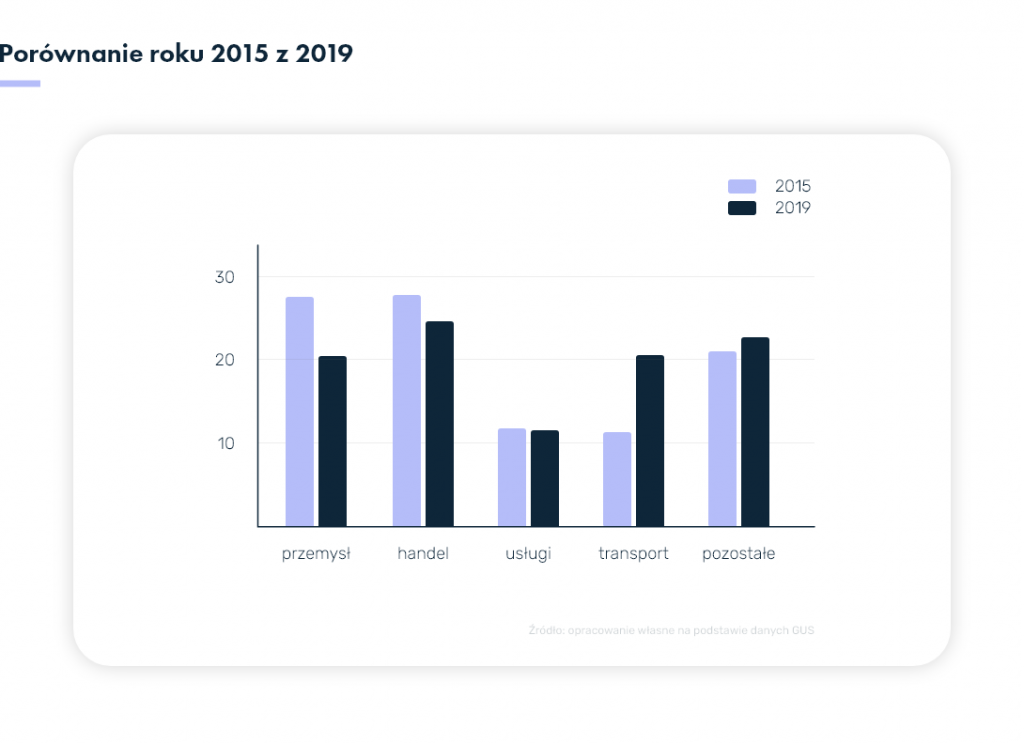

What types of businesses are most likely to use factoring? Let’s compare the situation in 2015 and 2019:

The above figures show that the biggest increase in interest in factoring has been in the transportation industry – in five years the share of factoring companies engaged in transportation has increased by more than 9 percent. The industrial sector declined the most (by 7.7 percent), while the situation in services remained largely unchanged (although there were some fluctuations along the way).

The condition of factoring in 2022

Although the coronavirus pandemic, which has been ongoing since March 2020, has significantly affected many sectors of the economy, there are some that have not experienced significant declines and have even seen their turnover increase.

Factoring in Poland is an increasingly popular source of financing that, in this unprecedented situation, has helped many entrepreneurs keep their jobs and continue to operate despite numerous difficulties.

Factoring, a form of short-term financing, is increasingly important for Polish companies.

PragmaGO, thanks to the introduction of innovative ways of providing online services, is part of an industry-wide growth trend, recording a continuous increase in the number of clients serviced (in Q2 2021, the increase was 171% year-on-year).

Lukasz Ramczewski, director of the factoring sales at PragmaGO

Maintaining the upward trend and even exceeding expectations – PragmaGO ended the second quarter of 2022 with 62% year-on-year growth – indicates that the factoring market is maintaining the stability so desired in recent months. Also significant is the company’s larger-than-ever customer base – in the first six months of 2022, the company financed 88,038 invoices for 8,010 customers.

The reason for this state of affairs should be seen not only in the mere fact that factoring is for many entrepreneurs a a valued source of financing (not only of invoices, but also of other business expenses), which can be relied on in times of crisis, but also in the wide range of products and the use of modern technology:

With the continuous development of factoring services and growing awareness among customers, factoring expectations are also on the rise. By combining technology with financial services and a wide range of products, PragmaGO can fully meet these expectations.

Lukasz Ramczewski, director of the factoring sales at PragmaGO

Even in spite of legal turmoil (such as changes to the allowed payment terms of invoices in January 2020) or economic turmoil (a significant drop in turnover in the service or trade industries due to the coronavirus), factoring in Poland is still thriving, thanks also to simple procedures and less restrictive requirements than in the case of obtaining a loan.

Recent months have confirmed that factoring services are a stable and often the most cost-effective financing instrument for companies operating in diverse market areas. And what will factoring look like in the near future?

The future of factoring in Poland

It is likely that it will not be until the middle of next year that we will know the next report on the factoring activity of financial companies, prepared by the Central Statistical Office (in previous years it was usually published at the end of June and the beginning of July), but the example of the situation at PragmaGO allows us to look to the future with optimism: Poles are still eager to use factoring and there is no indication that this state of affairs is about to change.

*Article prepared on the basis of data from the Central Statistical Office on factoring activities of financial companies in 2015-2021.