What is factoring? Learn about the factoring process

Before we get to the question of whether recourse or non-recourse factoring is more advantageous, let’s get to know their definitions and remind ourselves of exactly how the steps leading up to obtaining financing at PragmaGO work. Keep in mind that the process may look different at other factories.

Step 1: issue an invoice

When you make a sale of goods or services, you issue an invoice to your counterparty. With factoring, the key is the payment term that appears on it. This one can vary from 3 or 30 to – in extreme cases – even 120 days. The term depends on prevailing industry practice, regulations, but also on individual arrangements between you and your contractor.

Example:

Mr. Alfred sold goods to his contractor, Company X, for the amount of PLN 15,000. The customer had previously asked him to issue an invoice with a deferred payment date, to which the businessman agreed. The invoice thus shows a 60-day payment term.

Step 2: factoring application

You don’t want to wait for your customer to settle a payment. You may need the money for various reasons – in factoring it doesn’t matter. No one will ask you about the purpose of the financing. So you can approach the factoring company at this stage and submit a factoring application. You will include the details of your company, but also information about the counterparty or counterparties whose invoices you want to finance. The condition is that they are not due – that is, their due date cannot be exceeded.

Example:

Mr. Alfred needs funds faster than he thought. Lately, customers have been delaying payments more and more – several of them have already missed their due dates, and yet they still haven’t sent money. Mr. Alfred needs funds to settle his own obligations, so he submits an application on the PragmaGO website.

Step 3: choose the form of factoring and sign the agreement

After consulting with a customer advisor, it’s time to choose the right form of factoring and sign the contract. It is at this point that you will decide whether factoring with or without recourse is better for your company.

Example:

The entrepreneur signs a factoring agreement with PragmaGO, so he can receive an advance as soon as the counterparty confirms the assignment – even within hours.

Option A: Mr. Alfred opted for factoring with recourse.

Option B: Mr. Alfred chose non-recourse factoring.

Step 4: receive the funds

The factor, or factoring company, once the assignment is triggered, pays an advance – usually amounting to about 80-90% of the full invoice amount – to your company account. You receive the rest of the money when the debtor settles the obligation. With factoring, you get access to the funds right away. You can use them for any company purpose – for example, to pay off your own obligations, buy needed goods or invest.

Example:

Mr. Alfred quickly received the funds, which allowed him to settle his obligations and purchase goods for his store from the wholesaler. Under factoring, he was given access to a limit so that he can finance further invoices as needed. The entrepreneur pays only for the used portion of the limit.

Step 5: repayment term

Your counterparty’s due date is approaching. However, this one is dragging his feet on payment. It is at this point that the form of factoring chosen in the third step will be relevant. How will this situation resolve? Before we go into a full discussion, let’s learn the details by which recourse and non-recourse factoring differ.

How does recourse factoring (non-recourse factoring) work?

This form of financing is also called incomplete factoring or improper factoring. The cost of obtaining it is usually lower. This is because incomplete factoring leaves the risk of the debtor’s insolvency on the factor. In this scenario, the factor assumes the right to the claim, but this does not include the risk.

This means that in case the counterparty does not pay the invoice on time, the factor will be able to ask the factor to return the advance paid.

So when is it a good idea to use this type of factoring? When we are confident in the solvency of the counterparty, we work with them on a long-term contract basis, and we are anxious to receive the receivables as soon as possible. Partial factoring will also work well if you are sure that your counterparty is reliable, and even if he happens to be late with payment, a call for payment or a simple reminder will make him settle the debt quickly.

An important note is that even if you will have to return the amount received from the factor and take care of getting a refund from the counterparty yourself, it is worth considering this option for several reasons.

First: thanks to the faster payment from the factor, you will regain liquidity, and the payments that will flow from other customers in the meantime will stabilize the financial situation of your company.

Secondly: even when the repayment deadline by which the debtor has agreed to return the money has passed and your company has to give back the advance and seek to collect the receivables on its own, you will be given additional time to repay the advance received from the factor. By managing your finances wisely, such a situation will help you maintain high cash flow rates for your business.

