What is a break-even point?

The break-even point is a parameter that informs about the efficiency of a company’s asset and capital management. Reaching the threshold means reaching the point where the company has achieved revenues equal to fixed and variable costs. In simple language: it has gone to zero. In business language there is also the term break-even point, derived from English.

In running a company, it is important to correctly estimate the point at which profitability will be achieved. Exceeding the deadline set in the strategy means that the goal has not been reached and the company’s financial situation should be looked at closely. On the other hand, reaching the threshold ahead of schedule is a sign that the company is doing better than expected.

What is the break-even point useful for?

You can use the information you collect, for example, to calculate whether an order that your company can accept will prove profitable for your company. If a customer offers to buy 100 units of your product in exchange for a discount or the performance of an additional service, the break-even point can be calculated for that particular transaction and thus estimate whether it is profitable for your company.

Regularly calculating your threshold will also allow you – in conjunction with market and competitive analysis – to price your products more precisely.

This financial indicator will also come in handy for salespeople in your company. When negotiating with a customer, the ability to quickly calculate the profitability of a deal can be crucial to making the right decision.

Other profitability indicators

In addition to the break-even point, it is useful to know the other ratios – ROA, ROE and ROS.

- ROA – Return on Assets – indicates how capable a company’s assets are of generating profits. To calculate ROA, divide a company’s financial result by its equity, and multiply the result so obtained a hundred times. ROA is expressed as a percentage.

- ROE – Return on Equity – this parameter represents the level of profitability of equity. In this case, divide the net financial result by equity, and multiply the result times one hundred. ROE is an indicator that helps to determine the rate of return on investment.

- ROS – Return on Sales – indicates the profitability of sales, or the ratio of net profit to revenue. We calculate ROS by dividing net profit by the company’s revenue, and multiplying the total by one hundred.

What does the break-even point consist of?

To learn how to calculate the break-even point, you first need to know the four key components of this parameter – without them, calculations will not be possible.

Fixed costs are expenses that your business incurs on a regular basis, regardless of the amount of sales, number of orders or season. This category will include lease payments, loans and other company obligations, salaries for employees, insurance or premises costs (rent, fees).

Variable costs relate to the level of production and sales. This group will include ordered goods and raw materials, transportation and delivery costs, as well as the variable parts of the cost of services your company uses – for example, fulfillment, in which you pay according to the number of orders handled.

Sales price of products and services in the adopted period.

The unit cost of producing a single product or service.

How to calculate the break-even point and its variants?

The basic definition of break-even is worth expanding to include several popular variants. Your company can use one or more, depending on your situation and needs.

Quantitative break-even point

It indicates how many products or services a company must sell to reach break-even. To calculate it, divide the total fixed costs by the unit margin, that is, the value representing the difference between the unit price and the unit variable cost. The result is the number of units of the product that must be sold.

The unit price minus the unit variable cost is the unit margin.

For whom: for companies that offer one product with a fixed price or a small number of products with different prices.

Example:

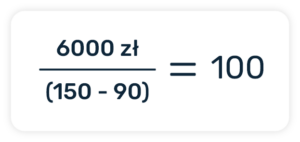

Ms. Kalina provides translation services. She charges an approximate fee of PLN 150 for each sheet translated, with about PLN 90 in unit costs. The company’s fixed costs amount to PLN 6,000. Ms. Kalina must divide this amount by the unit margin (i.e. the difference between the unit price and the unit cost):

The result obtained means that Ms. Kalina should translate about 100 sheets every month to cover costs and reach the BEP threshold.

