Polish economy and TSL industry in times of pandemic

Transportation has been growing rapidly for years, but the advent of COVD-19 has made the mood and outlook in the industry less optimistic. The numerous restrictions imposed in connection with the pandemic both in Poland and around the world have affected the entire economy, including, to a large extent, precisely the TSL industry, which at one point, due to the restrictions imposed, was very limited in its ability to operate and execute any orders.

To help Polish entrepreneurs, the government introduced financial support in the form of the Crisis Shield, which made little difference anyway. Unfortunately, some companies, including transport companies, were forced to close their operations, quite a few are still struggling with the problems created by the pandemic and the resulting payment bottlenecks.

The scale of the problem is perfectly captured by data published by the Central Statistical Office, which reports that in the second quarter of 2020 Poland’s GDP declined in real terms by as much as 8.9% from the previous quarter and by 7.9% from a year ago.[1] Figures for the third quarter of 2020 already look a bit more optimistic. During the period, Polish GDP, according to CSO estimates, decreased by 1.6% year-on-year, compared to an increase of 4.4% in the same period of 2019.[2] Thus, an improvement in the Polish economy is evident, but we have a long way to go to reach pre-pandemic GDP.

Looking a little more closely at the data prepared by the Central Statistical Office (CSO), it is immediately apparent that transport is the third most affected branch of the Polish economy (after catering and tourism, and construction) by COVID-19[3] .

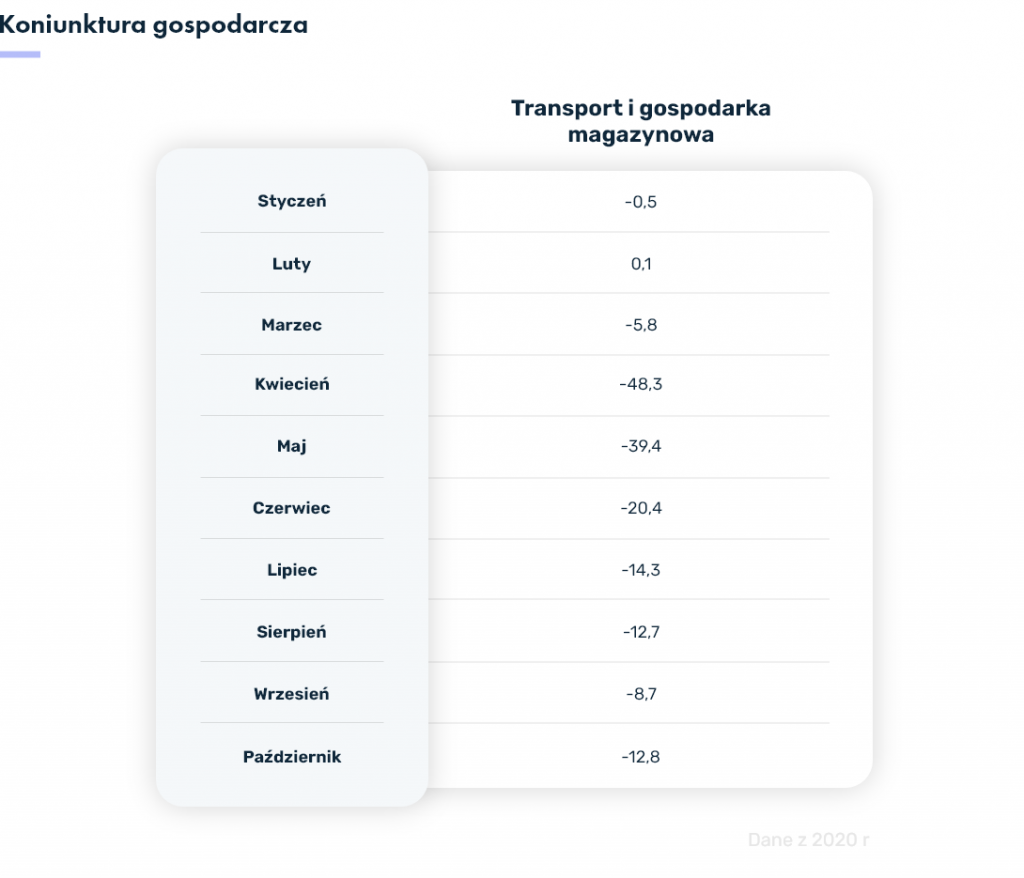

The economic conjuncture for transportation and warehousing as of the beginning of 2020 was as follows:

The beginning of the year looks relatively good compared to the rest of the data. As you can see from the graphic above, April and May are the months in which the TSL industry was most affected by the pandemic. In the following months, a slight improvement in the situation was evident. The impact of the pandemic on the business climate in the TSL industry is very evident. It’s easy to guess that the problems the industry has faced so far have grown to even greater proportions.

Distant payment terms a pain in the TSL industry

Regardless of the pandemic, the TSL industry is struggling with the problem of long payment terms. What’s more, these deadlines are getting longer over the years.

