Financing corporate purchases

Do you need funds for company purchases? Do not wait – place an order and send us an invoice.

We will pay your supplier for your purchases, and you will pay us the amount due in convenient installments!

How does purchase financing work?

Purchase financing (purchase factoring) is a way to help pay for any business-related expenses.

All you need to do is purchase goods or services on an invoice (or other document confirming the transaction) with deferred payment. Send the sales document you receive from the seller to us.

We pay all or part (depending on your needs) of the order amount by express transfer directly to your supplier. The funds will be in his account on the same day you accept the terms of cooperation.

You settle with us in installments – you can choose to spread the payment over 3, 6, 9, 12, 18 or 24 installments payable by 10. day of each month.

What business expenses can I finance?

With purchase factoring, you can finance any expenses related to the operation of your company, as long as their value is between PLN 100 and 100,000. They can be, for example:

goods and intermediate products,

services (e.g., consulting or training),

Marketing costs (e.g., SEO/SEM),

office equipment,

IT infrastructure development,

et al.

Purchase financing – check out a sample calculation

Installment amount

What does the final cost of the service depend on?

What is the funding limit?

The presented calculation does not constitute a commercial offer within the meaning of Art. 66 par. 1 KC.

What are the distinctive features of purchase financing?

Money not only for goods

We can also help you finance services or other expenses related to your business (such as marketing costs, software or office equipment).

Saving time

You don’t have to sign a paper contract – the process of applying, launching and handling purchase financing is done online.

You can spend from 100 to 100,000 PLN

We finance small and large business expenses – tailor the service to your company’s needs.

An alternative to loans and credits

By financing your purchases, you can avoid long-term commitments at high interest rates.

Purchase financing is for you if:

You need to pay for goods, products or services that are necessary to continue your business, and you temporarily have no spare funds.

You have a chance to accept a large order, but you don’t have the resources to carry it out.

You have the opportunity to purchase essential products or services at a promotional price, and the offer is limited.

You want to buy products to stock up ahead of projected price increases.

You want to invest in the development of your business and prefer to spread the cost in installments.

Questions and answers

Can any company apply for acquisition financing?

What amount of funding limit will I receive?

The allocated limit is insufficient for me, can I change it?

Do you contact the supplier I indicated?

Didn’t find the answer to your question?

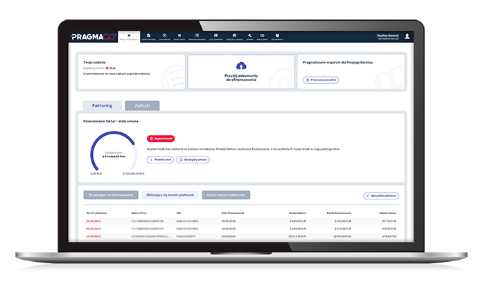

Customer Zone – take advantage of online financing

Customer Zone is a platform that you can access online whenever you need it.

Here you can submit for financing further purchase invoices that you want to spread in installments, as well as learn about other products in our offer.

In the Customer Zone you use our services on an ongoing basis – without additional paperwork.