VAT white list

Although contractor verification is the responsibility of the VAT taxpayer, the Ministry of Finance has been obliged to create conditions for entrepreneurs to check on their own. To this end, on September 1, 2019, the so-called “new” system was launched. VAT white list. This is an online list of VAT-registered, unregistered and deleted and reinstated businesses.

The register is updated once a day, on business days.

How to search for a VAT taxpayer?

To verify a contractor, simply visit the Tax Portal website – www.podatki.gov.pl. The VAT white list can be found at this address .

The next step is to enter the account number, VAT number, REGON number or the name of the entity you are looking for into the search engine. If necessary, we can also search for data current as of another date (for example, if we are checking a contractor with whom we entered into a contract a month ago, it is worth checking his status in the search engine as of the invoice date).

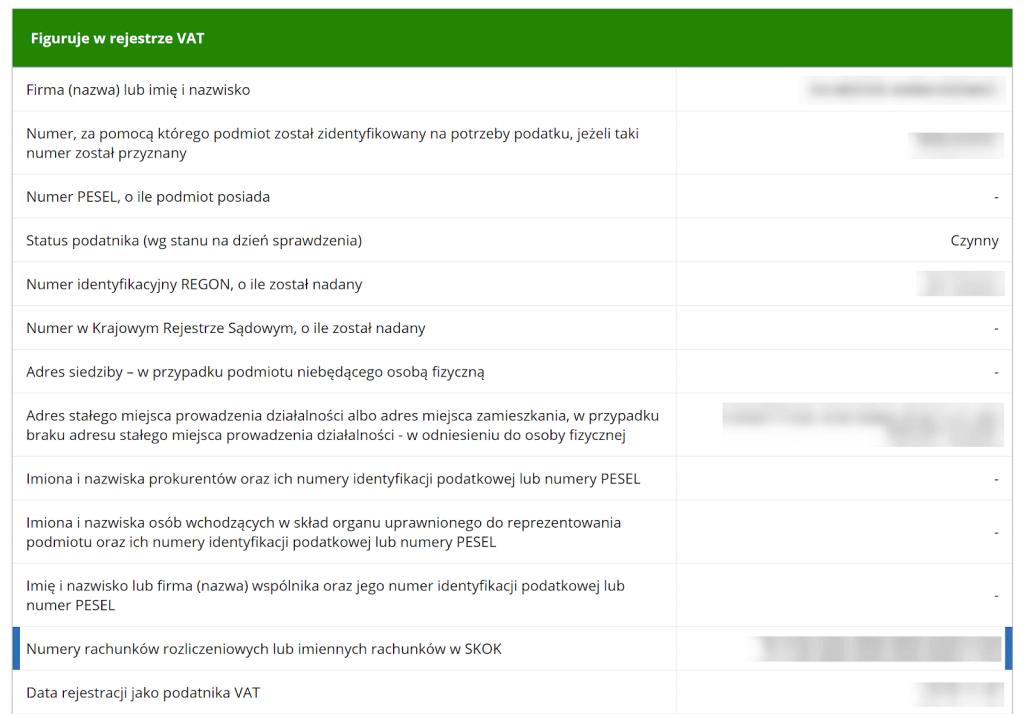

A positive search result should look like this ↓

This will not only give us information that the counterparty is in fact an active VAT taxpayer, but also allow us to verify all the basic data of the entity.

The negative search result should look like this ↓.

Important!

If, despite entering the correct contractor data, the list of VAT-registered entities returns a negative result, print the screen with the result and keep it for evidence purposes. It will then be necessary to contact the local tax office to obtain confirmation of our contractor’s status as an active or exempt VAT payer.

It is worth mentioning that entrepreneurs were until recently required to include the Tax Identification Number on invoices, but Art. 96 par. 11 of the VAT Law, which enforced this solution, has been repealed. The Tax Portal’s search engine is therefore one of two ways to determine whether a contractor with whom you do business is a registered VAT payer.

Application to the tax office

The second way mentioned is to contact the local tax office. Currently, this solution is not used very often – in the vast majority of cases, the data obtained through the VAT white list is completely sufficient. However, if you want more detailed information or just want to be sure, you can apply for a VAT taxpayer status certificate.

In the application we should include:

- our data, i.e. the data of the entity requesting the certificate (TIN, name and address);

- data of the entity about which we want to obtain information (TIN, name and address);

- the name of the confirmation we want to obtain – in the present case it will be the status of an active VAT taxpayer.

For obvious reasons, this route will be much longer and more cumbersome, and it is also possible that at the office we will hear about the possibility of using the search engine on the Tax Portal website, so let’s treat submitting an application to the Tax Office only as a fallback option.

Important!

In the situation described earlier (a negative result of “not listed in the VAT register”), submitting a request to the tax office to confirm the data obtained is a necessary step to resolve the matter (and allows the expenses to be included in deductible expenses). In this way, the entrepreneur also fulfills the duty of due diligence.

Checking the contractor’s TIN

In some situations it may also be necessary to verify the Tax Identification Number of one of our contractors. Fortunately, this possibility has also been provided for in the Tax Portal, making a trivially simple tool available to all interested parties – the following. Checking the status of the TIN .

The entire operation of this search engine comes down to entering the contractor’s TIN number – the response will tell us whether the number entered is correct or does not exist. To be sure, we can confirm the acquired data in the search engine of the Central Register and Information on Economic Activity. Just enter the same number to get all the basic contact information of the contractor. The CEIDG search engine is available at this address .

VAT verification of a foreign contractor

In theory, checking a foreign contractor is done the same way as for domestic companies. We enter his VAT number and check whether he is on the white list of taxpayers.

However, there are situations outside of this pattern – for example, when a company with which you do business has registered in Poland for VAT purposes, but in this particular transaction issued an invoice with a different TIN number. In the example given, the buyer can pay the invoice by sending the funds to an account that is not listed as a VAT payer – he will not then lose the right to include the transaction as a business expense.

Those entrepreneurs who trade with foreign companies with EU VAT can also sleep well – we can verify this number in the search engine on the European Commission’s website.

Payment to a foreign bank account

What is most questionable is the possibility of making payments to a foreign bank account number. When buying from a seller from another country, it is incumbent on us to verify the counterparty.

If the vendor has given us a foreign VAT number, and at the same time is an active VAT taxpayer registered in Poland, we are not entitled to include this transaction in our business expenses. At the same time, there is a risk of unknowingly recognizing that we can exercise this right based on verification of the VAT number on the white list and the EU VAT list. How, then, to protect yourself from an unpleasant mistake?

Let’s start by saying that, just to be sure, we should file a notice of payment to an unknown account ZAW-NR with the tax office having jurisdiction over the seller. More details and a downloadable printout can be found on the Tax Portal website . Remember that the time to send the completed ZAW-NR form is 3 days after payment of the invoice. Due to the COVID-19 pandemic, this time was extended to 14 days, but it is expected that sooner or later the situation will return to the status quo.

However, we can, in the case in question, try on our own to verify. At first, we can ignore the contractor’s VAT number – if it’s foreign, we won’t find it in the VAT whitelist anyway. The same will be true of the bank account number. Instead, we can try our luck with the name of the entity – however, a problem will arise if the search results show us several companies with a similar name. If this is the case, it is worth revisiting the idea of sending a ZAW-NR notice.

Important!

“Unnecessary” sending of a ZAW-NR notice (that is, when our foreign counterparty is not a VAT taxpayer registered in Poland) does not cause any consequences. The tax office is likely to ignore the document, or provide information that such a taxpayer is not registered in the US database.