When is a financial assessment made?

The company’s finances are screened every time it tries to take out a loan for the company or obtain financing from another source (such as investors). In such a situation, it happens automatically, but this is not the only time to order a financial analysis.

Many companies are taking advantage of the opportunities provided by the company’s financial health assessment and are choosing to use it themselves to get detailed information about their finances and better prepare their development strategy.

This analysis involves checking the financial situation of the company for which it was commissioned, usually to verify the solvency of the company and to assess the credit risk taken by the financing institution.

Letters containing relevant information must be prepared so that an assessment can be made. Depending on the legal form of the company , it may be about incorporation documents, balance sheet, income statement and P&L.

It is worth remembering, however, that such a set of information may turn out to be incomplete – after all, many companies depreciate equipment, account for costs and make provisions, so that initially their financial condition may look worse than it really is. The full picture will give us cash flow statement .

This will tell us, among other things, which elements of the business generate the most resources and which consume them. We will also learn about the company’s ability to finance core activities, and discover how much cash the company has spent on development and new investments (and what sources of financing it has used in these processes).

Methods of measuring and evaluating the financial health of a company

Of the accepted and widely used methods of assessing financial health, the most widely used is the ratio-based assessment of a company’s financial health. This is not the only method available, but we will start with it.

Indicator analysis

This is the most popular and considered by many to be the most important element in evaluating a company’s finances. Four indicators are taken into account in this case: profitability, liquidity, turnover and debt. They reflect the company’s financial situation and allow it to be clearly assessed.

Profitability analysis

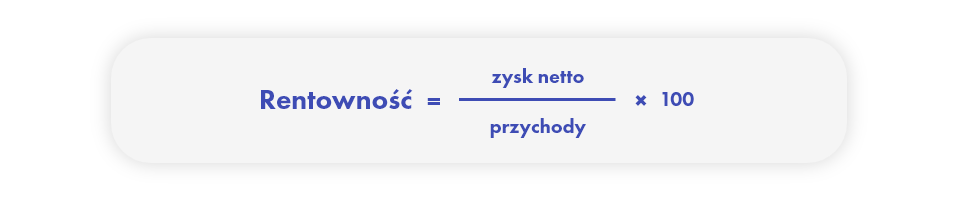

With a simple calculation, we get information on the ratio of profit to revenue. This allows you to assess how effective your company’s sales efforts are. This is expressed by the following equation:

The result of the profitability analysis makes it possible to assess whether the company sufficiently manages the resources involved in its operations.

Liquidity analysis

Liquidity is also an important criterion for a company’s financial health. This feature characterizes companies where there is no threat of insolvency. These companies cover their current obligations, regularly pay salaries to employees and have no delays in repayments.

