The role and definition of ROI

Every investment should pay off – this follows from the very definition of investment. So if you commit resources to an endeavor and do not receive the expected benefits from it, you should question the sense of investing. This is where ROI enters the scene. It is what allows you to verify whether the investment you are planning or have already made is profitable. But it doesn’t stop there – return on investment is used as a performance indicator in a great many contexts. Before we get to them, let’s establish a clear definition of the term.

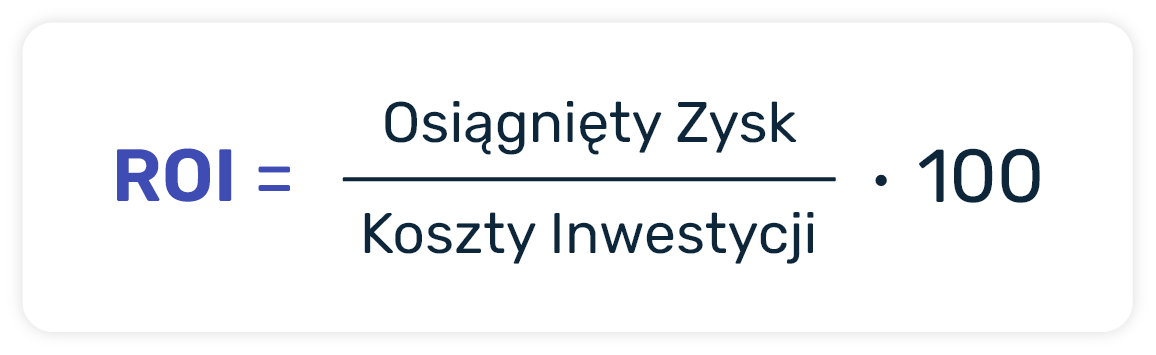

ROI is an indicator that determines the effectiveness of an investment based on a comparison of the costs incurred with the net profit achieved. How to calculate it?

In the above formula, Achieved Profit means revenue less costs incurred in connection with the venture.

Example:

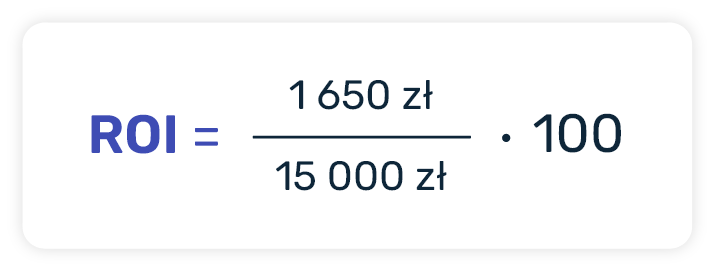

Ms. Jolanta’s company decided to purchase a used device to speed up the quality control department. After the first year, the ROI was 11%. This means that the investment brought a profit.

According to the above formula, the company spent PLN 15,000 to buy the machine, and earned PLN 16,650 thanks to it. After deducting the costs, the profit was PLN 1,650, which means an ROI of 11%. We will return to this example later.

What does the value of the ROI mean?

Despite the simplicity of the formula, it is worth pausing for a moment to consider the possible results of the calculations:

Positive return on investment

A score above 0% means that the investment generated a profit – so it is positive, because it means that the company made money. However, the real result of the investment is the final ROI result in relation to the ROI estimated before the project was launched.

Thus, if the company initially assumes an ROI of 75%, but after the investment is completed it will be 30%, it will hardly be a success. The company, true, will generate a profit, but much less than it assumed.

Zero return on investment

ROI of 0% literally means going “out in the clear.” The company did not make a loss, but it did not generate a profit either. However, it is difficult to interpret such a result in the category of profit – any investment takes time, and since it did not generate a profit, it means that it was not the best choice.

What’s more, a zero ROI almost always means a real loss – because the return on investment ratio does not take inflation into account.

Negative ROI

The least desirable result, of course, is an ROI on the downside. Such a result means that the company on the investment lost – it paid more than it earned, and on top of that it lost time.

Example:

Ms. Jolanta’s company invested PLN 15,000 in the purchase of a used device to speed up the work of the quality control department. Preliminary analysis allowed the company to assume an ROI of 80% in the first year (revenue equal to PLN 27,000, costs equal to PLN 15,000, profit equal to PLN 12,000).

Unfortunately, the staff was not properly trained in the use of the equipment, and on top of that, the equipment underwent a series of failures in the first few months of use. Repairs were therefore necessary, which generated further costs (since the used equipment was not covered under warranty). As a result, although the investment generated a profit after 12 months, the final ROI was only 11%, and this did not include the costs associated with the repairs.

This means that the income from the investment was equal to PLN 16,650. After subtracting the costs (PLN 15,000), the achieved profit was only PLN 1,650 against the assumed PLN 12,000.

