Tax microaccounting – what is it used for?

A micro tax account (also known as an IRP – Individual Tax Account) is a bank account number to which any taxpayer can send advance payments for income tax and value added tax. Yes – you will now pay your PIT, CIT and VAT in one place instead of making transfers to several different accounts!

How to pay into a microaccount?

The principle is the same as for other tax transfers. If you use your bank’s online banking or mobile app, log in, select the “transfers” tab, and then “tax transfer.”

Important!

Depending on which bank you use, the various options may differ slightly in nomenclature or even the order in which they appear, but the core of functionality remains the same – each bank provides the ability to send tax transfers.

Then enter or select the tax symbol, depending on what tax you want to pay, and enter the tax microaccount number.

However, if you want to pay your taxes the traditional way, you need to know how to fill out a microaccount transfer. At the post office, ask for the appropriate tax remittance blank and fill it out, remembering to fill in the name of the tax authority, your IRP number, or, if necessary, your liability identification.

We have already mentioned twice that when making a transfer to a microaccount, you must enter the appropriate number. However, you have to get it from somewhere.

Tax microaccounting – where to get it from?

How to check a microaccount?

At podatki.gov.pl you will find the Tax Microaccount Generator – although the name may be a bit misleading (this site does not allow you to generate, but only to check your tax account number), it is the only secure place on the Internet where you can check your microaccount number.

After clicking on the link above, simply enter your tax ID and click on “Generate.” In response, you will receive an individual microaccount number, which you can then save in the bank’s app or elsewhere from where it is convenient for you to use it.

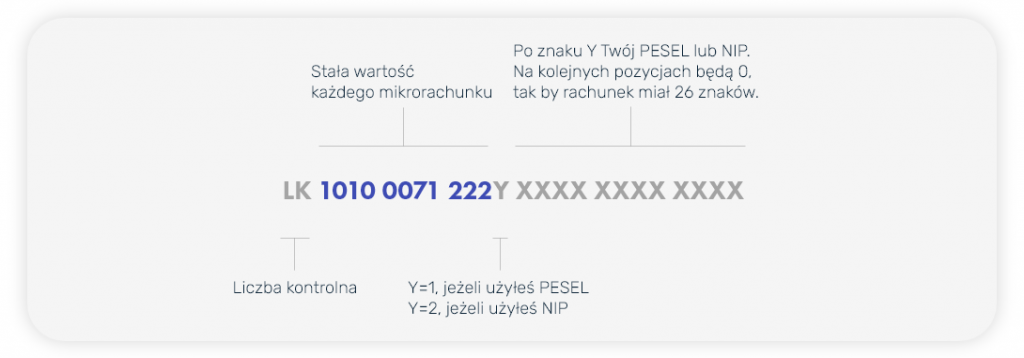

How to interpret the microaccount number?

To ensure that you have the correct microaccount number, it is worth noting its distinguishing elements:

- The microaccount must consist of 28 characters (two letters and 26 digits);

- begins with two letters (usually PL);

- The next two digits are the control number;

- the next 11 digits are always fixed: 1010 0071 222 – this is the billing number at the NBP;

- the next digit is 1 or (2) If the taxpayer uses the PESEL number for tax purposes, it will be the number 1. If it uses the TIN instead, it will be the number 2;

- The penultimate component of the microaccount is the taxpayer’s PESEL or NIP number;

- There is one (if the taxpayer uses a PESEL number) or three zeros (if he uses a TIN) at the end.

How to pay taxes without a PESEL or TIN number?

It may happen that you already have an activity that obliges you to pay taxes in Poland, but… you have neither a PESEL number nor a NIP number yet, because you are waiting for it to be granted. In this situation, you must pay your taxes to the bank account number of the relevant tax authority. A list of accounts can be found at gov.pl – List of bank account numbers of tax offices.

Which taxes are not covered by microaccounting?

The above-referenced list will come in handy if you also pay other taxes as part of your business (as well as outside of it). You will also pay other taxes – for example, the tax on civil law transactions (PCC) or excise taxes – to the same account numbers, covered by the National Court Administration list.

Important!

If you run a business and settle with the help of a tax card, you are also not affected by the microaccount payment. Instead, you must pay your taxes under the current rules – by sending money to the account of the relevant tax office.

Payment to a microaccount – how to fix a mistake?

Sometimes, when making tax transfers, especially when there are some changes or we have not written down the correct account number for ourselves, we make a simple mistake – we send money to someone else’s micro-account or pay PCC tax to a micro-account (instead of the tax authority’s account number). Fortunately, any such mistake can be undone – all you have to do is submit a request to have the payment rebooked.

It is worth remembering, however, that a mistake remains a mistake, and if you realize that you have made a mistake, already after the deadline, you should include the inclusion of the default interest due in the reclassification request.

Having trouble paying your taxes on time? There is a solution for that!

The accumulation of liabilities can turn out to be a serious problem for your business, especially when circumstances arise that make it difficult or even impossible to operate as before. The immediately imposing example is the coronavirus pandemic, which paralyzed some industries for months. Although the situation has been partially brought under control over time, the consequences of global problems continue to affect many entrepreneurs.

In such a situation (and many others), paying taxes on time can be quite a hassle, especially for companies that have suddenly lost contracts or otherwise been prevented from continuing operations. While a small delay may not have sizable consequences, we know what is at stake for repeated failure to pay taxes. So if you want to avoid unpleasant consequences and stop this spiral of problems growing inside the company, think about tax financing.

Tax financing is a simple service, thanks to which you will receive the funds you need to pay PIT, VAT or Social Security contributions immediately, and the payment will be spread into convenient installments or deferred for a selected period. You can find the cost of the service and more details on the PragmaGO website.