When is a bank loan unaffordable?

The obstacles standing between a company and obtaining a bank loan can be many. Among them are an insufficient period of running the company (usually banks require a minimum of 12 months of activity), negative entries in the BIK or too low monthly income (the reason for which may be, for example, investments made) affecting the creditworthiness of the company.

Bank procedures for granting cash loans to companies are usually clear, but at the same time very restrictive. Even the apparent fulfillment of all the conditions does not guarantee that our company will receive a loan – the bank will pay attention to the current situation of the company, but will also scrutinize the mood of the industry, x-ray the company’s finances even up to several years back and meticulously check all the entries in BIK and BIG concerning the potential borrower.

Another reason why a bank loan may prove to be a bad solution for our company is the time it must take from the time we submit the appropriate applications until we receive the funds in our account. In many random situations, we will need the money not in a few weeks, but as soon as possible, in which case a bank loan is unlikely to help us.

Non-bank financing for companies

Among the most popular non-bank forms of financing is a wide range of loans – among them are investment loans, payday loans, bridging loans, technology loans or loans against collateral. We can not fail to mention the extremely popular instant loans – although their repayment period is usually very short (for example, up to 14 days), customers are attracted primarily by the ease and short time of obtaining such a loan. The scotch, however, is in the cost.

Currently, in the market for non-bank financial services, we have more choices than the above-mentioned non-bank loans or credits for companies – companies can finance their operations through factoring, for example.

Factoring is a generic term for a set of services offered by factoring companies and some banks. Among them you will find the possibility of selling invoices (buying back receivables), permanent factoring, and even a financing service for company purchases . What makes the latter stand out?

- Secure financing for purchases

Liquidity problems can affect any company, and while they are usually temporary difficulties, finding a quick and safe solution is by no means easy. Although the conditions for using factoring are much less restrictive than for bank loans, it is a safe solution, as evidenced by the growing popularity of this sector of financial services in Poland.

- Clear financing terms

PragmaGO’s purchase financing service features clear terms and conditions – a simple purchase financing calculator is available on the service’s website to estimate repayment costs depending on the amount of company purchases and the number of installments.

The final cost of the service depends on the financial condition of the company and the financing period.

Additional information to keep in mind:

- the cost invoice should be reported by the due/payment date;

- the criterion of the period of operation does not apply – even new companies can take advantage of the purchase financing service;

- you can repay the amount due in 1, 3, 6, 9, 12, 18 or even 24 installments;

- after receiving a positive financing decision, the factor will pay for the company’s order by express transfer;

- the maximum limit for company purchases is 100,000 zlotys.

When is financing company purchases a good idea?

It is not always the case that the desire to use purchase financing is a signal that a company is not doing well in the market – many times we encounter situations in which a company that decides on a non-bank loan is just waiting to be repaid by several of its contractors. At such a time, purchase financing is a good idea for a quick boost to the budget, especially if a bargain for needed products is on the horizon, or if an immediate repair or replacement of essential equipment is needed. In some industries, long invoice payment terms are normal practice (for example, in construction or logistics) – which is why non-bank loans for companies are quite popular.

How to take advantage of purchase financing?

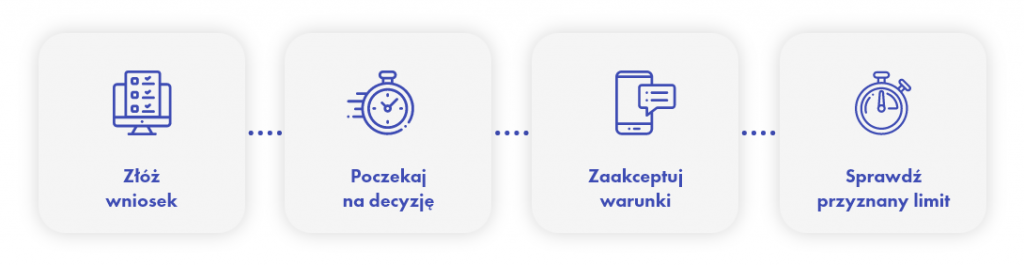

One of the most important factors for customers when financing business purchases is time – PragmaGO makes an effort to reduce the required formalities to the necessary minimum – so cost invoices can be financed quickly and safely in a few simple steps, and everything is done online.

- Submit your application – prepare a file with your invoice, order confirmation or pro forma, your company’s TIN and contact information, as well as transfer details for the contractor. Then use the online form.

- Wait for a decision – the moment you receive approval for financing purchases, you will receive the relevant information, and the contractor will immediately receive the money sent by express transfer.

- Accept the terms and conditions – you will receive your customer account information to your email address. Log on to it to review the financial terms and agreement. You can accept the arrangements instantly via SMS.

- Check the allocated limit – from the moment you receive a limit for business purchases in your customer account, you can use the allocated amount to finance expense invoices. You can pay off installments up to 10. day of each month.

That’s it! The process of obtaining financing is fast, convenient, and secure. Take advantage of purchase financing and get your business back on track!