What exactly is factoring?

Factoring is a financial service that allows a business to monetize its invoices instead of waiting for payment from customers. If you are in business and issue invoices with – for example – a 60-day payment deadline, you can submit them for factoring. As a result, you will receive the funds due to your company immediately. Factoring for transport companies is a particularly popular service – this is due to the specifics of the industry.

Important!

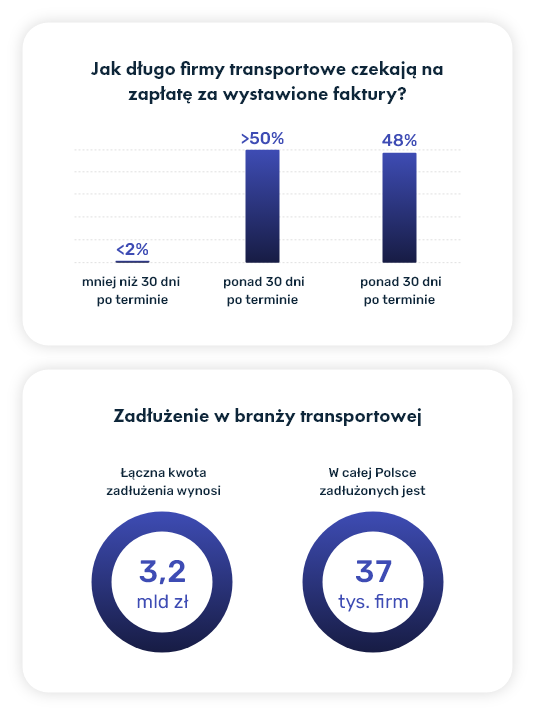

Representatives of many industries complain that they often receive payment for issued invoices even dozens of days after the due date. Transportation is the worst in this regard – a report by BIG InfoMonitor showed that in the first quarter of 2024 , more than half of small and medium-sized transport companies (specifically, 54%) waited more than 60 days after the due date for payment.

This makes factoring for transportation more necessary than ever for the industry today. This will remain the case at least until legislation to combat late payment in commercial transactions comes into force.

Data: BIG InfoMonitor

Types of factoring

There are many types of factoring. They differ, among other things, in the scope of services offered by the factor (factoring company or bank), but also in the extent or financial responsibility for the possible insolvency of counterparties. Most often, we divide factoring by the risk taken by the service providers and the openness of the operation. We speak – respectively – of full or incomplete factoring and silent or open factoring.

In full factoring, the factoring company assumes responsibility for the possible insolvency of the counterparty. Incomplete factoring means that it is the entrepreneur who uses the service who must ensure that his counterparty pays the invoice on time. Thus, in reality, he will receive the money that he will have to pay back according to his contract with the factor. Whether he uses funds from the contractor or his own to do so is of secondary importance.

Open factoring (open factoring) means that the entrepreneur must notify his customers of the sale of invoices that he has previously issued to them. Silent factoring for transportation companies, like many others, is used when factoring financing is necessary, but for various reasons we do not want to inform contractors of the situation. At present, however, it is important to remember that the use of silent factoring is hindered by the white list of VAT taxpayers.

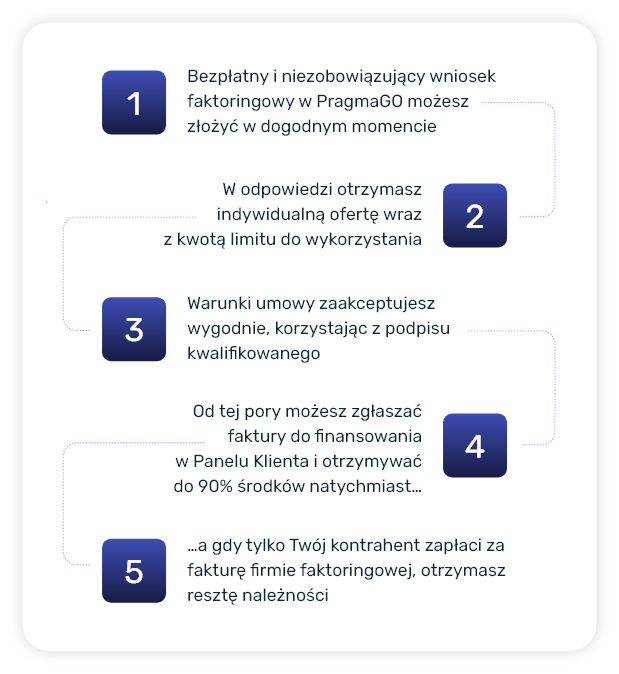

See how factoring works at PragmaGO!