On the carrier’s side, the most important thing is to get paid on time for the freight performed. The freight forwarder, on the other hand, focuses on securing a large number of subcontractors for the freight it offers. The issue seems trivial at first glance. Unfortunately, things are not as colorful as they might seem.

The common payment term for freight performed in the market, is 60 days. In addition, you should add a few days for the circulation of documents, since, as is well known, the payment term in the industry is calculated from the date of delivery of the original documents to the freight forwarder such as CMR, invoice and order.

During this time, the carrier must pay all its obligations including, among others. lease, driver and fuel. Lease installments must be paid monthly, and the same is true for driver salaries. Payments for fuel cards must be paid according to the deadline agreed with their supplier. Cash will also come in handy for the carrier to pay for repairs or maintenance of its fleet. The quoted expenses, are only a drop in the ocean of the needs of the carrier, which usually receives payments after approx. 60 days, and he himself must settle his obligations usually in twice as short terms.

Ways to combat payment congestion in TSL

Such a large discrepancy in the payment terms of the invoices that the TSL industry issues to its contractors and those in which it must settle its own obligations very often contributes to liquidity problems and the resulting payment bottlenecks. However, ways are available to prevent them.

Discount from your freight forwarder

The natural solution is to ask the freight forwarder to grant a discount, i.e. a percentage reduction in the amount owed to the carrier, in exchange for early payment of the obligation. Unfortunately, this solution is not as common as it might seem, and not every carrier can apply for it.

Freight forwarders, if they give discounts at all, do so only after several transactions giving a positive history of cooperation. It should be noted that the situation in the industry has resulted in the discount being offered less and less frequently than could be observed just 2 years ago. The main contributor to this is the fact that freight forwarders also have to wait for repayment from the contractor. In their case, the payment term sometimes reaches up to 120 days!

Freight forwarders, wanting to be more attractive in the market by offering discounts to carriers, have so far used solutions in the form of reverse factoring lines or working capital overdrafts. Currently, the situation has changed in this regard as well, and looks not very favorable. Given the problems in the industry and the ever-lengthening payment terms, financial institutions have reduced their risk appetite, which has resulted in problems in renewing credit lines or not lending them to TSL companies at all.

The transportation situation does not look good. The future, so far, doesn’t look too optimistic either. Lack of working capital, can lead to serious financial difficulties, and in the long run even bankruptcy of the company.

Factoring may be another, more readily available solution.

Factoring to the rescue of shipping

Factoring is a service that is becoming increasingly popular in the TSL industry due to its numerous advantages. It gives the carrier the opportunity to get cash for its services in a much shorter time than the date indicated on its invoices. Factor – the institution(company or bank) providing the financing transfers 100% of the gross value of the invoice to the account of the factor (in this case, the carrier) immediately after confirmation by the recipient.

EXAMPLE

Mr. Marek owns a company that offers transportation of goods at home and abroad. It performs transportation to Spain for one of the shippers. After completing the order, Mr. Marek issues an invoice to the said freight forwarder with a payment term of 60 days. However, he is well aware of the obligations he himself has to repay. As soon as he issues an invoice, he approaches his factor to request that it be financed through factoring. Cash is credited to Mr. Mark’s account as soon as his recipient confirms the legitimacy of the invoice. Mr. Marek can now pay his current obligations on time and avoid payment bottlenecks!

Factoring from PragmaGO

At PragmaGO, we have prepared an offer “tailored” for carriers. They have the opportunity to take advantage of two types of factoring – single factoring and permanent factoring. Single factoring is a service available with us under the name “INVOICE FINANCING”, permanent factoring is called by us, in turn, “ONLINE FACTORING”.

Under both services, carriers can finance invoices issued to their customers. The benefits they can get regardless of the offer they choose are similar.

When choosing the best deal for your company, it is worth considering how the aforementioned services differ from each other.

Online factoring should be opted for by all those carriers who invoice regular customers. If you perform orders for various freight forwarders, invoice financing (single factoring) will be a better option for you.

The difference can also be seen in the limit that a factor can receive. Under online factoring, you can request a limit of up to PLN 1 million, or 100,000 for invoice financing. PLN.

Factoring provides an opportunity to quickly liquidate funds frozen in invoices issued. Payment congestion need no longer be a problem. With our offer, you can turn invoices into cash without leaving the tractor cab, as the entire financing process is done 100% online – all you need is a phone with internet access.

[1] https://stat.gov.pl/obszary-tematyczne/rachunki-narodowe/kwartalne-rachunki-narodowe/szybki-szacunek-produktu-krajowego-brutto-za-drugi-kwartal-2020-roku,1,30.html

[2] https://stat.gov.pl/obszary-tematyczne/rachunki-narodowe/kwartalne-rachunki-narodowe/szybki-szacunek-produktu-krajowego-brutto-za-trzeci-kwartal-2020-roku,1,31.html

[3] https://stat.gov.pl/infografiki-widzety/infografiki/infografika-koniunktura-gospodarcza-w-pazdzierniku-2020-r-,38,52.html