A way to double taxation

Poles who work abroad are, in a sense, at a crossroads between the tax laws of the country where they earn and those of their place of residence. For many years, Poland has provided a very favorable method of avoiding double taxation for those in this situation.

Example:

Ms. Hanna spends most of the year in Poland, but during the winter she works in an Alpine ski resort. Earning in Austria, she would have to pay income tax twice – once in the place where the income was generated, and a second time in Poland. This would be the case if it were not for the existence of the abolition relief.

However, the situation has changed over time, as Poland signed the MLI Convention in 2019, committing to change to a method of accounting less favorable to taxpayers. In return, the Finance Ministry promised Poles working abroad that the abolition relief in effect since 2008 would in practice avoid the negative effects of ratifying the convention.

Before we go further, let’s answer three questions:

- What are the methods of avoiding double taxation?

- What is abatement relief?

- Who can benefit from it?

Methods of avoiding double taxation

Double taxation is an undesirable situation in which a taxpayer must pay income tax on one income twice. This applies, among others, to those with a residential address in Poland, while performing work abroad. The Republic of Poland has signed agreements with a number of countries that were intended to help avoid double taxation. Depending on which country the Polish resident works in, one of two methods is used:

- method of exclusion with progression;

- proportional deduction method.

Important!

If no agreement has been signed between Poland and the country where the taxpayer performs work, the latter method is used.

Method of exclusion with progression

Under this method, one country (which is party to the relevant treaty) gives up its tax claim on income earned by the taxpayer in the other country.

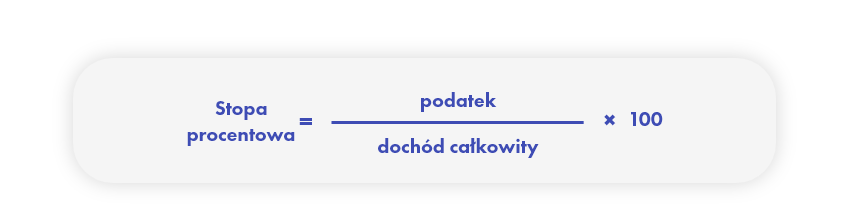

The taxpayer must add up the income earned at home and abroad, which gives him the amount of total income. It then calculates tax on the total according to the tax scale. The next step is to calculate the interest rate. For this purpose, the formula is used:

The result applies only to income earned in Poland and indicates the amount of income tax to be paid.

EXAMPLE

Mr. Jędrzej, who works in France, earns an income of PLN 60,000 there, while in Poland he earns an income of PLN 12,000. 12% of the PLN 72,000 amount is PLN 8,640. Mr. Jedrzej must now deduct the tax-reducing amount – PLN 3,600. It receives the result of 5,040 zloty. The interest rate (according to the formula above) is 7% in this case. The last step to take is to multiply the amount of income earned in Poland by the interest rate – the amount of tax to be paid is PLN 840.

Proportionate deduction method

Under this method, all income (not just that earned in Poland) is taxed, but the amount of tax already paid abroad can be deducted. However, there is a limit up to which income can be deducted.

EXAMPLE

What if Mr. Jedrzej had earned the same income in the Netherlands instead of in France? To begin with, he should combine the income earned and calculate income tax from it. Let’s use a simple calculation: (72,000 * 12%) – 3,600 = PLN 5,040. The resulting amount is multiplied times the ratio of income earned abroad to total income: 11,714.88 * (60,000 / 72,000) = PLN 4,200.

This is the amount the taxpayer could deduct. Mr. Jedrzej’s Dutch employer withheld advance income tax in the amount of PLN 3,500. Since the taxpayer has paid an amount abroad that is less than the limit just calculated, he can only deduct the amount up to the amount of tax paid. The final amount of tax to be paid is therefore 4,200 – 3,500 = PLN 700.

It is worth remembering that the application of the proportional deduction method requires the taxpayer to file an additional document – this is the annual return filed to show foreign income. This document must be prepared even if the taxpayer did not generate income in Poland during the period in question.

Abolition relief – what is it?

Important!

The main function of the abatement allowance is to equalize the amount of taxes payable regardless of whether the employee earns income in a country where the exclusion method or the proportional deduction method is applied.