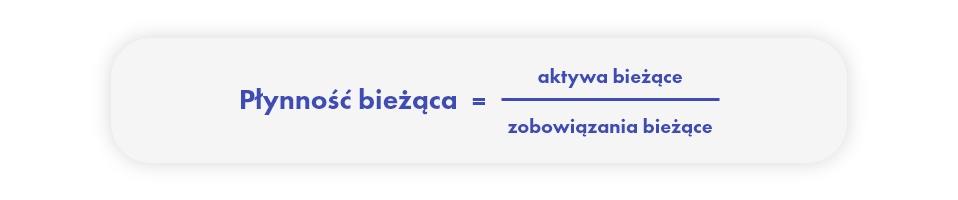

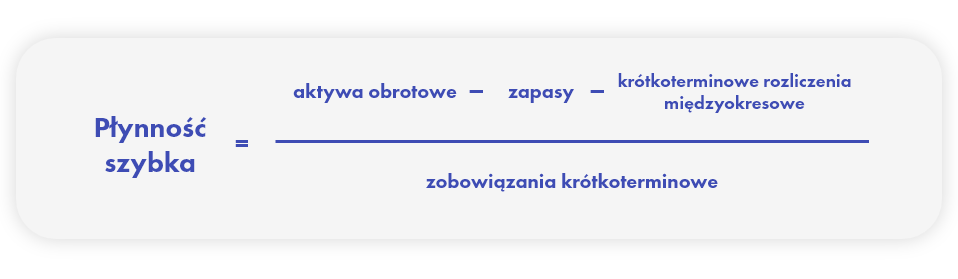

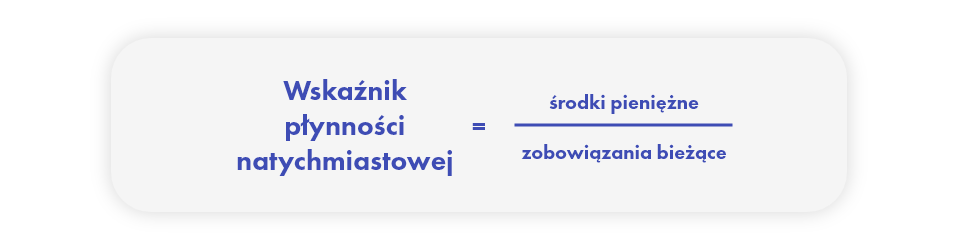

The liquidity analysis verifies whether the company can pay its current obligations (current ratio), whether it can handle its receivables if it does not include accumulated inventory (quick ratio), and finally whether the accumulated cash alone would be enough to pay current obligations (immediate ratio).

Read more about liquidity in the article: Company liquidity without secrets

Turnover analysis

It examines a company’s turnover (a.k.a. operating efficiency or activity) to see how efficiently it generates revenue and how skillfully it manages assets.

Criteria for assessing a company’s financial health, which allow a reliable analysis of the company’s efficiency, include:

- payables repayment period ratio in days;

- turnover rate of total assets;

- inventory turnover ratio;

- Inventory turnover ratio in days;

- accounts receivable turnover ratio;

- accounts receivable turnover ratio in days;

- cash conversion cycle ratio.

Debt analysis

The analyst, who evaluates the company’s debt, looks at how smoothly the company’s short- and long-term liabilities are handled. It is worth mentioning here that debt is not always something unequivocally bad for a company – carefully controlled it allows companies to apply leverage. However, beware of high debt, which increases the credit risk of the business.

Debt ratios are also used to reliably assess the structure of the company’s debt, and at the same time get information on what are the sources of financing of the company.

The most important indicators in debt analysis are:

- overall debt ratio;

- debt-to-equity ratio;

- long-term debt ratio;

- ratio of share of long-term liabilities;

- debt service coverage ratio;

- Interest coverage ratio.

Additional measures for assessing the health of the company

Ordinary indicator analysis – although it provides a lot of useful information – can still be enriched by other methods. One of them, used when alarming results are observed in the ratio analysis, is the bankruptcy risk assessment.

Assessing the risk of company bankruptcy

This type of analysis uses the indicators discussed earlier, but also takes into account statistics specific to the industry, type and size of the company.

In assessing bankruptcy risk, the discriminant method is used in various models, for example, Gajka and Stos, Altman and Holda.

The financial situation of the company is already known – what’s next?

Depending on the reason for which the company’s financial health assessment was ordered, the results will be different. Let’s divide this summary into two parts.

Evaluate company finances before taking out a loan

A positive result of the analysis of the company’s finances means that not only is the company liquid, but it is also very likely to retain this liquidity for a longer period of time, which will allow it to repay the obligation without hindrance. Such an assessment means that a loan (or other form of financing) is likely to be granted.

In a situation where the “note” issued is too low, the company will not receive credit. This is, of course, an undesirable situation, so in order to avoid it and prepare for the credit process, it is a good idea to use the Entrepreneur’s BIK and pre-verify your company’s creditworthiness beforehand.

Assessment of the financial health of the company for strategic purposes

In this case, we will treat the results slightly differently from the previous one. If the analysis shows that the company’s financial condition is not satisfactory, this will be a clear signal that far-reaching changes are needed to get the company back on track.

Liquidity, wise investments and steady growth – a company that can boast these three qualities should have no trouble getting a positive financial health rating. However, there are no companies where there is nothing to improve. A detailed analysis is able to identify such elements even for extremely successful companies… and this can only help them.