In order to interpret ROI more effectively, it is necessary to use this parameter in conjunction with others, such as WACC (Weighted Average Cost of Capital). This indicator is equal to the weighted average of the cost of the components of capital financing a given investment.

With WACC, an organization can more accurately calculate the return – taking into account the detailed structure of investment financing (and therefore the cost of raising funds for the investment – for example, if a company uses factoring for this purpose.

Example:

Mr. Henry’s company has launched a new business project, in which it has invested PLN 300,000. A conservative estimate established an initial ROI of 15%. This means that Mr. Henryk expected revenues of PLN 345,000, which, after deducting costs, would have resulted in a profit of PLN 45,000.

However, Mr. Henry knows that he obtained the funds for the investment from factoring financing. ROI is therefore only one indicator for him. He needs to consider others as well to estimate the actual cost of the investment and the potential return.

After 6 months, Mr. Henry’s company achieved an ROI of 110% on this investment. This equates to revenue of PLN 630,000 and a tidy profit of PLN 330,000. This is a mighty success, but to get the full picture, Mr. Henry needs to include the additional costs he incurred in raising the financing. His calculations show that they amounted to PLN 21,000.

So in the end, Mr. Henry’s company earned PLN 309,000, which gives an ROI of 103%. An impressive result.

Calculation of ROI at different stages of investment

In the context of ROI, it is particularly important that you can (and even should) use this indicator at different stages of investment: from planning, through verification at several important points, to summary when the investment is completed. Each time, the ROI value will bring with it important information:

- Before investing, we will be able to enter the expected profit in the “Achieved Profit” item. In this way, we will get the estimated ROI.

- Once you start investing (investing your first funds or making your first profits), the ROI will tell you how close you are to your goal. As time passes and more profits are recorded, the ROI should increase. As you reinvest, the target will move further away.

- At the end of the investment, the ROI should be equal to or greater than the result before the investment began – this means that the investment has been profitable.

Important!

The return on investment ratio is susceptible to interpretation. A final ROI lower than the initial one does not necessarily mean a loss incurred – sometimes it can be a signal that the assumptions made at the beginning turned out to be too optimistic. This is valuable information that will come in handy when planning future investments.

An equally important feature of ROI is that regularly reviewing the ratio over the life of the investment can help calibrate it. If you notice that you are moving away from your goal over time, instead of getting closer to it, this is a sign that optimization techniques should be implemented. The next ROI check will give you an answer as to whether the changes you’ve made have had an effect.

Examples of ROI application

Investing involves many aspects of business, so we can use ROI as a measure of performance:

In marketing efforts

Every marketing activity requires an investment – this can be directly transferred money (for example, to the accounts of advertising platforms), but also man-hours (i.e., employee involvement). The easiest way to apply ROI is in the context of paid advertising campaigns, calculated for a specific, measurable goal (for example, the purchase of a product).

With campaign data at our disposal, we can see how many people have purchased the advertised product due to marketing efforts.

In business projects

Every project within a company’s operations can be analyzed for potential profitability. This is because the company invests time of its employees, funds for training or materials. By meticulously tracking expenses, a company is able to estimate the profitability of a project – just by using ROI. As this indicator is used more and more, its usefulness will increase. With each successive project, ROI should become more precise.

In production processes

When planning to start production, it is necessary, among other things, to choose the right materials, technology, contractors and many other factors. It is worth comparing different variants (for example, the materials used), for each version comparing the ROI. This way it is possible to estimate the return on investment even before any company funds are spent.

What are the disadvantages of ROI?

The simplicity of ROI is a double-edged sword. Thanks to the fact that the formula is short and its application unproblematic, anyone can estimate the ROI for a planned investment or calculate the return for an already completed investment. Unfortunately, ROI does not take into account many factors, making it severely limited.

What does the ROI value not take into account?

- Impact of investments on brand reputation

- Impact of investments on customer and employee satisfaction

- Changes in the value of money over time

- Investment risks

- Profits and costs not directly related to the investment

Other indicators for evaluating investment efficiency

ROI is not the only indicator of profitability. In addition to this most popular one, there are also functions such as:

- SROI (Social Return on Investment), or social return on investment, is a tool by which organizations can assess the social (but also environmental or economic) impact of their activities.

- IRR (Internal Rate of Return), or internal rate of return, is a return on investment ratio that takes into account the change in the time value of money and the duration of the investment.

- PP (Payback Period), or payback period, is a parameter that indicates how long it takes for an investment to recover, i.e. to go “zero.”

What is ROI? Summary

The ROI parameter allows an initial assessment of profitability. It is worth using it at many stages of the process, starting with initial estimates and ending with verification many months after the investment is closed.

However, ROI is a general solution that works best in cooperation with other indicators. So if you want to make it a useful tool, don’t rely entirely on it.