Example:

If Mr. Alfred chose option A – factoring with recourse – he bears the risk of his counterparty’s insolvency. In a situation in which company X does not pay the factor on time, the latter has the right to ask Mr. Alfred to return the advance paid.

Mr. Alfred will receive an additional 14 days for repayment from the factor, so he can plan further steps with peace of mind – for example, use the previously granted factoring limit to raise further funds or issue a payment notice to the counterparty.

What is non-recourse factoring (full factoring)?

For full factoring, we will pay more to the factoring company primarily because it assumes the risk of the counterparty’s insolvency (total or up to a certain amount, depending on the provisions in the contract). With this development, the factoring process described above will look almost identical, but we will add another point at the end: the factoring company’s own collection of receivables.

Thanks to such an arrangement, a company that opts for non-recourse financing can, as soon as it receives payment from the factor, plan further moves with peace of mind and conduct business without worrying about the debtor’s possible financial troubles. The remaining amount will be received when the factor recovers the receivable.

When is it a good idea to use non-recourse factoring? First of all, in the case where your company is growing at a high rate, so that it establishes cooperation with many new entities and you do not know their financial situation. This is also a good solution if the financed invoice is for a high amount – in such an arrangement it is better to protect yourself in case the counterparty turns out to be unreliable.

Full factoring can also prove helpful if you want to improve your company’s balance sheet by getting rid of receivables, thus positively affecting your company’s financial rating.

Example:

If Mr. Alfred has previously chosen option B – full factoring – and the counterparty does not pay on time… nothing happens. In exchange for the higher cost of factoring, it is the factor that assumes responsibility for the risk of the recipient’s insolvency. Mr. Alfred will not incur any expenses for this, since it is the factoring company that will collect the receivable from the late contractor on its own.

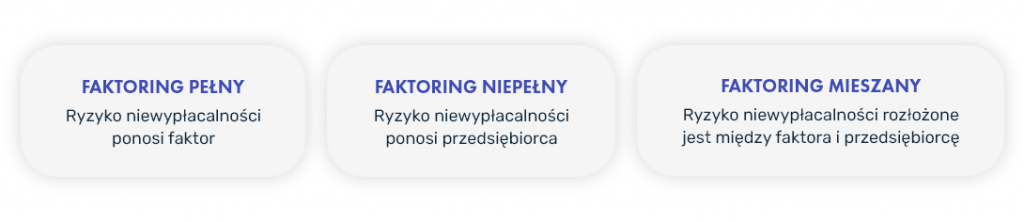

Mixed factoring

Mixed factoring is a type of factoring that combines elements of full factoring and partial factoring. In this case, the risk of insolvency is shared by both the factor and the factoring party – the terms and amount of liability for each party are established in the contract.

Cost of factoring with and without recourse

Partial factoring costs less because it generates fewer costs on the part of the factor. The factoring company in this option still pays the funds to your company, but in the event of the debtor’s insolvency, it will recover the funds from you. As a result, it will not incur collection costs and is not in danger of waiting weeks or even months for repayment.

Full factoring places greater demands on the factor – it should monitor the receivable more closely and make a thorough verification of the counterparty. The mere assumption of risk costs money, and in the event of insolvency, the factor bears the cost of recovering funds from the debtor. This all adds up to a higher cost for the factor, but in return it offers peace of mind in terms of resolving any problems with timely payment on the part of the recipient.

Important!

You don’t have to finance all your invoices with one type of factoring. Choose full factoring for high-value transactions where you are not sure about the reliability of the counterparty. You will pay more for them, but you will protect your company from unpleasant surprises.

However, if you are confident that the debtor will pay on time or the value of the invoice you are financing is not large, use part factoring, for which you will pay less.

Factoring at PragmaGO

Both recourse and non-recourse financing are services available from PragmaGO. If you’re not sure which form of online factoring will work best for your situation, schedule a phone call. Choose a convenient date and we will contact you to help you make the right decision.