The abolition relief applies to those who work in a country with which Poland has signed an agreement assuming the use of the proportional deduction method – but this is not the only condition. The relief is available to taxpayers who earn income abroad from specific sources, as indicated in the PIT Law (Articles 12(1), 13 and 14), as well as from copyright and related property rights.

Until 2021, the abatement relief could be applied regardless of income. However, this state of affairs has undergone many changes.

Who can benefit from the abatement relief?

The abolition relief was provided for Polish tax residents, i.e. people who live permanently in Poland and pay taxes here. A taxpayer taking advantage of the abolition relief must:

- Be subject to unlimited tax liability in Poland,

- use the tax scale, flat tax or registered lump sum,

- Generate income abroad originating:

- From a business relationship, employment relationship, contract work or cooperative employment relationship,

- From personally performed activities,

- From business activities or

- from property rights in the field of copyright and related rights within the meaning of separate regulations, with the exception of income derived from the use or disposal of such rights.

Important!

The abatement relief does not apply to income earned in tax havens.

Abolition relief – changes

In September 2020, the Finance Ministry announced another amendment to the PIT Law. The effect of the change, which was passed in the Sejm a month ago, will include. Establishing a limit on the amount of deductions under the abatement relief. What will change in reality? Who will lose out on this and how much?

The amendment provided for in the draft sets the amount of the limit identical to the tax-reducing amount on income not exceeding PLN 8,000. In practice, this means that the taxpayer will be able to deduct a maximum of PLN 1,360. For details, see the PIT Law (Article 27, paragraph 1a, item 1).

A controversial fact is that the abolition relief was eliminated by the Finance Ministry with virtually no warning. The ministry chose to give the following reason:

The abolition relief provides an incentive to undertake economic activity outside the territory of the Republic of Poland, which is often the first stage of the process of permanent relocation of residence abroad […] The new approach requires the gradual elimination of solutions that favor relocation […] outside the country (such as the abolition relief) and the simultaneous creation of mechanisms that encourage people to stay in the country.

Not surprisingly, as of 2021, the abolition relief is said to have virtually ceased to exist. Polish residents who work abroad in countries where the amount of tax is calculated using the proportional deduction method primarily lost out on the changes: among others. In Belgium, Denmark, the Netherlands, Iceland or the United States.

Important!

The abolition of the abolition relief does not apply to those who reside abroad permanently and have a center of interest there (such as family).

Limit for abatement relief – exceptions

Wspomniany już limit – 1 360 zł – nie obowiązuje jednak wszystkich beneficjentów ulgi abolicyjnej. Art. This is because 26g paragraph 5 of the PIT Law indicates exceptions – situations in which a taxpayer can deduct the full amount of the relief without applying a limit.

We can find these exceptions in Art. 12 paragraph. 1 and Article 13(8)(a) and (9) of the same law. We cite them below:

- income from a business relationship, employment relationship, contract work and cooperative employment relationship (Article 12(1) of the PIT Law),

- income from the provision of services under a contract of mandate or contract for specific work, obtained exclusively from a sole proprietorship, a legal person and its organizational unit and an organizational unit without legal personality (Article 13(8)(a) of the updof),

- income earned on the basis of business management contracts, management contracts or contracts of a similar nature, including income from such contracts concluded as part of the taxpayer’s non-agricultural business activity (Article 13, item 9) – with the exception of income referred to in item 7 (income received by persons who are members of management boards, supervisory boards, committees or other governing bodies of legal entities).

Important!

All of the discussed exceptions can be applied only if the said income is earned by the taxpayer from work or services performed outside the territory of the landed countries. Thus, this applies primarily to those working on board aircraft and ships – stewardesses, pilots, sailors, but also to workers stationed on oil rigs.

Summary

The abolition relief in its old form has not existed for many years – as of 2021 there is a deduction limit of PLN 1,360 per year, and there is no indication that this situation will change.

The state’s message on the matter is clear: the legislature has no intention of making it easier for Polish taxpayers to leave the country permanently – which is how the desire to take advantage of the relief before 2021 was interpreted.

Today, only a few taxpayers – those working outside the countries’ mainland territories – can take full advantage of this tax preference.