Division of sources of corporate financing

There are different ways to finance businesses. Because of their number, it is worth trying to make a breakdown that will make it easier to get an idea of the available financing options for companies.

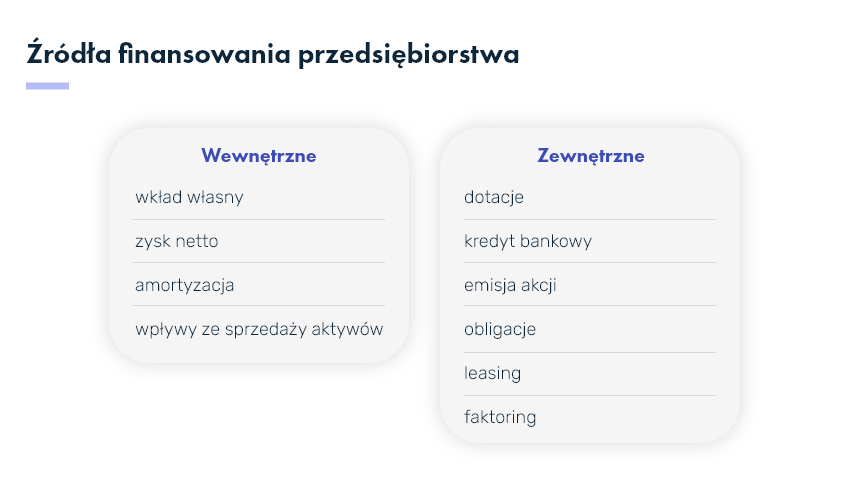

At a basic level, we divide a company’s sources of financing into internal (coming from the company’s own funds, as well as from its shareholders) and external (also called foreign).

It is worth distinguishing between two issues that are often confused with each other. Sources of capital do not mean the same thing as sources of corporate financing. In simple terms, we can say that the sources of capital are contained in a larger set called “sources of financing.”

Internal sources of corporate financing

Internal sources of funding include:

- own contribution;

- net income;

- depreciation;

- Proceeds from the sale of assets.

We will briefly discuss each of them.

Own contribution as a source of financing for enterprises

Investing one’s own accumulated funds in a private account is a popular and beneficial solution for those starting a new business. The biggest advantage of this solution is safety (we spend our own money without risking high interest if the investment fails), while the disadvantage is the need to raise the right amount in advance. In addition, the use of the contribution is not burdened with additional obligations related to accounting or recording the funds spent.

Net profit as a source of corporate financing

Another equally attractive source is self-financing, i.e., using the money a company earns to cover the costs of the company’s continued operations.

Sole proprietorships can use the accumulated funds in any way they like (even spend them for purposes unrelated to their business), while companies, on the other hand, are subject to certain restrictions: they cannot withdraw funds to a private account (such as that of the company owner), and the amounts spent can only be used for purposes prescribed by law.

For obvious reasons, self-funding cannot be used by new companies – as a rule, at least several months pass before the enterprise becomes profitable. Financing a company’s expenses from earned income is not necessarily as attractive as it might seem – it’s hard to grow a company dynamically when you use your own funds. The growth rate is certainly lower in such a case than if the entrepreneur had used external financing. However, companies that choose to self-fund often raise the argument of independence – and on this point it is hard to disagree with them.

Depreciation as a source of business financing

Any company can benefit from depreciation deductions – these apply to fixed assets owned by the company. Often depreciation is applied to computer equipment, vehicles and other assets whose value decreases over time. Through depreciation, the tax base is reduced, and thus the amount of income tax to be paid.

What is fixed asset depreciation and how does it work? Read in our guide!

Proceeds from the sale of assets as a source of corporate financing

Companies can sell off their assets in any proportion. It is not only about ready-to-sell products, but also materials and other fixed assets (for example, when market conditions change and it is more profitable to sell them than to use them in the production process).

Internal sources of financing are less burdensome to a company’s financial health, but their capabilities are often limited. When self-financing and other internal forms of financing business operations are not enough, foreign sources of financing can be useful.

External sources of funding

The use of foreign capital is an avenue that allows rapid business development, but it generally involves greater risk. This is because regardless of the amount of profit earned (or even in the absence of profit), the company will have to return the amount received earlier, often with not inconsiderable interest.

Here are examples of external forms of corporate financing:

- subsidies;

- bank loan;

- share issuance;

- Bonds;

- leasing;

- factoring.