Factoring for transportation companies – why is it useful?

Issuing invoices with a distant due date is not unusual in the transportation industry. 30 or 60 days – these time frames are normal for many entrepreneurs. This is due to industry conditions, long-standing practice and a complex network of suppliers.

A single invoice, for which we will have to wait two months for repayment (and this is only assuming that the counterparty meets the deadline, which is not the rule), is probably not a problem. However, if it is for an unusually high amount or there are more such documents, it may be useful to use factoring. After all, obligations such as e-toll, leases, fuel cards or driver payments that a trucking company must pay cannot wait that long. The big problem in the transportation industry is often not profitability, but liquidity. It is this that is strained by distant payment terms on invoices.

Instead of worrying about where you’ll get the money to cover your business needs, you can submit an invoice for financing to PragmaGO. This way you will receive the funds almost immediately (usually in no more than 2 hours!).

Factoring is a service that provides constant access to cash. Customers are given a factoring limit – an amount they can use to finance their invoices. In this way, the waiting time for funds is drastically reduced. The limit is revolving, which means that each invoice paid by the counterparty returns part of the used funds. So if an entrepreneur uses 40,000 zlotys of the 100,000 zlotys limit, he will have 60,000 zlotys left to use. However, when the recipient pays an invoice worth PLN 20,000, this amount will “return” to the limit. From then on, the entrepreneur will again have at his disposal the amount of PLN 80,000. Find out what you can gain from factoring, using an example:

Learn the full story of our client – read the case study!

Factoring for transportation – ad hoc or permanent solution?

Depending on your situation, you can use PragmaGO financing on a one-time basis (we call it single invoice financing) or on a permanent basis (by choosing an online factoring service). Which solution is more beneficial?

If the problems with payments from contractors are temporary – they have not occurred before and you do not expect a recurrence – it is worth using single invoice financing. This is a service in which you submit an invoice or invoices for financing via an online form, confirm the terms of the agreement via SMS, and receive the money in as little as two hours.

Remember, this way you can finance sales documents of 500 to 100 thousand zloty! It’s also a great way to test financing. If you are not sure if factoring is the service for you, invoice financing is a good choice to start with. Instead of tying yourself to a permanent contract right away, you test whether such a service suits you and actually translates into better business prosperity. If everything goes according to plan, and you want to dismiss the risk of payment bottlenecks already permanently, use online factoring.

Online factoring is precisely fixed financing. In this variant, factoring costs are lower, and the maximum amount you can finance increases up to fifteen million zlotys. The minimum value of the factoring limit, in turn, is PLN 50,000. If you opt for this financing option, you will probably be pleased to know that a global assignment is drawn up when signing the factoring agreement. It covers all customers whose invoices you want to finance with the help of factoring. From the moment you sign it, you don’t have to fill out any more paperwork! Each invoice you submit, issued to a ceded counterparty, will be financed as long as there are still funds available in the factoring limit assigned to your account.

When you start financing with PragmaGO – whether using online factoring or invoice financing – you get access to the Client Zone. This is a convenient panel where you submit all invoices for financing within the limits of the limit granted to your company.

Also read:

What are the benefits of factoring for transportation?

Improving liquidity

Thanks to factoring, transportation companies across the country can regain full liquidity and freely pursue their goals and operations – without looking at payment deadlines and constantly urging contractors to keep their agreements.

Support from the first days of operation

Factoring for small transport companies is not a pipe dream – the smallest companies and even start-ups can benefit from factoring financing. In the absence of a credit history, in such a case, the assessment of the payment reliability of recipients is analyzed.

Guaranteed payout

Factoring works on the basis of an assignment of receivables – so it is necessary to obtain the contractor’s consent to the assignment. In PragmaGO, however, you receive a guaranteed payment to start. This means that you will have access to some of the funds as soon as you sign the contract – without waiting for the assignment to be executed.

Individual caregiver

You don’t have to worry about nuances. When using online factoring or single invoice financing for transportation, you can benefit from the assistance of a customer advisor. The person assigned to help your company will illuminate any issues that may need more description. He or she will also help you set a factoring limit or purchase additional services.

Monitoring of contractors

When you use factoring, you don’t have to worry about payment deadlines. As part of the service, we monitor your receivables and inform you of repayment deadlines.

Summary

Online factoring and invoice financing – transportation companies especially appreciate these two services because they help them achieve their primary goals. Instead of nervously checking your account balance and dealing with the unpleasant necessity of being reminded of upcoming payment deadlines, you can have constant access to cash and people to ensure timely repayments from your contractors.

Check out online factoring – fill out a free, no-obligation application, to get an offer tailored to your business.