What is liquidity?

To make sure we have a good understanding of the issue, we need to start with the basics – in this case, a definition. Liquidity is a company’s ability to pay current obligations, cover debts, pay off receivables and procure products and services necessary for daily operations.

In other words: a liquid company is able to pay its employees on time, buy the right equipment and supplies (for example, components for making the goods it later sells), and pay its dues for goods and services on time.

It seems that maintaining liquidity is not at all difficult, but the long payment period of invoices often stands in the way. The usual practice in many industries is to issue sales documents with payment terms of 30, 60, 90 days and even longer! Thus, a situation may arise in which, despite the successful completion of a major transaction and all the formalities associated with it, the company still has no money in its account. This risks losing liquidity, after all, taxes have to be paid anyway, salaries for employees can’t wait either, and there is still the question of necessary purchases.

In order to prepare for all eventualities, it is necessary to realize that liquidity is one of the elements of evaluating a company, and consequently, there are indicators associated with it that will enable us to independently assess liquidity and take preventive measures.

How to calculate the liquidity of a company?

In order to accurately assess a company’s ability to pay its debts, it is important to know what actually defines liquidity:

- Cash balance.

- The ability to transform assets and their components into money.

- The ability to cover the company’s liabilities with money.

Liquidity analysis can be carried out in static or dynamic terms. The first takes into account the financial data shown in the balance sheet and income statement, or on the basis of ratios in effect on a particular date. The second takes into account data from cash flows taking place over a given time period.

Liquidity ratios

There are three basic criteria to determine the liquidity of a company:

- current liquidity;

- fast fluidity;

- instant liquidity.

The calculation used in calculating liquidity is based on current assets, that is, funds that are, so to speak, “in reserve” financially for the company. This is not only the money in the company’s bank account, but also accounts receivable and short-term investments, that is, money that can be converted into cash relatively quickly. If necessary, this money can be used to pay off current obligations.

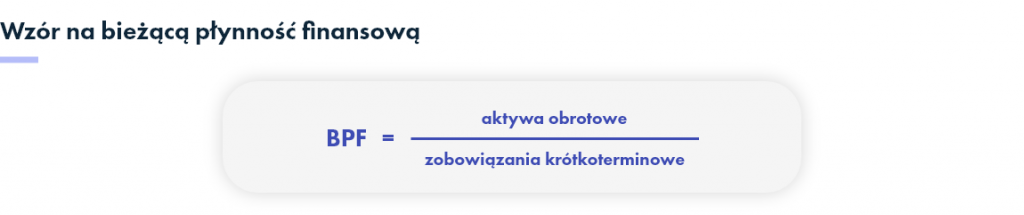

Current liquidity

An analysis of a company’s liquidity usually begins by determining the degree of current liquidity. This will give the person or entity conducting the analysis an idea of the company’s ability to meet its current obligations.

The higher the ratio, the better. The optimal recommended value of current liquidity for most companies is a range of 1.5-2.0. However, this is not the end of this part of the analysis.

To get a meaningful result, these values are compared with other companies operating in the country in the same industry. It is also worth comparing the current result with that achieved in the previous accounting period.

A current ratio of less than 1.0 is a clear signal that care should be taken to pay liabilities.

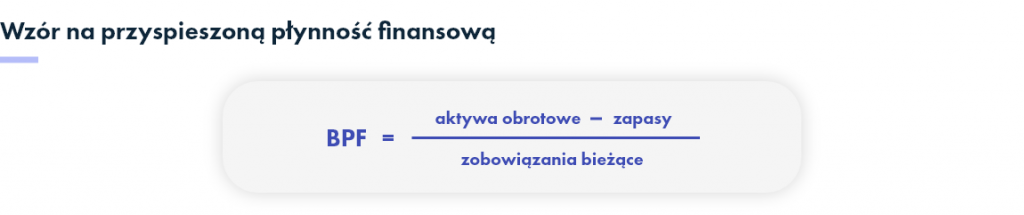

Accelerated liquidity

This ratio is used to determine the ability to cover liabilities with only assets with a higher degree of liquidity, namely investments and short-term receivables. We calculate accelerated liquidity in almost the same way as current liquidity. The difference is that accumulated inventory and goods in production are excluded from the calculation.

The result should be greater than or equal to 1.0. In simple terms, this means that the company is able to cover all current liabilities without having to liquidate physical assets. A PPF value of less than 1.0 means that liquidity has been lost.

It is worth knowing that the juxtaposition: high current liquidity – low accelerated liquidity is an undesirable situation, as it indicates the company’s outstanding inventory. This usually generates additional unwanted costs (such as storage of goods).

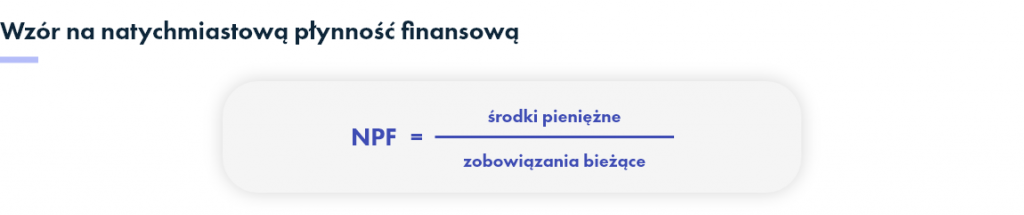

Immediate liquidity ratio

The last of the company’s liquidity indicators determines the company’s ability to settle its current obligations with only its cash on hand.

The value of the last indicator should be approx. 0.1-0.2. Even a lack of funds in a company account is not necessarily a cause for concern. As long as the accelerated and current liquidity ratios are high, and the collection of receivables is operating smoothly, there should be no negative consequences of this.

Lack of liquidity in the company – what to do?

It can happen that even despite the best intentions, a receptive market and wise management of the company, the enterprise loses liquidity. An unfavorable economic situation, dishonesty of contractors avoiding payment of debts, as well as completely unforeseen circumstances, such as a natural disaster or epidemic, can lead to this.

If the company has been doing well in the market so far, and temporary difficulties surprised us at an inopportune moment or were completely unpredictable, there is no point in folding arms. There are several ways to overcome the loss of business liquidity.

Ways to regain liquidity

Companies that are on the brink of bankruptcy most often turn to credit. But that’s not the only option available. Moreover, there are times when no bank will give our company a loan, yet we still have a good chance to get the business back on its feet.

- Credit – we can pay off the piled-up liabilities by obtaining funds from the bank. We can opt for a special company loan, or standard investment or working capital loans. However, each of them will require adequate creditworthiness. What in case we don’t have it?

- Acquisition of advances – it happens that our contractors did not plan to default on payments at all, but are themselves facing financial problems. In such a situation, we may ask for down payments to at least somewhat cover current obligations. However, one has to reckon with the fact that advances are not enough for everything.

- Factoring – this increasingly popular service on the Polish market is an interesting alternative to loans. By using factoring, you are not borrowing money, and therefore you are not increasing your debt. Instead, we sell to a factoring company the invoices that our contractors are late in paying. In return, the factor charges a commission, but our company receives the funds immediately. We also don’t have to worry about creditworthiness as much as we do when applying for a loan. Factoring institutions are less interested in the finances of our company, the solvency of our debtors is more important to them. In practice, this means that entering into a factoring agreement may be more advantageous than going into debt with a bank, and is certainly more readily available.

Loss of liquidity is not a judgment, but perhaps only a temporary difficulty. Take advantage of factoring at PragmaGO!