Grants as a source of funding for the company

There are both Polish and foreign institutions on the market that support entrepreneurship with subsidies. Investment funds are eager to provide grants especially to fledgling small and medium-sized companies (startups) that manifest the potential for clear success. As one would expect, the subsidy is not a charitable service – investment funds stimulate promising industries in this way, hoping for returns that in the long run will exceed the invested contribution.

EU funds are also very popular as a source of financing for businesses. The European Investment Fund and the European Investment Bank are two important institutions tasked with investing in growing companies through grants, loans or credit.

Important!

Young entrepreneurs who set up their first business can expect to receive subsidies of up to 6 times the average salary. In 2023, the maximum amount is approx. 40,000. PLN. However, it is worth remembering that in order to obtain such a grant from the Labor Office, you must have the status of an unemployed person, an unemployed caregiver of a disabled person or a graduate of a social integration center.

Bank credit as a source of financing for enterprises

This is one of the most popular ways to obtain financing for a company in any sector. If you want to use a loan, you should be aware of possible difficulties in obtaining it (it is worth checking before starting the loan process BIK of the entrepreneur ), high costs and limited time to use the granted funds.

The potential benefits of corporate borrowing can outweigh the obstacles, as long as the company properly prepares to take out a loan.

Read also: Factoring vs. credit – learn the differences

Share issuance as a source of corporate financing

This form of financing applies only to companies (joint-stock and limited joint-stock partnerships). Such a company can put its shares into circulation. The sale of shares translates directly into a profit for the company, which it can then use for investments, liabilities or operations.

If a company wants to issue securities, it must do so through the Stock Exchange, with prior approval from the Financial Supervisory Commission.

Bonds as a source of corporate financing

Like stocks, bonds are a type of security, but they are in the nature of debt. The company issuing the bonds incurs debt from the buyers of the bonds. Over time, it “repurchases” the bonds, increasing the payment amount by a small percentage.

From the buyer’s perspective , bonds are a guarantee of profit, albeit a small one. For some reasons, stocks may be a more interesting option, whose value depends on a company’s financial situation and can yield large profits, but also expose shareholders to sizable losses if the company takes a turn for the worse.

Leasing as a source of corporate financing

Leasing is a popular form of financing, especially among one-person businesses. There are two types of it: operating leases and finance leases . Both involve the staggered purchase of equipment, cars or other assets, which are then paid off, thereby raising the company’s fixed costs and lowering income tax.

Operating leases resemble long-term rentals in many ways. During the term of the contract, the company does not become the owner of the leased property; only at the end of the contract does it have the right to buy it back in the amount established in the provisions of the contract. This type of leasing is also characterized by the fact that the lessor (for example, a bank) bears the cost of insurance or some of the repairs to the leased equipment. The lessor shall bear the cost of repairs when they occur due to natural wear and tear or are the fault of the lessor. If it is the entrepreneur’s fault that the equipment needs to be repaired, he is responsible for bearing the costs. Operating leases generally have a shorter duration.

Finance leases also legally do not give ownership of the equipment to the lessee, but in practice the company treats the leased item as its own – it can depreciate the equipment (thus further reducing income tax) and treat it like other fixed assets. After repayment of the required amount, the company receives full ownership of the leased object.

Factoring as a source of financing for businesses

This is another form of external financing, thanks to which the company is able to obtain the funds due to it faster than in the usual way. For this purpose, it uses the services of a factoring company (hereinafter referred to as a factor). A factor is in the business of buying back receivables from a company (which we will call a factor in this process).

Online factoring is used, among other things. in situations where contractors delay payment of receivables until the date indicated on the invoice, and the company can no longer wait (for example, due to its own obligations). Taking advantage of factoring is generally easier and involves less paperwork than borrowing, plus it does not increase the company’s debt.

Companies using the factoring service can count on quick disbursement of funds and, consequently, also improve their immediate liquidity ratio. In practice, this means that they will be able to pay their current obligations on time.

Summary

The dozen or so proposals listed above show that modern sources of corporate financing are not only popular loans or securities issues available only to companies, but also leasing, grants or factoring. It is worth mentioning that it is factoring that is gaining more recognition every year and more entrepreneurs are using it. In 2023, factoring is a secure and flexible financing service that makes it easier for companies to operate resiliently in the market even during more difficult times.

The market for financial services is constantly expanding, and it is possible that in time there will be even more opportunities to obtain external or internal financing. There are already many options to choose from. The question remains to be answered: which one best suits your company’s business model?