What is the overall debt ratio?

The debit ratio or debt ratio, or DR for short, is a parameter that indicates the ratio between a company’s assets and borrowed capital. A properly calculated ratio allows you to identify the risks involved in, for example, lending to a particular company or investing in its development over the long term.

A high overall debt ratio means that the company is heavily indebted – it tells creditors or potential lenders that the company’s financial credibility is questionable, and the risk of lending to the entity is growing dangerously.

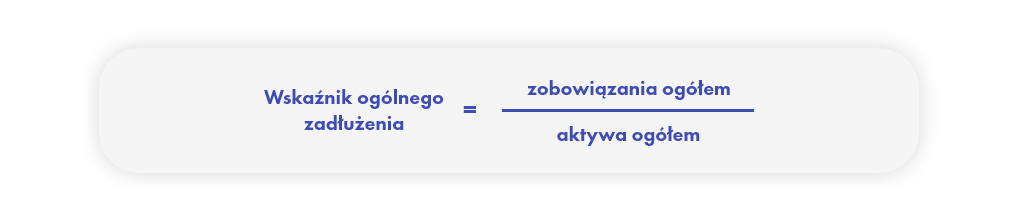

Overall debt ratio – formula

Accurate calculation of the total debt ratio requires having data from the company’s balance sheet. If you already have them, just apply the following formula:

The result of the equation will be a number in the range of 0-1.

How to interpret the overall debt ratio?

The rule of thumb for reading the score is quite simple: the higher the total debt ratio, the more external sources of financing in the company’s assets (this means that the company is using loans, credits or grants of high value).

A low coefficient, on the other hand, indicates that the company is trying to operate without involving external resources – in other words, it is financing itself independently or almost independently.

So in theory, the lower the overall debt ratio, the better. However, practice shows that this is not always the case. A company that uses no foreign capital at all (or very little) may be seen as taking too safe a line, and thus failing to realize its potential.

The other way is easier to interpret – a very high index score poses a serious risk to potential lenders or investors. However, this does not mean that a 40- or 50-percent debt ratio is a big problem for a company and does not imply an optimal financing structure.

Large companies that have been in business for many years and boast a high and steadily growing customer base tend to have more commitments than small and micro businesses – this is related to the need to expand their offerings or long-range expansion plans (e.g., opening new branches, increasing employment or purchasing new technologies). In the case of large, well-established companies, it is difficult to speak of problems regarding debt service – steady growth and years of experience indicate the pursuit of an optimal financing structure, even if it means standing out with a high debt ratio.

It is worth stopping for a moment at this point and answering the question: is there a standard for the overall debt ratio?

Overall debt ratio – the norm

While the general rule of thumb may be to try to keep your overall debt ratio relatively low, it’s not very helpful without a benchmark – but this one varies depending on a number of factors, most notably the industry in which the company operates, its size or the costs it generates.

Various sources indicate that the norm of the total debt ratio can be viewed differently. However, it is often argued that a “safe” result is a number in the range of 0.3 – 0.6 – such a debt ratio will not scare off investors, and at the same time informs about the dynamic (probably also developmental) financial situation of the company. A slightly narrower range is reported by some Polish sources, indicating a result in the range of 0.57 – 0.67.

Investors are reluctant to take excessive credit risk, so before they decide to work with a company, they absolutely perform a debt analysis, wanting to know the potential partner’s debt structure, sources of asset financing and the company’s level of financial self-reliance.

Other debt ratios

The total debt ratio is not the only parameter that is helpful when a ratio analysis of a company’s financial statements is conducted. The debt analysis should also include:

Long-term debt ratio

This ratio is also called the risk or leverage ratio – it tells how much of a company’s long-term liabilities are financed with the help of equity.

To calculate the long-term debt ratio, use the following formula:

Debt to equity ratio

The calculation of this parameter allows you to get an idea of how high the level of debt equity of the company is. At the same time, this indicator tells the extent to which the company is financed with the help of equity and foreign capital.

How to calculate the debt-to-equity ratio?

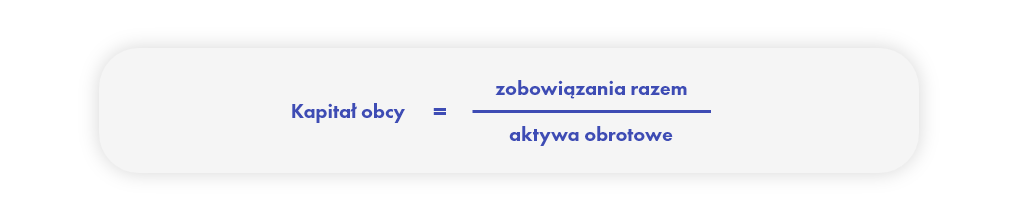

Share of foreign capital

Derived from the previous indicator, it tells how much of a company’s current assets are financed with the help of foreign capital.

These, of course, are not all the indicators we can use in analyzing a company’s debt. For more on this topic, see our post titled: Assessing a company’s financial health.