What are fixed assets?

Let’s start with the basics, because without understanding the nature of fixed assets, it will be difficult to make correct depreciation deductions. To know the exact definition of fixed assets, it is necessary to refer to the Personal Income Tax Law. Article 22a (1) of the same law states:

Depreciation is subject, subject to Art. 22c, owned or jointly owned by the taxpayer, purchased or manufactured on its own, complete and fit for use on the date of acceptance for use:

- structures, buildings and premises under separate ownership;

- machinery, equipment and means of transportation;

- other items;

– with an expected period of use of more than one year, used by the taxpayer for the purposes related to his business activity or given for use on the basis of a contract of lease, rental or a contract specified in Article. 23a(1), referred to as fixed assets.

TIN, or Classification of Fixed Assets

As of 2018, the updated classification of fixed assets into groups and subgroups – Fixed Asset Classification 2016 – is in effect. This division replaced the 2010 NACE, which had been in effect until then. At a basic level, fixed assets are divided into:

| Group 0 | Processing period |

| Group 1 | Buildings and premises, as well as cooperative right to commercial premises and cooperative ownership right to residential premises |

| Group 2 | Civil engineering facilities |

| Group 3 | Boilers and power machinery |

| Group 4 | Machinery, equipment and apparatus of general use |

| Group 5 | Machinery, equipment and apparatus of specialized use |

| Group 6 | Technical devices |

| Group 7 | Means of transport |

| Group 8 | Tools, instruments, movables and equipment, not elsewhere classified |

| Group 9 | Livestock |

Further, fixed assets are divided into subgroups and types, which makes it possible to precisely designate which elements of company assets constitute depreciable fixed assets.

What is depreciation of fixed assets?

Depreciation of fixed assets is the process of reducing the value of things as a result of their use. Making depreciation deductions reduces the value of things and reflects their real value.

Depreciation is applied only to fixed assets indicated in the Fixed Asset Classification.

Moreover, entrepreneurs make depreciation deductions based on the planned distribution of the depreciable item’s value over a given period.

Depreciation costs of fixed assets

An important feature of depreciation of fixed assets is that depreciation deductions are tax deductible, and therefore affect the amount of income tax to be paid for a given period.

In other words, if an entrepreneur accounts for the depreciation expense of fixed assets, he will pay less income tax.

Important!

You can start depreciating a fixed asset no earlier than one month after it is entered in the company’s asset register. Depreciation ends in three cases:

- When the value of depreciation reaches the initial value of the item;

- When the company is sold;

- When the company is liquidated.

Fixed asset depreciation methods – which one to choose?

In tax practice, there are three methods of depreciating fixed assets. Each of them is characterized by slightly different assumptions, and on top of that, some of them can be applied only to certain groups of fixed assets (according to the classification of the TIN).

Linear method

The first depreciation technique discussed is also the most popular – the straight-line method. The basis for the calculation is the assumption that the wear and tear of things will occur evenly.

To depreciate a fixed asset using the straight-line method, a fixed depreciation allowance rate must be established.

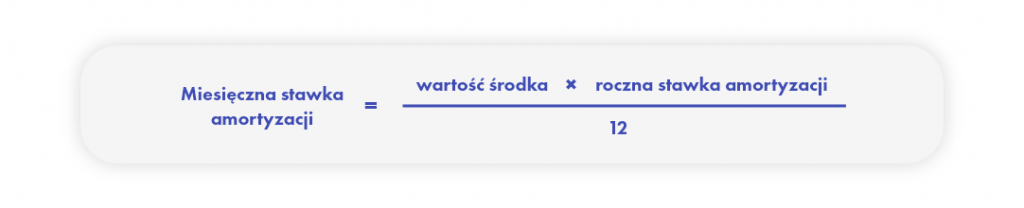

The rate depends on the group to which the fixed asset belongs (according to the Classification of Fixed Assets), and the way to determine it is determined by a simple formula:

The annual depreciation rate can be found in Appendix 1 of the Personal Income Tax Law and the Corporate Income Tax Law and is different for each group of fixed assets.

Important!

Two methods that are derivatives of the linear method are also available: we are talking about the individual linear method and the accelerated linear method.

Individual linear method

If the fixed asset is entered into the company’s records for the first time and is used and improved on a permanent basis, the entrepreneur can set an individual depreciation rate. In this case, it must also set a minimum depreciation period (from 24 to 60 months, depending on the initial value of fixed assets, and 30 months if the thing is a means of transportation).

Accelerated linear method

If the fixed asset is used in a special way, the entrepreneur may apply a higher rate of depreciation according to the list:

- if the thing is a building or structure and is used in deteriorated conditions, a factor of 1.2 shall be applied;

- if the thing is a building or structure and is used in poor conditions – a factor of 1.4;

- if the thing is a machine, equipment or means of transport belonging to the group requiring special technical efficiency – 1.4;

- if the thing is a machine or device subject to technical progress – 2.0.

One-time method

If the fixed asset belongs to any of Groups 3-8 of the Classification of Fixed Assets (excluding passenger cars), one-time fixed asset depreciation may be applied to it.

Thus, if an entrepreneur purchased an energy boiler with an initial value of 35,000 zlotys, he can depreciate the purchase in full, since the value of the item does not exceed 50,000 euros, the limit for annual depreciation.

The amount restriction is not the only one that applies to entrepreneurs who want to use the one-time depreciation method for fixed assets.

Only new companies in their first year of operation and small taxpayers (already without a time limit) can use this method.

If the initial value of the fixed assets exceeded the one-time depreciation limit for the year, the entrepreneur can depreciate the purchase up to the limit amount, after which he switches to the straight-line method, accounting for the purchase as standard in subsequent years.

Degressive method

This technique applies only to fixed assets belonging to groups: 3, 4, 5, 6, 8 of the NIT, as well as means of transportation (except passenger cars). To take advantage of this method, the entrepreneur adopts the highest rate to reduce it as the asset is used.

The declining balance method can be used until depreciation charges reach a lower value than they would have if the straight-line method were used. Then you switch to the straight-line method with the beginning of the next fiscal year.

Depreciation period of fixed assets

The depreciation period for fixed assets is not uniform – it depends on the type of asset (for example, for used cars the depreciation period is 30 months, for new cars it is 60 months, while we can depreciate a laptop purchased for a company for 40 months).

We can also determine the depreciation period of fixed assets by scheduling the wear and tear of the subject of depreciation, that is, by spreading the initial value of the thing over a certain number of months, after which the value of depreciation allowances will equal the initial value of the thing.

EXAMPLE

Ms. Helena purchased a “tiny house” – a house built on a truck platform – for the sum of PLN 180,000.

So he can plan its depreciation in accordance with the list mentioned earlier – the annual depreciation rate for motor homes (group 8) is 10%, which means that the monthly depreciation allowance is PLN 1,500.

In this arrangement, the depreciation period of Ms. Helena’s motorhome will be 120 months.