Value break-even point

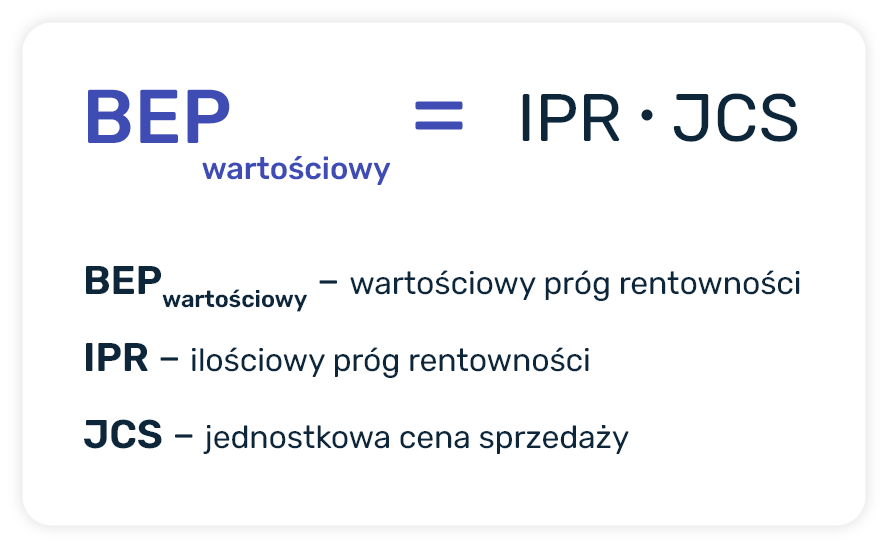

With the value break-even point, we can determine how much sales a company must achieve in order for revenue to match total costs. To calculate it, first calculate the quantitative break-even point and multiply the resulting value by the unit sales price.

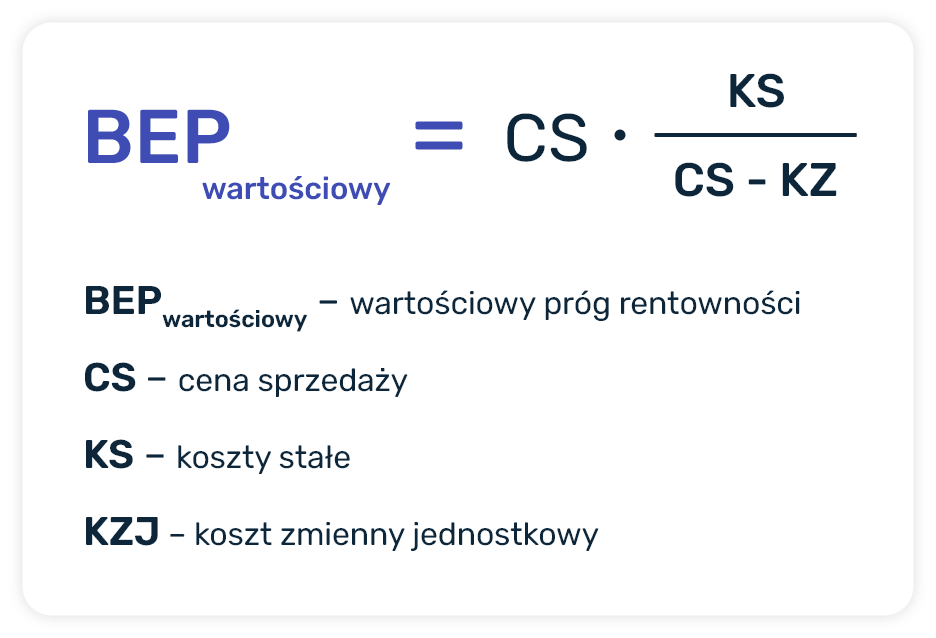

There is also a second formula that allows you to calculate the value break-even point without first having a quantitative break-even point (this one is calculated “by the way”, so to speak).

For whom: value threshold is especially useful for companies that have multiple products or services with varying prices.

Example:

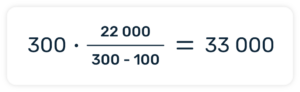

Company XYZ sells its products at a price of PLN 300 per unit with variable costs of PLN 100. The company’s fixed costs amount to PLN 22,000. In this arrangement, the value break-even point should be calculated using the above formula:

According to the above calculations, company XYZ needs to sell products totaling 33,000 PLN in a month to break even.

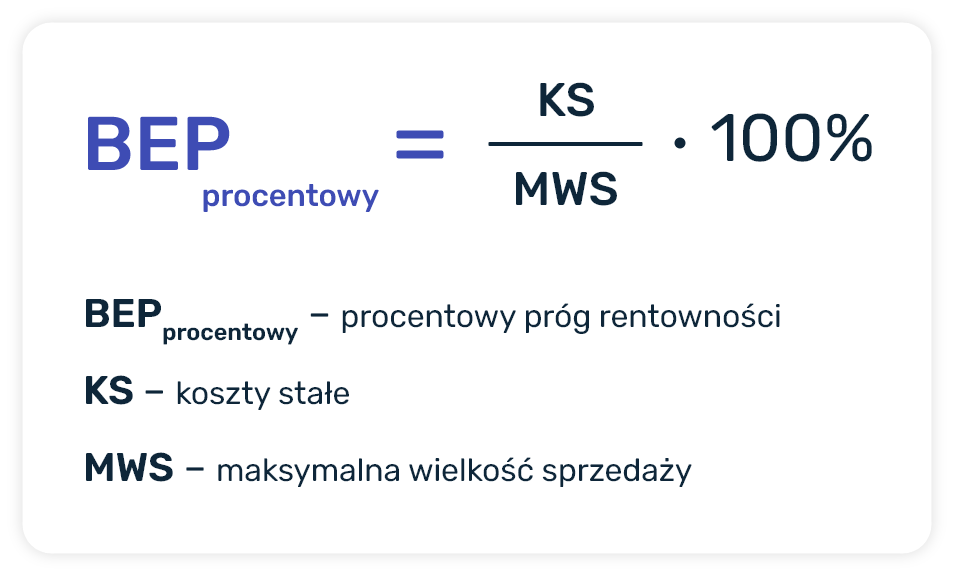

Percentage break-even point

This parameter indicates what percentage of maximum possible sales is required to reach break-even point. To use this indicator, you must first determine the maximum possible sales volume using the demand forecast.

Having this indicator, we can apply the formula:

For whom: this indicator can be used by all companies – any of the previously mentioned variants can be substituted under the break-even point and a percentage can be calculated based on it.

Example:

Mr. Matthew has an analysis according to which his company is able to generate revenue of PLN 200,000 in the coming quarter. The company’s fixed costs during this period will be PLN 46,000.

The above result should be interpreted to mean that Mr. Matthew’s company should achieve 23% of its revenue target to reach breakeven.

Extended break-even point

The above types of BEPs are characterized by simplicity of design. This makes them easy to apply, but at the same time their precision can leave much to be desired. If you need more detailed data, you can use an extended variant that takes into account one or more additional factors.

What can you consider?

- changes in cost structure,

- changes in selling prices,

- economies of scale,

- finance costs.

Here’s a sample formula to help calculate the extended break-even point with finance costs:

Break-even analysis

What to do once you have the results and know the break-even point (or thresholds)? It’s time to check the collected data to draw the correct conclusions. This kind of analysis is done to verify profitability and make important decisions. Here are some sample aspects to check.

- Production volume – with the help of break-even analysis you will find out whether to reduce or increase production, employment in the company, occupied warehouse space, etc.

- Pricing policy – rising production costs are affecting the break-even point. The margin achieved decreases, although the company’s revenue remains at a similar level. Thanks to the analysis, it is easier to make decisions on pricing policy – for example, whether it is necessary to increase prices of certain products to equalize or increase the margin.

- Costs incurred – by analyzing the break-even point, we simultaneously update our knowledge of the company’s costs. In this way, it is easier to identify the reasons for their growth and respond to them accordingly – for example, by reducing costs.

Profitability threshold in the face of change

Business and market conditions are sometimes unpredictable. When calculating the break-even point, you take into account the current circumstances. So it is not the best idea to include too long a period in these calculations.

The break-even point calculated for the coming year is not much different from fortune-telling, even assuming the relative stability of the business. Remember, too, that if the calculations indicate that the break-even point is difficult for your company to reach (the result is high), you are taking on more risk.

What can you do?

- Repeat the calculations from time to time – it is best to do this regularly, so that over time you have some history of the results, useful for other analyses, and so that you can react in time to worrying changes.

- Try to anticipate changes – careful observation of the market will allow your company to prepare for changes. New taxes and burdens, increases in raw material prices, rising fuel costs – information on these issues is worth keeping track of so that you won’t be caught by surprise.

- Pay close attention to costs – this point links strongly to the previous one. By regularly making break-even calculations, you will naturally keep your finger on the pulse in terms of costs. You will notice when and in what area they are increasing, thus quickly identifying places with potential for cost reduction.